Food Lion 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

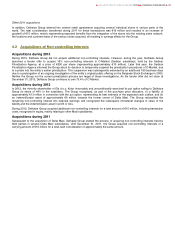

the projected cash flows used to determine the recoverable amount of the CGUs and might result in additional stores identified

as being possibly impaired and/or on the impairment amount calculated.

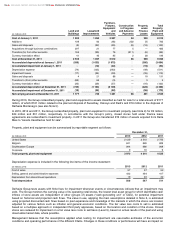

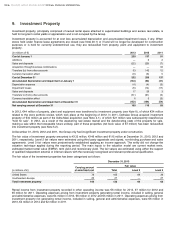

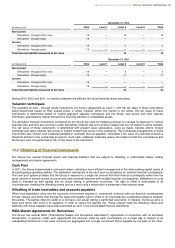

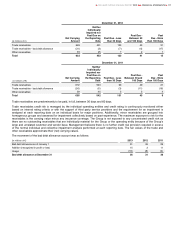

The impairment charges can be summarized by property, plant and equipment categories as follows:

(in millions of

€)

December 31,

Note

2013

2012

2011

Land and buildings

2

15

17

Leasehold improvements

5

23

24

Furniture, fixtures, equipment and vehicles

7

36

39

Construction in progress

—

1

—

Property under finance leases

3

12

35

Total

17

87

115

Recognized in :

Other operating expenses

28

11

45

120

Result from discontinued operations

6

42

(5)

In 2012, the Group recognized impairment charges of €87 million related to (i) 45 stores (34 Sweetbay, 8 Food Lion and 3

Bottom Dollar Food) that were closed early 2013 and 9 underperforming stores, all in the United States, for a total amount of €54

million, (ii) the closing of 6 stores and underperformance of 57 stores in Southeastern Europe (€28 million), and (iii) 1 store

closing and the impairment of 6 stores in Belgium (€5 million).

A store portfolio review resulted in the decision to close 146 underperforming stores in the first quarter of 2012. Consequently,

the Group recorded in 2011 €120 million impairment charges relating to 126 stores in the U.S. (113 Food Lion, 7 Bloom and 6

Bottom Dollar Food stores) and one distribution center, while the underperformance of 20 Maxi stores (in Serbia, Bulgaria and

Bosnia and Herzegovina) was already reflected in the fair values of the related assets in the opening balance sheet (see Note 4).

In addition, Delhaize Group recognized impairment reversals of €5 million in the United States, which was offset by impairment

charges in various other parts of the Group.

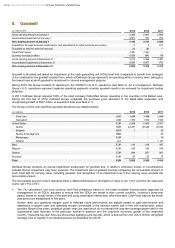

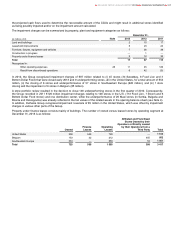

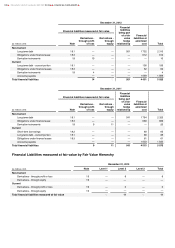

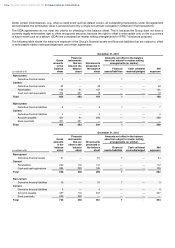

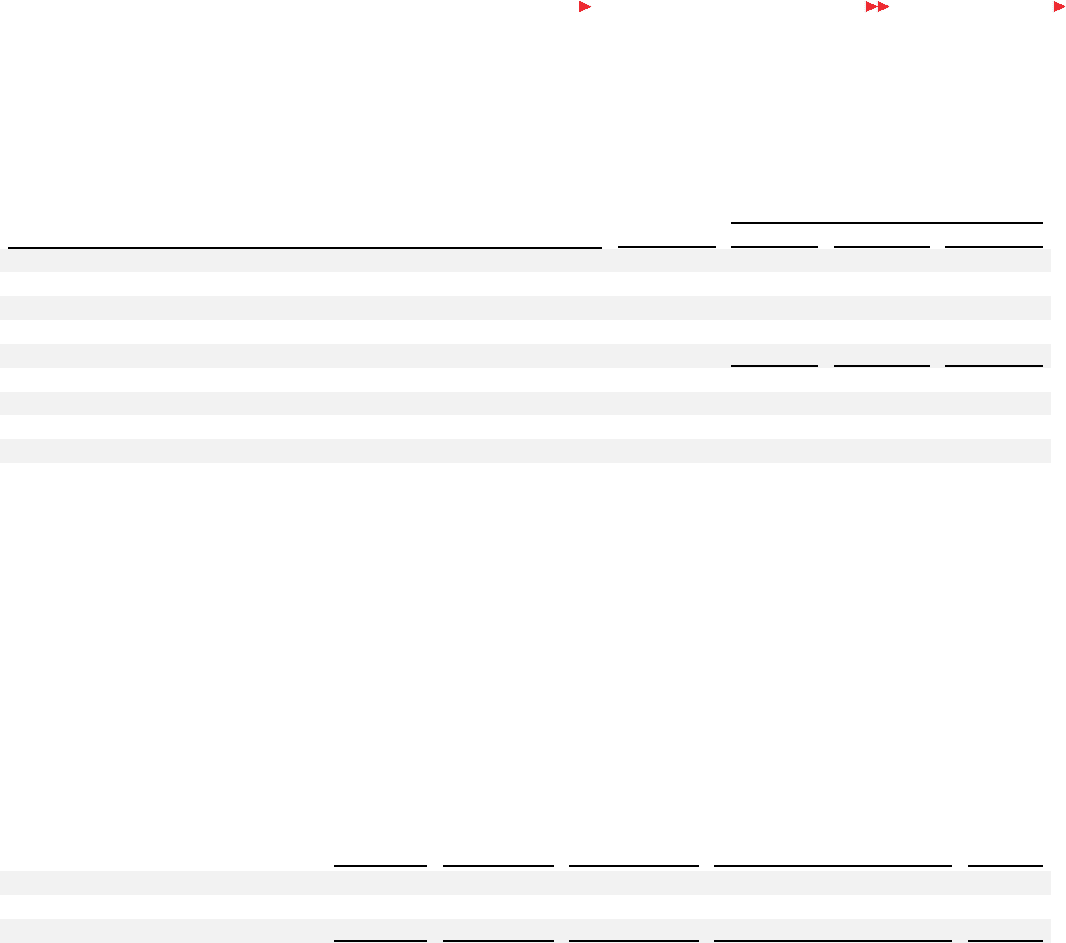

Property under finance leases consists mainly of buildings. The number of owned versus leased stores by operating segment at

December 31, 2013 is as follows:

Owned

Finance

Leases

Operating

Leases

Affiliated and Franchised

Stores Owned by their

Operators or Directly Leased

by their Operators from a

Third Party Total

United States

238

556

720

—

1 514

Belgium

153

32

212

455

852

Southeastern Europe

334

—

663

54

1 051

Total

725

588

1 595

509

3 417

DELHAIZE GROUP ANNUAL REPORT 2013 FINANCIAL STATEMENTS

107