Food Lion 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

DELHAIZE GROUP ANNUAL REPORT 2013

REVIEW

Southeastern Europe

Review

Alfa Beta - Greece

Through a combination of company-operated

and affiliated stores, Alfa Beta operates a mul-

ti-format store network in Greece. Alfa Beta is

known for its large assortment, including fresh

and organic products and local specialties. In

2013, Alfa Beta continued to meet the needs

of the Greek customer and was rewarded for

its customer-centricity with a higher market

share. Its store network increased by 13 stores

to reach a total of 281.

Mega Image - Romania

Mega Image operates neighborhood

supermarkets concentrated in Bucharest

with a focus on proximity and competitive

prices, coupled with variety and a strong

fresh offering. After accelerating its expan-

sion program in 2011 and 2012, Mega Image

maintained its high pace of expansion in 2013

by opening 103 new stores. An important lever

for this growth has been the development and

deployment of the Shop & Go format, enabling

Mega Image to respond to the proximity and

convenience needs of Romanian customers.

For the first time since the launch of the new

store format in 2010, Mega Image opened its

first Shop & Go store outside of Bucharest.

Serbia

Operating 381 stores mainly under the Maxi

brand, Delhaize Group is the leading food

retailer in Serbia. Next to Maxi, Delhaize Serbia

also operates under the Tempo brand. Both

banners offer a broad assortment, including

fresh and bakery products, with Maxi focusing

primarily on food and Tempo stressing more

non-food and general merchandise. One of

the significant strengths of Delhaize Serbia is

its excellent store locations.

To further develop its locational differentiation,

Delhaize Serbia introduced in 2013 a new

concept to the market, the Mini store. The Mini

store concept is located at a petrol station

and is open 24/7. It offers a wide assortment

of goods, including private brand products,

across a range of categories including dairy,

fruit, beverages, pet food and personal

hygiene.

Bulgaria(2)

In Bulgaria, Delhaize operates under the Pic-

cadilly brand. Piccadilly is known for its large

assortment, strong focus on fresh products

and extended opening hours. The network is a

mix of traditional Piccadilly supermarkets and

the Piccadilly Daily convenience stores. Most

Piccadilly stores are concentrated in the cities

of Sofia, Varna and Plovdiv. In the summer

of 2013, Piccadilly reached the important

milestone of opening its 50th store in the center

of Sofia. At the end of 2013, Delhaize Group

operated 54 stores in Bulgaria, an increase of

11 stores compared to the prior year.

Bosnia and Herzegovina(2)

Delhaize Group operates a network of

39 stores, making it one of the largest food

retailers in Bosnia and Herzegovina. The

multi-format network comprises Mini Maxi

convenience stores, Maxi supermarkets,

Tempo hypermarkets, and Tempo Express

discount stores.

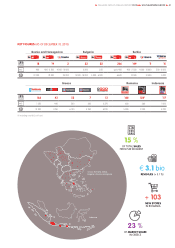

INDONESIA

Delhaize Group operates in

Indonesia through a 51% holding

stake in Super Indo. Based on

a change in IFRS rules, Super

Indo is no longer proportionally

consolidated and is accounted for

under the equity method (one-line

consolidation).

With more than 245 million

inhabitants, Indonesia is the

largest economy in Southeast Asia

and in 2013 it has maintained its

reputation as a solid growth engine:

GDP(1) was up again by 5.7%, the

unemployment rate decreased

slightly, consumer confidence

climbed toward the high levels of

2005 and retail sales(1) peaked at the

end of 2013, with a solid growth rate

of 18.3%.

Super Indo capitalized on these

improving economic conditions

by opening 15 new stores in 2013,

expanding its total store count to

117. Most Super Indo stores are

located on the island of Java in the

densely populated cities of Jakarta,

Bandung, Surabaya and Yogyakarta.

Super Indo supermarkets offer a

wide variety of fresh products with a

focus on fresh fish and meat at low

prices, both of which are important

differentiators in the Indonesian

market.

DELHAIZE GROUP

HAS MAINTAINED

ITS INVESTMENT

LEVELS IN GREECE,

ROMANIA AND

SERBIA.

(1) Source: Trading Economics.

(2) Divested in the 1

st

quarter of 2014.