Food Lion 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Review

The net debt to equity ratio was 29.0% at the

end of 2013 compared to 39.9% at the end

of 2012. Net debt decreased by €599 million

to €1.5 billion mainly as a result of strong free

cash flow generation.

At the end of 2013, Delhaize Group had total

annual minimum operating lease commit-

ments for 2014 of €269 million, including

€21 million related to closed stores. These

leases generally have terms that range

between 1 and 45 years with renewal options

ranging from 3 to 30 years.

Events after balance

sheet date

In February 2014, Delhaize Group announced

the planned sale of its Bulgarian operations to

AP Mart. The Group expects to recognize an

impairment loss of approximately €10 million

and going forward will classify these opera-

tions as assets held for sale and discontinued

operations. The transaction is expected to

close in the second quarter of 2014 and is

subject to regulatory approval as well as cus-

tomary closing conditions and working capital

adjustments.

Also in February 2014, Delhaize Group

received approval from the U.S. Federal Trade

Commission (FTC) to proceed with the sale of

its Sweetbay, Harveys and Reid’s operations

to Bi-Lo. As part of the clearance, Bi-Lo agreed

to divest 12 Delhaize America stores and Del-

haize Group agreed to retain two other stores

and convert them into the Food Lion banner.

The final approval by the FTC will be issued

after a 30-day comment period.

NON-GAAP MEASURES

In its financial communication, Delhaize Group uses certain measures

that have no definition under IFRS or other generally accepted

accounting standards (non-GAAP measures). Delhaize Group does

not represent these measures as alternative measures to net profit

or other financial measures determined in accordance with IFRS.

These measures as reported by Delhaize Group might differ from

similarly titled measures by other companies. We believe that these

measures are important indicators for our business and are widely

used by investors, analysts and other parties. A reconciliation of

these measures to IFRS measures can be found in the chapter

“Supplementary Information” of the Financial Statements

(http://annualreport.delhaizegroup.com). A definition of non-GAAP

measures and ratios composed of non-GAAP measures can be found

in the glossary. The non-GAAP measures provided in this report have

not been audited by the statutory auditor.

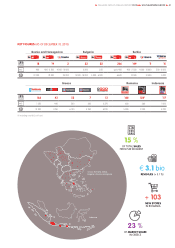

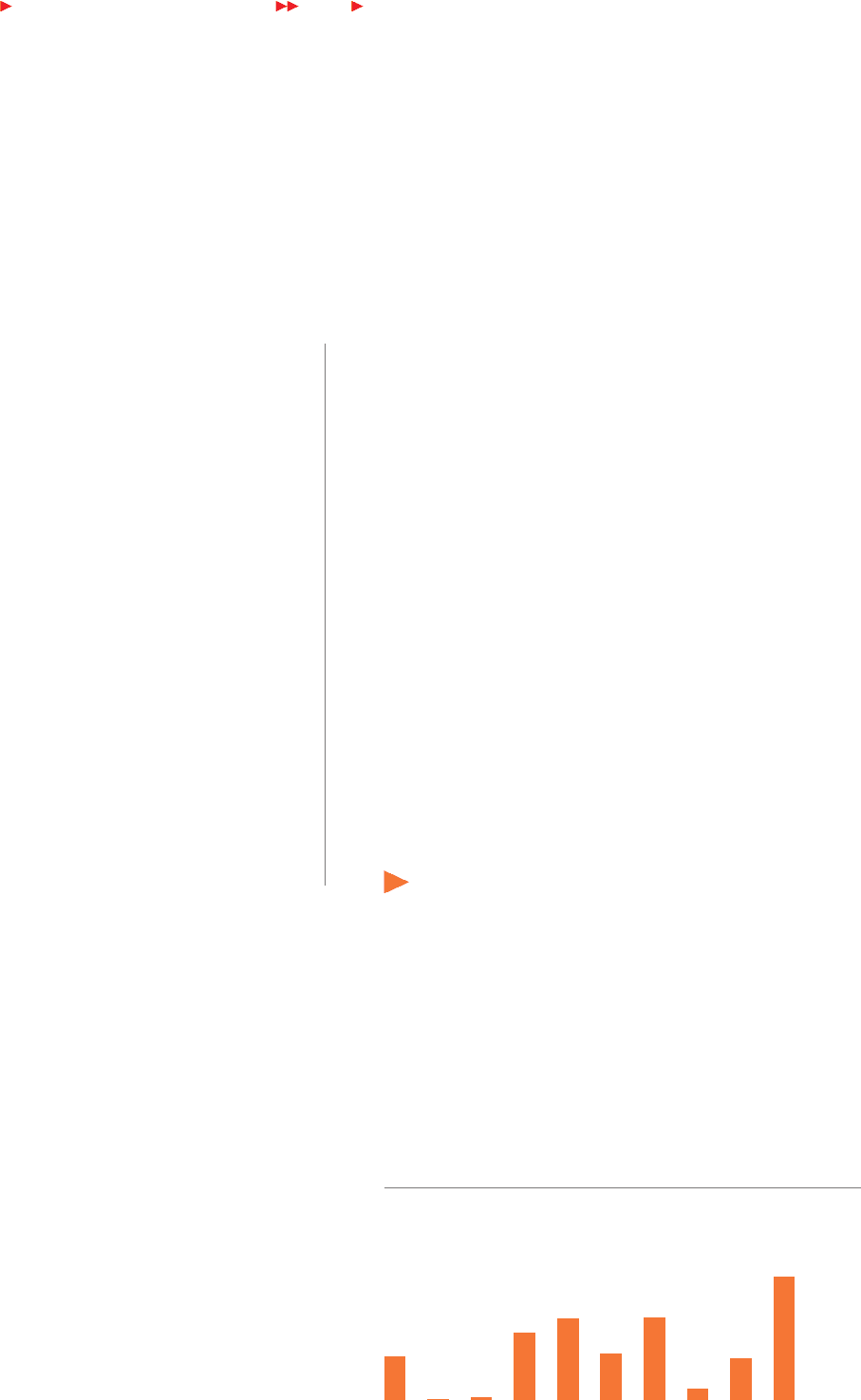

DEBT MATURITY PROFILE(1) (AFTER SWAPS)

(IN MILLIONS OF €)

(1) Excluding finance leases; principal payments (related premiums and discounts

not taken into account) after effect of cross-currency interest rate swaps.

32

DELHAIZE GROUP ANNUAL REPORT 2013

REVIEW

15

1

14

211

18

400

16

7

17

326

27

51

19

225

20

400

31

202

40

600