Food Lion 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

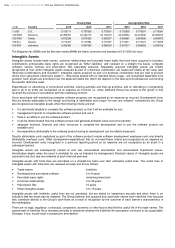

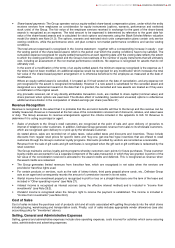

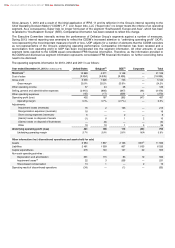

Since January 1, 2013 and a result of the initial application of IFRS 11 and its reflection in the Group’s internal reporting to the

Chief Operating Decision Maker (“CODM”), P.T. Lion Super Indo, LLC (“Super Indo”) no longer meets the criteria of an operating

segment. As a consequence, Super Indo no longer forms part of the segment “Southeastern Europe and Asia”, which has been

re-labeled to “Southeastern Europe” (SEE). Comparative information has been restated to reflect this change.

The Executive Committee internally reviews the performance of Delhaize Group’s segments against a number of measures.

During 2013, internal reporting was amended to reflect the CODM’s increased attention to “underlying operating profit” (UOP),

now representing the most important measure of profit or loss. UOP adjusts for a number of elements that the CODM considers

as non-representative of the Group’s underlying operating performance. Comparative information has been restated and a

reconciliation from operating profit to UOP has been incorporated into the segment information. All other amounts of each

segment items reported to the CODM equal consolidated IFRS financial information. Therefore, as the information provided to

the CODM and disclosed as segment information represents consolidated IFRS financial information, no further reconciling items

need to be disclosed.

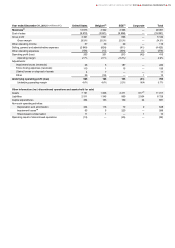

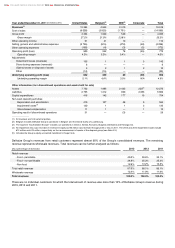

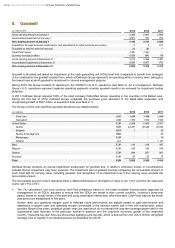

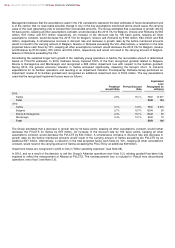

The operating segments information for 2013, 2012 and 2011 is as follows:

Year ended December 31, 2013

(in millions of €)

United States

Belgium(2)

SEE(3)

Corporate

Total

Revenues(1)

12 889

5 071

3 148

—

21 108

Cost of sales

(9 554)

(4 045)

(2 405)

—

(16 004)

Gross profit

3 335

1 026

743

—

5 104

Gross margin

25.9%

20.2%

23.6%

—

24.2%

Other operating income

57

44

28

—

129

Selling, general and administrative expenses

(2 915)

(866)

(647)

(48)

(4 476)

Other operating expenses

(45)

(17)

(209)

1

(270)

Operating profit (loss)

432

187

(85)

(47)

487

Operating margin

3.4%

3.7%

(2.7%)

—

2.3%

Adjustments:

Impairment losses (reversals)

16

2

195

—

213

Reorganization expenses (reversals)

18

—

—

—

18

Store closing expenses (reversals)

6

—

2

—

8

(Gains) losses on disposal of assets

(1)

8

1

2

10

(Gains) losses on disposal of businesses

—

(9)

—

—

(9)

Other

10

10

1

5

26

Underlying operating profit (loss)

481

198

114

(40)

753

Underlying operating margin

3.7%

3.9%

3.6%

N/A

3.6%

Other information (incl. discontinued operations and assets held for sale)

Assets

6 984

1 867

2 106

639(5)

11 596

Liabilities

2 481

1 399

807

1 833

6 520

Capital expenditures

276

140

127

22

565

Non-cash operating activities :

Depreciation and amortization

391

115

83

10

599

Impairment losses(4)

22

3

206

—

231

Share-based compensation

13

1

—

2

16

Operating result of discontinued operations

(34)

—

(1)

—

(35)

92

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS