Entergy 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

72

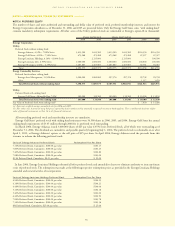

The credit facilities have variable interest rates and the average

commitment fee is 0.13%. The Entergy Arkansas credit facility

requires that it maintain total shareholders’ equity of at least 25% of

its total assets.

ENTERGY NEW ORLEANS DEBTOR-IN-POSSESSION CREDIT AGREEMENT

On September 26, 2005, Entergy New Orleans, as borrower, and

Entergy Corporation, as lender, entered into the Debtor-in-Possession

(DIP) credit agreement, a debtor-in-possession credit facility to

provide funding to Entergy New Orleans during its business restora-

tion efforts. On December 9, 2005, the bankruptcy court issued

its final order approving the DIP Credit Agreement. The credit

facility provides for up to $200 million in loans. The facility enables

Entergy New Orleans to request funding from Entergy Corporation,

but the decision to lend money is at the sole discretion of

Entergy Corporation. As of December 31, 2006, Entergy New

Orleans had $52 million of outstanding borrowings under the DIP

credit agreement.

Borrowings under the DIP credit agreement are due in full, and the

agreement will terminate, at the earliest of (i) August 23, 2007, (ii) the

acceleration of the loans and the termination of the DIP credit agree-

ment in accordance with its terms, (iii) the date of the closing of a sale

of all or substantially all of Entergy New Orleans’ assets pursuant to

either section 363 of the United States Bankruptcy Code or a con-

firmed plan of reorganization, or (iv) the effective date of a plan of

reorganization in Entergy New Orleans’ bankruptcy case.

As security for Entergy Corporation as the lender, the terms of the

December 9, 2005 bankruptcy court order provide that all borrow-

ings by Entergy New Orleans under the DIP Credit Agreement are:

(i) entitled to superpriority administrative claim status pursuant to

section 364(c)(1) of the Bankruptcy Code; (ii) secured by a perfected

first priority lien on all property of Entergy New Orleans pursuant to

sections 364(c)(2) and 364(d) of the Bankruptcy Code, except on any

property of Entergy New Orleans subject to valid, perfected, and non-

avoidable liens of the lender on Entergy New Orleans’ $15 million

credit facility that existed as of the date Entergy New Orleans filed its

bankruptcy petition; and (iii) secured by a perfected junior lien pur-

suant to section 364(c)(3) of the Bankruptcy Code on all property of

Entergy New Orleans subject to valid, perfected, and non-avoidable

liens in favor of the lender on Entergy New Orleans’ $15 million cred-

it facility that existed as of the date Entergy New Orleans filed its

bankruptcy petition.

The interest rate on borrowings under the DIP credit agreement

will be the average interest rate of borrowings outstanding under

Entergy Corporation’s $2 billion revolving credit facility, which was

approximately 5.7% per annum at December 31, 2006.

The lien granted by the bankruptcy court under sections 364(c)(2)

and 364(d) primes the liens that secure Entergy New Orleans’ obliga-

tions under its mortgage bond indenture that existed as of the date

Entergy New Orleans filed its bankruptcy petition. To secure Entergy

New Orleans’ obligations under its mortgage bond indenture, the

bankruptcy court’s December 9, 2005 order grants in favor of the

bond trustee, for the benefit of itself and the bondholders, a lien on

all Entergy New Orleans property that secures its obligations under

the DIP Credit Agreement. The lien in favor of the bond trustee is

senior to all other liens except for the liens in favor of Entergy

Corporation and the lender on Entergy New Orleans’ $15 million

credit facility that existed as of the date Entergy New Orleans filed its

bankruptcy petition.

Events of default under the DIP credit agreement include: failure

to make payment of any installment of principal or interest when due

and payable; the occurrence of a change of control of Entergy New

Orleans; failure by either Entergy New Orleans or Entergy

Corporation to receive other necessary governmental approvals and

consents; the occurrence of an event having a materially adverse effect

on Entergy New Orleans or its prospects; and customary bankruptcy-

related defaults, including, without limitation, appointment of a

trustee, “responsible person,” or examiner with expanded powers,

conversion of Entergy New Orleans’ chapter 11 case to a case under

chapter 7 of the Bankruptcy Code, and the interim or final orders

approving the DIP Credit Agreement being stayed or modified or

ceasing to be in full force and effect.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued