Entergy 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

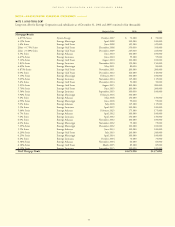

NOTE 5. LONG-TERM DEBT

Long-term debt for Entergy Corporation and subsidiaries as of December 31, 2006 and 2005 consisted of (in thousands):

Maturity Date 2006 2005

Mortgage Bonds:

4.875% Series System Energy October 2007 $ 70,000 $ 70,000

4.35% Series Entergy Mississippi April 2008 100,000 100,000

3.6% Series Entergy Gulf States June 2008 325,000 325,000

Libor + 0.75% Series Entergy Gulf States December 2008 350,000 350,000

Libor + 0.40% Series Entergy Gulf States December 2009 225,000 225,000

4.5% Series Entergy Arkansas June 2010 100,000 100,000

4.67% Series Entergy Louisiana June 2010 55,000 55,000

5.12% Series Entergy Gulf States August 2010 100,000 100,000

5.83% Series Entergy Louisiana November 2010 150,000 150,000

4.65% Series Entergy Mississippi May 2011 80,000 80,000

4.875% Series Entergy Gulf States November 2011 200,000 200,000

6.0% Series Entergy Gulf States December 2012 140,000 140,000

5.15% Series Entergy Mississippi February 2013 100,000 100,000

5.09% Series Entergy Louisiana November 2014 115,000 115,000

5.6% Series Entergy Gulf States December 2014 50,000 50,000

5.25% Series Entergy Gulf States August 2015 200,000 200,000

5.70% Series Entergy Gulf States June 2015 200,000 200,000

5.56% Series Entergy Louisiana September 2015 100,000 100,000

5.92% Series Entergy Mississippi Feburary 2016 100,000 –

5.4% Series Entergy Arkansas May 2018 150,000 150,000

4.95% Series Entergy Mississippi June 2018 95,000 95,000

5.0% Series Entergy Arkansas July 2018 115,000 115,000

5.5% Series Entergy Louisiana April 2019 100,000 100,000

5.66% Series Entergy Arkansas February 2025 175,000 175,000

6.7% Series Entergy Arkansas April 2032 100,000 100,000

7.6% Series Entergy Louisiana April 2032 150,000 150,000

6.0% Series Entergy Arkansas November 2032 100,000 100,000

6.0% Series Entergy Mississippi November 2032 75,000 75,000

7.25% Series Entergy Mississippi December 2032 100,000 100,000

5.9% Series Entergy Arkansas June 2033 100,000 100,000

6.20% Series Entergy Gulf States July 2033 240,000 240,000

6.25% Series Entergy Mississippi April 2034 100,000 100,000

6.4% Series Entergy Louisiana October 2034 70,000 70,000

6.38% Series Entergy Arkansas November 2034 60,000 60,000

6.18% Series Entergy Gulf States March 2035 85,000 85,000

6.30% Series Entergy Louisiana September 2035 100,000 100,000

Total Mortgage Bonds $4,675,000 $4,575,000

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

73