Entergy 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

terminating the lease and repurchasing the 11.5% interest in the unit

at certain intervals during the lease. Furthermore, at the end of the

lease term, System Energy has the option of renewing the lease or

repurchasing the 11.5% interest in Grand Gulf.

In May 2004, System Energy caused the Grand Gulf lessors to refi-

nance the outstanding bonds that they had issued to finance the

purchase of their undivided interest in Grand Gulf. The refinancing is

at a lower interest rate, and System Energy’s lease payments have been

reduced to reflect the lower interest costs.

System Energy is required to report the sale-leaseback as a financing

transaction in its financial statements. For financial reporting purposes,

System Energy expenses the interest portion of the lease obligation and the

plant depreciation. However, operating revenues include the recovery of the

lease payments because the transactions are accounted for as a sale and lease-

back for ratemaking purposes. Consistent with a recommendation

contained in a FERC audit report, System Energy initially recorded as a net

regulatory asset the difference between the recovery of the lease payments

and the amounts expensed for interest and depreciation and continues to

record this difference as a regulatory asset or liability on an ongoing basis,

resulting in a zero net balance for the regulatory asset at the end of the lease

term. The amount of this net regulatory asset was $51.1 million and $63.1

million as of December 31, 2006 and 2005, respectively.

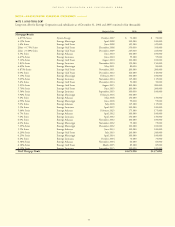

As of December 31, 2006 System Energy had future minimum

lease payments (reflecting an implicit rate of 5.62%), which are

recorded as long-term debt as follows (in thousands):

2007 $ 46,552

2008 47,128

2009 47,760

2010 48,569

2011 49,437

Years thereafter 204,396

Total 443,842

Less: Amount representing interest 98,502

Present value of net minimum lease payments $345,340

NOTE 11. RETIREMENT, OTHER POSTRETIREMENT BENEFITS,

AND DEFINED CONTRIBUTION PLANS

QUALIFIED PENSION PLANS

Entergy has seven qualified pension plans covering substantially all of

its employees: “Entergy Corporation Retirement Plan for Non-

Bargaining Employees,” “Entergy Corporation Retirement Plan for

Bargaining Employees,” “Entergy Corporation Retirement Plan II for

Non-Bargaining Employees,” “Entergy Corporation Retirement

Plan II for Bargaining Employees,” “Entergy Corporation Retirement

Plan III,” “Entergy Corporation Retirement Plan IV for Non-

Bargaining Employees,” and “Entergy Corporation Retirement Plan

IV for Bargaining Employees.” Except for the Entergy Corporation

Retirement Plan III, the pension plans are noncontributory and pro-

vide pension benefits that are based on employees’ credited service

and compensation during the final years before retirement. The

Entergy Corporation Retirement Plan III includes a mandatory

employee contribution of 3% of earnings during the first 10 years of

plan participation, and allows voluntary contributions from 1% to

10% of earnings for a limited group of employees.

Entergy Corporation and its subsidiaries fund pension costs in

accordance with contribution guidelines established by the Employee

Retirement Income Security Act of 1974, as amended, and the

Internal Revenue Code of 1986, as amended. The assets of the plans

include common and preferred stocks, fixed-income securities,

interest in a money market fund, and insurance contracts. The

Registrant Subsidiaries’ pension costs are recovered from customers as

a component of cost of service in each of their jurisdictions. Entergy

uses a December 31 measurement date for its pension plans. As a

result of the Entergy New Orleans bankruptcy filing, Entergy has dis-

continued the consolidation of Entergy New Orleans retroactive to

January 1, 2005, and is reporting Entergy New Orleans’ results under

the equity method of accounting.

In September 2006, FASB issued SFAS 158, “Employer’s

Accounting for Defined Benefit Pension and Other Postretirement

Plans, an amendment of FASB Statements Nos. 87, 88, 106 and

132(R),” to be effective December 31, 2006. SFAS 158 requires an

employer to recognize in its balance sheet the funded status of its ben-

efit plans. This is measured as the difference between plan assets at fair

value and the benefit obligation. Employers are to record previously

unrecognized gains and losses, prior service costs, and the remaining

transition asset or obligation as a result of adopting SFAS 87 and

SFAS 106 as accumulated other comprehensive income (“OCI”) or as

a regulatory asset reflective of the recovery mechanism for pension

and OPEB costs in the Utility’s jurisdictions. For the portion of

Entergy Gulf States that is not regulated, the unrecognized prior serv-

ice cost, gains and losses, and transition asset/obligation for its

pension and other postretirement benefit obligations are recorded in

other comprehensive income. The portion of Entergy Gulf States reg-

ulated by the LPSC and Entergy Louisiana recover other

postretirement benefits costs on a pay as you go basis and will record

the unrecognized prior service cost, gains and losses, and transition

obligation for its other postretirement benefit obligation in other

comprehensive income. SFAS 158 also requires that changes in the

funded status be recorded in other comprehensive income or as a reg-

ulatory asset in the period in which the changes occur.

As of December 31, 2005, Entergy recognized an additional mini-

mum pension liability for the excess of the accumulated benefit

obligation over the fair market value of plan assets. In accordance with

SFAS 87, an offsetting intangible asset, up to the amount of any

unrecognized prior service cost, was also recorded, with the remaining

offset to the liability recorded as a regulatory asset or accumulated

other comprehensive income.

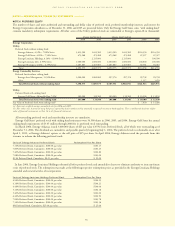

COMPONENTS OF QUALIFIED NET PENSION COST

Total 2006, 2005, and 2004 qualified pension costs of Entergy

Corporation and its subsidiaries, including amounts capitalized,

included the following components (in thousands):

2006 2005 2004

Service cost – benefits earned

during the period $ 92,706 $ 82,520 $ 76,946

Interest cost on projected

benefit obligation 167,257 155,477 148,092

Expected return on assets (177,930) (159,544) (153,584)

Amortization of transition asset – (662) (763)

Amortization of prior service cost 5,462 4,863 5,143

Recognized net loss 43,721 35,604 21,687

Net pension costs $ 131,216 $ 118,258 $ 97,521

Estimated amortization amounts from the regulatory assets or OCI to

net periodic cost in the following year (in thousands):

Prior service cost $ 5,531

Net loss $ 44,316

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

83