Food Lion 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

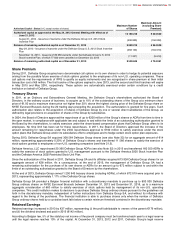

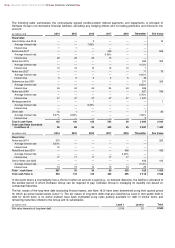

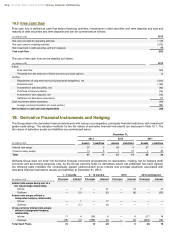

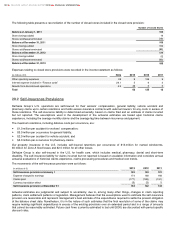

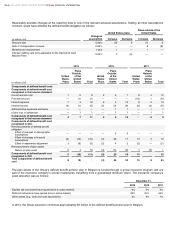

18.5 Free cash flow

Free cash flow is defined as cash flow before financing activities, investments in debt securities and term deposits and sale and

maturity of debt securities and term deposits and can be summarized as follows:

(in millions of €)

2013

Net cash provided by operating activities

1 185

Net cash used in investing activities

(572)

Net investment in debt securities and term deposits

56

Free cash flow

669

The use of free cash flow can be detailed as follows:

(in millions of €)

2013

Inflow:

Free cash flow

669

Proceeds from the exercise of share warrants and stock options

12

Outflow:

Repayments of long-term loans (including lease obligations), net

(213)

Dividends paid

(142)

Investment in debt securities, net

(43)

Purchase of treasury shares

(15)

Investment in term deposits, net

(13)

Settlement of derivative instruments

(1)

Cash movement before translation

254

Foreign currency translation (on cash portion)

(28)

Net increase in cash and cash equivalents

226

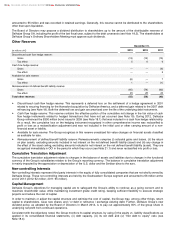

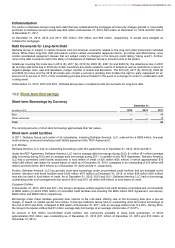

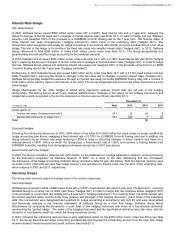

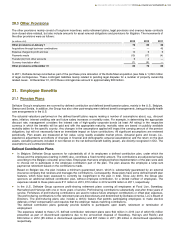

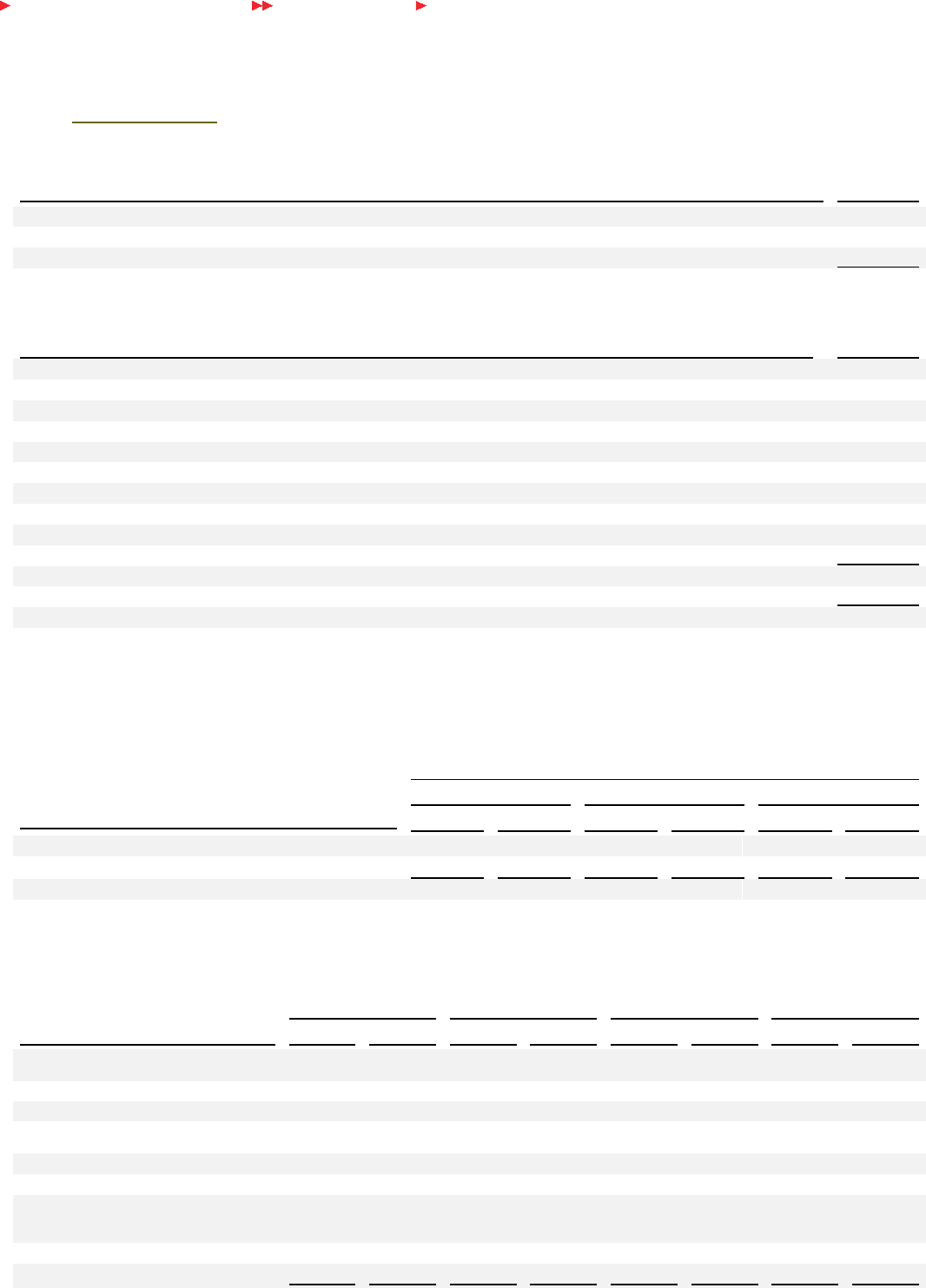

19. Derivative Financial Instruments and Hedging

The Group enters into derivative financial instruments with various counterparties, principally financial institutions with investment

grade credit ratings. The valuation methods for the fair values of derivative financial instruments are disclosed in Note 10.1. The

fair values of derivative assets and liabilities are summarized below:

December 31,

2013

2012

2011

(in millions of €)

Assets

Liabilities

Assets

Liabilities

Assets

Liabilities

Interest rate swaps

27

3

60

4

57

—

Cross-currency swaps

14

8

1

10

1

20

Total

41

11

61

14

58

20

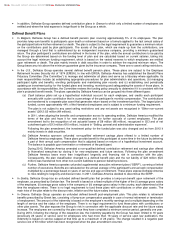

Delhaize Group does not enter into derivative financial instrument arrangements for speculation / trading, but for hedging (both

economic and accounting) purposes only. As the Group currently holds no derivatives where net settlement has been agreed,

the following table indicates the contractually agreed (undiscounted) gross interest and principal payments associated with

derivative financial instruments (assets and liabilities) at December 31, 2013:

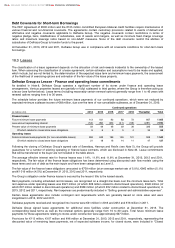

(in millions of €)

1 - 3 months

4 - 12 months

2015

2016 and beyond

Principal

Interest

Principal

Interest

Principal

Interest

Principal

Interest

Interest rate swaps being part of a

fair value hedge relationship

Inflows

—

3

—

21

—

12

—

47

Outflows

—

(3)

—

(6)

—

(8)

—

(29)

Interest rate swaps without a

designated hedging relationship

Inflows

—

1

—

17

—

—

—

—

Outflows

—

(1)

—

(4)

—

—

—

—

Cross-currency interest rate swaps

without a designated hedging

relationship

Inflows

17

4

500

6

—

6

217

19

Outflows

(18)

(4)

(486)

(5)

—

(5)

(225)

(18)

Total Cash Flows

(1)

—

14

29

—

5

(8)

19

128

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS