Food Lion 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

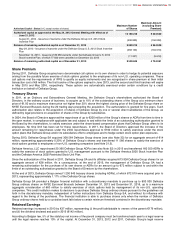

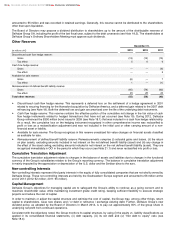

Collateralization

The portion of Delhaize Group’s long-term debt that was collateralized by mortgages and security charges granted or irrevocably

promised on Delhaize Group’s assets was €22 million at December 31, 2013, €23 million at December 31, 2012 and €37 million

at December 31, 2011.

At December 31, 2013, 2012 and 2011, €35 million, €39 million and €56 million, respectively, of assets were pledged as

collateral for mortgages.

Debt Covenants for Long-term Debt

Delhaize Group is subject to certain financial and non-financial covenants related to the long-term debt instruments indicated

above. While these long-term debt instruments contain certain accelerated repayment terms, as further described below, none

contain accelerated repayment clauses that are subject solely to changes in the Group’s credit rating (“rating event”). Further,

none of the debt covenants restrict the ability of subsidiaries of Delhaize Group to transfer funds to the parent.

Indentures covering the notes due in 2014 (€), 2017 ($), 2019 ($), 2020 (€), 2027 ($) and 2040 ($), the debentures due in 2031

($) and the retail bond due in 2018 (€) contain customary provisions related to events of default as well as restrictions in terms of

negative pledge, liens, sale and leaseback, merger, transfer of assets and divestiture. The 2014 (€), 2017 ($), 2019 ($), 2020 (€)

and 2040 ($) notes and the 2018 (€) bonds also contain a provision granting their holders the right to early repayment for an

amount not in excess of 101% of the outstanding principal amount thereof in the event of a change of control in combination with

a rating event.

At December 31, 2013, 2012 and 2011, Delhaize Group was in compliance with all covenants for long-term debt.

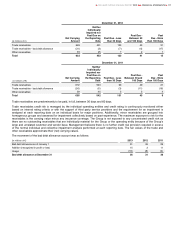

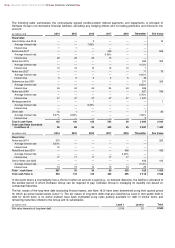

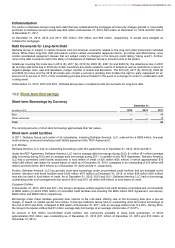

18.2 Short-term Borrowings

Short-term Borrowings by Currency

(in millions of €)

December 31,

2013

2012

2011

Euro

—

—

45

Other currencies

—

—

15

Total

—

—

60

The carrying amounts of short-term borrowings approximate their fair values.

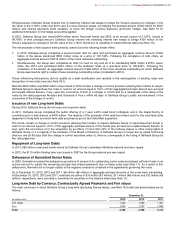

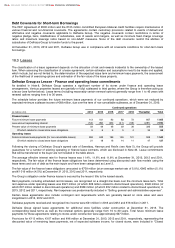

Short-term credit facilities

In 2011, Delhaize Group and certain of its subsidiaries, including Delhaize America, LLC, entered into a €600 million, five-year

multi-currency, unsecured revolving credit facility agreement (the “RCF Agreement”).

U.S. Entities

Delhaize America, LLC had no outstanding borrowings under this agreement as of December 31, 2013, 2012 and 2011.

Under the RCF Agreement, Delhaize America, LLC had no average daily borrowings during 2013, $1 million (€1 million) average

daily borrowing during 2012 and no average daily borrowings during 2011. In addition to the RCF Agreement, Delhaize America,

LLC had a committed credit facility exclusively to fund letters of credit of $35 million (€25 million) of which approximately $13

million (€9 million) was drawn for issued letters of credit as of December 31, 2013, compared to an outstanding of $12 million (€9

million) and $16 million (€13 million) as of December 31, 2012 and 2011, respectively.

Further, Delhaize America, LLC has periodic short-term borrowings under uncommitted credit facilities that are available at the

lenders’ discretion and these facilities were $100 million (€73 million) at December 31, 2013, of which $35 million (€25 million)

may also be used to fund letters of credit. As of December 31, 2013, 2012 and 2011, Delhaize America, LLC had no borrowings

outstanding under such arrangements but used in 2012 and 2011 $5 million (€4 million) to fund letters of credit.

European Entities

At December 31, 2013, 2012 and 2011, the Group’s European entities together had credit facilities (committed and uncommitted)

of €895 million (of which €725 million of committed credit facilities and including the €600 million RCF Agreement: see above),

€846 million and €864 million, respectively.

Borrowings under these facilities generally bear interest at the inter-bank offering rate at the borrowing date plus a pre-set

margin, or based on market quotes from banks. In Europe, Delhaize Group had no outstanding short-term bank borrowings at

the end of 2013 and 2012, compared to €60 million at December 31, 2011, with an average interest rate of 2.95%. During 2013,

the Group’s European entities had €1 million average daily borrowings at an average interest rate of 10.97%.

An amount of €45 million uncommitted credit facilities was exclusively available to issue bank guarantees, of which

approximately €34 million was outstanding as of December 31, 2013 (€11 million at December 31, 2012 and €10 million at

December 31, 2011).

DELHAIZE GROUP ANNUAL REPORT 2013 FINANCIAL STATEMENTS

125