Food Lion 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

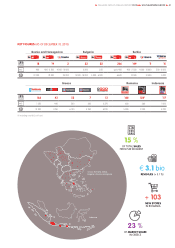

SOUTHEASTERN

EUROPE

Market

Without a doubt, 2013 was another challeng-

ing year for doing business in Southeastern

Europe. However, there have been signs of

improvement. In Serbia, for instance, GDP

growth turned slightly positive in the second

half of the year and the unemployment rate

(1)

declined from the record level of 25% it had

reached in 2012. In Greece, the unemploy-

ment has hopefully reached a peak and GDP

contraction has slowed. The bright spot in

the region has been Romania, where GDP

growth and consumer spending both seem to

indicate that the tough years of 2010 and 2011

have been digested.

Strategy

Delhaize Group continues to believe in and

stimulate the development of this region. This

is why, in 2013, we started building a new

distribution center in Serbia to reduce our

Direct-Store-Deliveries and to support our

growth ambitions. In Greece, Alfa Beta has

made the right strategic choices to win the

hearts and the wallets of Greek customers.

Market share was up again in 2013, reaching

a record level of 23% (Source: AC Nielsen). In

Romania, Mega Image is also gaining market

share, albeit mostly through its rapid store

expansion program.

Performance

For the full year 2013, revenues in Southeast-

ern Europe increased by 5.1% to €3.1 billion,

mainly as a result of volume growth in Greece

and 103 store openings in Romania. Compa-

rable store sales evolution for the region was

-0.3% for the year. During 2013, gross margin

increased by 31 basis points to 23.6% due to

improved procurement conditions in Romania

and Serbia. Selling, general and administra-

tive expenses as a percentage of revenues

increased by 16 basis points to 20.6% due to

higher expenses in Serbia and as a result of the

high growth in Romania. Underlying operating

margin was 3.6% (3.5% in 2012) while under-

lying operating profit was €114 million, or an

increase of 8.7% at identical exchange rates.

THE SOUTHEASTERN EUROPE SEGMENT HAS SHOWN THE

HIGHEST GROWTH WITHIN DELHAIZE GROUP. IN 2013, ALMOST

15% OF SALES CAME FROM THIS REGION. DELHAIZE GROUP HAS

MAINTAINED ITS INVESTMENT LEVELS IN GREECE, ROMANIA AND

SERBIA IN ORDER TO FURTHER EXPAND ITS STORE NETWORK AS

WELL AS TO DEVELOP AND IMPROVE ITS SUPPLY CHAIN.

ALBANIA AND

MONTENEGRO

In 2013, Delhaize Group made some

structural changes and strategic

choices to improve the overall

performance of the segment. As

a result, the operations in Albania

and Montenegro were sold. In

Montenegro, Delhaize Group and the

buyer, Expo Commerce, entered into

a franchise agreement whereby Expo

Commerce will continue to operate

the Maxi, Mini Maxi and Tempo

stores under the same names and to

offer Delhaize private brand products

in the stores. These transactions will

allow Delhaize Group to allocate

resources where they can deliver the

highest return and create the most

value for all of our stakeholders.

DELHAIZE GROUP ANNUAL REPORT 2013

SOUTHEASTERN EUROPE

39

(1) Source: Trading Economics.