Food Lion 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

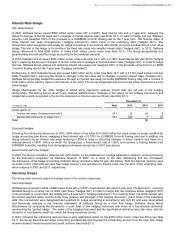

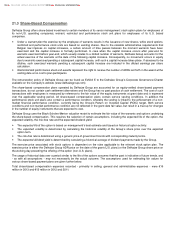

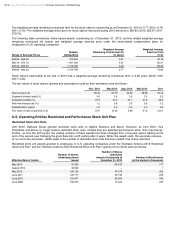

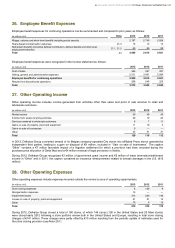

Non-U.S. Operating Entities Stock Options Plans

In its non-U.S. operating entities, Delhaize Group grants stock options to vice presidents and above.

25% of the options granted under these plans vest immediately and the remaining options vest after a service period of

approximately 3½ years, the date at which all options become exercisable. Options expire seven years from the grant date.

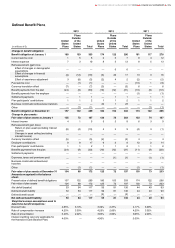

Delhaize Group stock options granted to employees of non-U.S. operating companies were as follows:

Plan

Effective

Date of

Grants

Number of

shares

Underlying

Award

Issued

Number of shares

Underlying Awards

Outstanding at

December 31, 2013

Exercise

Price

Number of

Beneficiaries (at the

moment of

issuance)

Exercise

Period

2013 grant under the 2007

Stock option plan

December

2013

93 063 93 063 €41.71 1

Jan. 1, 2017 –

May 29, 2020

November

2013

15 731 15 731 €43.67 1

Jan. 1, 2017

–

May 29, 2020

May 2013 267 266 267 266 €49.85 111

Jan. 1, 2017

–

May 29, 2020

2012 grant under the 2007

Stock option plan

November

2012

35 000 35 000 €26.39 1 Jan. 1, 2016 –

May 24, 2019

May 2012 362 047 362 047 €30.99 95

Jan. 1, 2016

–

May 24, 2019

2011 grant under the 2007

Stock option plan

June 2011 290 078 266 755 €54.11 83 Jan. 1, 2015 -

June 14, 2018

2010 grant under the 2007

Stock option plan

June 2010 198 977 176 210 €66.29 80

Jan. 1, 2014 -

June 7, 2017

2009 grant under the 2007

Stock option plan

June 2009 230 876 196 242 €50.03 73

Jan. 1, 2013 -

June 8, 2016

2008 grant under the 2007

Stock option plan May 2008 237 291 206 866 €49.25 318

Jan. 1,

2012 - May 29,

2015

2007 grant under the 2007

Stock option plan June 2007 185 474 158 848 €71.84 619

Jan. 1,

2011 - June 7,

2017

(1)

_______________

(1) In 2009, Delhaize Group offered to the beneficiaries of the 2007 grant (under the 2007 stock option plan) the exceptional choice to extend the exercise period

from 7 to 10 years. This was accounted as a modification of the plan and the non-significant incremental fair value granted by this extension, measured in

accordance with IFRS 2, was accounted over the remaining vesting period. In accordance with Belgian law, most of the beneficiaries of the 2007 Stock option

plan agreed to extend the exercise period of their stock options for a term of three years. The very few beneficiaries who did not agree to extend the exercise

period of their stock options continue to be bound by the initial expiration date of the exercise period of the plan, i.e., June 7, 2014.

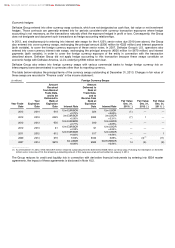

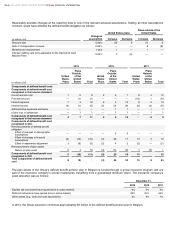

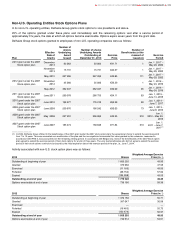

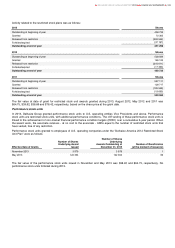

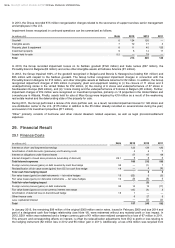

Activity associated with non-U.S. stock option plans was as follows:

2013 Shares

Weighted Average Exercise

Price (in €)

Outstanding at beginning of year

1 606 255

49.95

Granted

376 060

47.58

Exercised

(11 166)

49.56

Forfeited

(58 753)

57.02

Expired

(134 368)

49.55

Outstanding at end of year

1 778 028

49.25

Options exercisable at end of year

738 166

58.39

2012 Shares

Weighted Average Exercise

Price (in €)

Outstanding at beginning of year

1 379 150

55.71

Granted

397 047

30.58

Exercised

—

—

Forfeited

(16 463)

55.73

Expired

(153 479)

50.97

Outstanding at end of year

1 606 255

49.95

Options exercisable at end of year

742 612

54.61

DELHAIZE GROUP ANNUAL REPORT 2013 FINANCIAL STATEMENTS

139