Food Lion 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

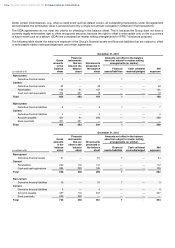

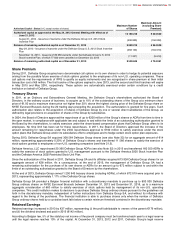

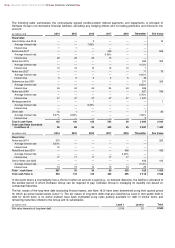

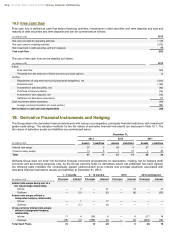

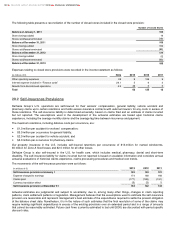

The following table summarizes the contractually agreed (undiscounted) interest payments and repayments of principal of

Delhaize Group’s non-derivative financial liabilities, excluding any hedging effects and not taking premiums and discounts into

account:

(in millions of $)

2014

2015

2016

2017

2018

Thereafter

Fair Value

Fixed rates

Senior Notes due 2016

—

—

9

—

—

—

10

Average interest rate

—

—

7.06%

—

—

—

Interest due

1

1

—

—

—

—

Bonds due 2017

—

—

—

450

—

—

509

Average interest rate

—

—

—

6.50%

—

—

Interest due

29

29

29

15

—

—

Notes due 2019

—

—

—

—

—

300

309

Average interest rate

—

—

—

—

—

4.13%

Interest due

12

12

12

12

12

7

Notes due 2027

—

—

—

—

—

71

78

Average interest rate

—

—

—

—

—

8.05%

Interest due

6

6

6

6

6

48

Debentures due 2031

—

—

—

—

—

271

328

Average interest rate

—

—

—

—

—

9.00%

Interest due

24

24

24

24

24

306

Notes due 2040

—

—

—

—

—

827

789

Average interest rate

—

—

—

—

—

5.70%

Interest due

47

47

47

47

47

1 037

Mortgage payable

—

—

1

—

—

—

1

Average interest rate

—

—

8.25%

—

—

—

Interest due

—

—

—

—

—

—

Other debt

12

1

—

—

—

7

20

Average interest rate

5.27%

0.00%

—

—

—

7.00%

Interest due

1

—

—

—

—

6

Total $ cash flows

132

120

128

554

89

2 880

2 044

Total cash flows translated

in millions of €

96

88

94

402

65

2 087

1 482

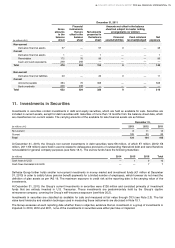

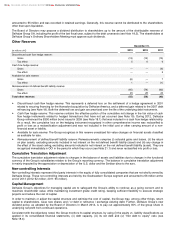

(in millions of €)

2014

2015

2016

2017

2018

Thereafter

Fair Value

Fixed rates

Notes due 2014

215

—

—

—

—

—

220

Average interest rate

5.63%

—

—

—

—

—

Interest due

12

—

—

—

—

—

Retail Bond due 2018

—

—

—

—

400

—

430

Average interest rate

—

—

—

—

4.25%

—

Interest due

17

17

17

17

17

—

Senior Notes due 2020

—

—

—

—

—

400

410

Average interest rate

—

—

—

—

—

3.13%

Interest due

13

13

13

13

13

25

Total € cash flows

257

30

30

30

430

425

1 060

Total cash flows in €

353

118

124

432

495

2 512

2 542

In the event where a counterparty has a choice of when an amount is paid (e.g., on demand deposits), the liability is allocated to

the earliest period in which Delhaize Group can be required to pay. Delhaize Group is managing its liquidity risk based on

contractual maturities.

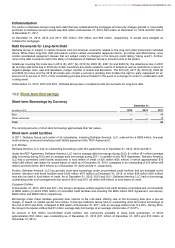

The fair values of the long-term debt (excluding finance leases, see Note 18.3) have been determined using their quoted prices

for which an active market exists (Level 1). The fair values of long-term debts that are classified as Level 2 (non-public debt or

debt for which there is no active market) have been estimated using rates publicly available for debt of similar terms and

remaining maturities offered to the Group and its subsidiaries.

(in millions of

€)

Level 1

Level 2

Total

Fair value hierarchy of long-term debt

2 519

23

2 542

124

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS