Food Lion 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 Food Lion annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34. Contingencies and Financial Guarantees

Delhaize Group is from time to time involved in legal actions in the ordinary course of its business. Delhaize Group is not aware

of any pending or threatened litigation, arbitration or administrative proceedings (individually or in the aggregate) that is likely to

have a material adverse effect on its business or consolidated financial statements. Any litigation, however, involves risk and

potentially significant litigation costs and therefore Delhaize Group cannot give any assurance that any currently pending

litigation or which may arise in the future will not have a material adverse effect on our business or consolidated financial

statements.

The Group continues to be subject to tax audits in jurisdictions where we conduct business. Although some audits have been

completed during 2011, 2012 and 2013, Delhaize Group expects continued audit activity in 2014. While the ultimate outcome of

tax audits is not certain, the Group has considered the merits of its filing positions in its overall evaluation of potential tax

liabilities and believes it has adequate liabilities recorded in its consolidated financial statements for exposures on these matters.

Based on its evaluation of the potential tax liabilities and the merits of our filing positions, it is unlikely that potential tax exposures

over and above the amounts currently recorded as liabilities in its consolidated financial statements will be material to its financial

condition or future results of operations.

Delhaize Group is from time to time subject to investigations or inquiries by the competition authorities related to potential

violations of competition laws in jurisdictions where we conduct business.

In this context, in 2007, representatives of the Belgian Competition Authority visited Delhaize Belgium’s procurement department

in Zellik, Belgium, and requested the provision of certain documents. This visit was part of a national investigation affecting

several companies active in Belgium in the supply and retail sale of health and beauty products and other household goods. In

2012, the Auditor to the Belgian Competition Authority issued its investigation report. The investigation involves 11 suppliers and

7 retailers, including Delhaize Belgium, alleging coordination of price increases for certain health and beauty products sold in

Belgium from 2002 to 2007. In 2013, Delhaize Belgium and other retailers have lodged an appeal against the decision of the

Auditor to utilize certain documents seized during the visits to Zellik and other companies’ facilities and have requested a

suspension of the procedure pending in front of the Belgian Competition Authority. A decision by the Court of Appeal of Brussels

on the suspension is expected in March or April 2014 and a decision on the merits of the procedural challenge is possible by the

end of 2014. Based on the information contained in the investigation report and relevant case precedents, Delhaize Group does

not have sufficient information to estimate a possible fine or compensation payment that may result from any adverse future

decision of the Belgian Competition Authority. According to Belgian legislation, fines for competition law infringements are

calculated on the turnover of the products affected by the alleged infringement in the last full year of the alleged coordination

activities, capped at 10% of the Group’s annual Belgian revenues in the year preceding the decision of the Competition Authority.

However, there are many variables and uncertainties associated with the application of the relevant legislation to the facts and

circumstances of this investigation, regardless of the outcome of the procedural appeal pending before the Court of Appeal.

Moreover, a decision on the merits of the matter by the Authority would likely not occur before 2015, and, under current Belgian

legislation, the parties have the right to appeal an adverse decision of the Authority in court. Consequently, the Group does

currently not have sufficient information available to make a reliable estimate of any possible financial impact or the timing

thereof.

In a separate matter related to another of Delhaize Group’s operations, Mega Image in Romania, the Group has, since 2009,

answered a series of questionnaires sent by the Romanian Competition Authority to various suppliers and retailers operating in

Romania in connection with an ongoing antitrust investigation. The questionnaires focused on the contractual and commercial

relationships between the retailers and local food suppliers. At December 31, 2013, these broad inquiries have neither resulted in

the issuance of any investigation report nor of a Statement of Objections. The Romanian legislation provides that antitrust fines, if

any, are based on a percentage of the total turnover of the year preceding a decision by the Romanian Competition Plenum.

In a shareholders’ matter related to the Group’s wholly-owned subsidiary in Greece, Delhaize Group was notified in 2011 that

some former shareholders of Alfa Beta Vassilopoulos S.A., who together held 7% of Alfa Beta shares, have filed a claim in front

of the Court of First Instance of Athens challenging the price paid by the Group during the squeeze-out process that was

approved by the Hellenic Capital Markets Commission. Delhaize Group believes that the squeeze-out transaction has been

executed and completed in compliance with all legal and regulatory requirements. Delhaize Group continues to assess the merits

and any potential exposure of this claim and to vigorously defend itself. The first hearing took place in 2013 and the Court of First

Instance of Athens appointed a financial expert to assist the Court in assessing the value of the Alfa Beta shares when the

squeeze-out was launched. The decision of the Court of First Instance of Athens is expected in 2014.

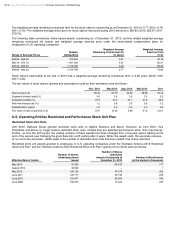

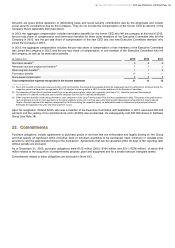

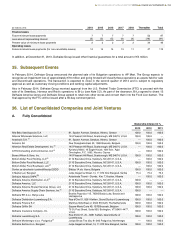

Following the closing of Delhaize Group’s agreed sale of Sweetbay, Harveys and Reid’s, the Group will provide guarantees for a

number of existing operating or finance lease contracts, which extend through 2036. In the event of a future default of the buyer,

Delhaize Group will be obligated under the terms of the contract to the landlords. The schedule below provides the future

minimum lease payments over the non-cancellable lease term of the guaranteed leases, excluding other direct costs such as

common area maintenance expenses and real estate taxes, as of December 31, 2013. Currently, the Group does not expect to

be required to pay any amounts under these guarantees.

152

DELHAIZE GROUP ANNUAL REPORT 2013

FINANCIAL STATEMENTS