Entergy 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

In 2004, Entergy realized a pre-tax gain of $0.9 million upon the sale to a third party of preferred shares, and less than 1% of the common

shares, of Entergy Asset Management, an Entergy subsidiary. See Note 3 to the financial statements for a discussion of the tax benefit realized

on the sale. Entergy Asset Management’s stockholders’ agreement provides that at any time during the 180-day period prior to December 31,

2007 or each subsequent December 31 thereafter, either Entergy Asset Management or the preferred shareholders may request that the preferred

dividend rate be reset. If Entergy Asset Management and the preferred shareholders are unable to agree on a dividend reset rate, a preferred

shareholder can request that its shares be sold to a third party. If Entergy Asset Management is unable to sell the preferred shares within 75 days,

the preferred shareholder has the right to take control of the Entergy Asset Management board of directors for the purpose of liquidating the

assets of Entergy Asset Management in order to repay the preferred shares and any accrued dividends.

NOTE 7. COMMON EQUITY

COMMON STOCK

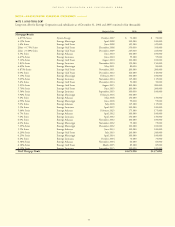

Treasury Stock

Treasury stock activity for Entergy for 2006, 2005 and 2004 is as follows ($ in thousands):

2006 2005 2004

Treasury Shares Cost Treasury Shares Cost Treasury Shares Cost

Beginning Balance, January 1 40,644,602 $2,161,960 31,345,028 $1,432,019 19,276,445 $ 561,152

Repurchases 6,672,000 584,193 12,280,500 878,188 16,631,800 1,017,996

Issuances:

Employee Stock-Based Compensation Plans (1,803,471) (101,393) (2,965,006) (147,888) (4,555,897) (146,877)

Directors’ Plan (6,820) (370) (15,920) (359) (7,320) (252)

Ending Balance, December 31 45,506,311 $2,644,390 40,644,602 $2,161,960 31,345,028 $1,432,019

Entergy Corporation reissues treasury shares to meet the requirements of the Stock Plan for Outside Directors (Directors’ Plan), the Equity

Ownership Plan of Entergy Corporation and Subsidiaries (Equity Ownership Plan), the Equity Awards Plan of Entergy Corporation and

Subsidiaries, and certain other stock benefit plans. The Directors’ Plan awards to non-employee directors a portion of their compensation in the

form of a fixed number of shares of Entergy Corporation common stock.

On January 29, 2007, the Board approved a new repurchase program under which Entergy is authorized to repurchase up to $1.5 billion of

its common stock, which Entergy expects to complete over the next two years.

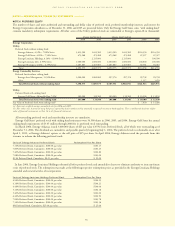

RETAINED EARNINGS AND DIVIDEND RESTRICTIONS

Provisions within the articles of incorporation or pertinent indentures and various other agreements relating to the long-term debt and preferred

stock of certain of Entergy Corporation’s subsidiaries restrict the payment of cash dividends or other distributions on their common and pre-

ferred stock. As of December 31, 2006, Entergy Arkansas and Entergy Mississippi had restricted retained earnings unavailable for distribution

to Entergy Corporation of $396.4 million and $121.6 million, respectively. Entergy Corporation received dividend payments from subsidiaries

totaling $950 million in 2006, $424 million in 2005, and $825 million in 2004.

The Federal Power Act restricts the ability of a public utility to pay dividends out of capital. As a result of its restructuring and the related

accounting, Entergy Louisiana, LLC applied to the FERC for a declaratory order to pay distributions on its common and preferred membership

interests from the following sources: (1) the amount of Entergy Louisiana, Inc.’s retained earnings immediately prior to its restructuring on

December 31, 2005; (2) an amount in excess of the amount in (1) over a transition period not expected to last more than 3 years as long as

Entergy Louisiana, LLC’s proprietary capital ratio is, and will remain, above 30%; and (3) the amount of Entergy Louisiana, LLC’s retained earn-

ings after the restructuring. The FERC granted the declaratory order on January 23, 2006. Distributions paid by Entergy Louisiana, LLC on its

common membership interests to Entergy Louisiana Holdings, Inc. may, in turn, be paid by Entergy Louisiana Holdings, Inc. to Entergy

Corporation without the need for FERC approval. As a wholly-owned subsidiary, Entergy Louisiana Holdings, Inc. dividends its earnings to

Entergy Corporation at a percentage determined monthly.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

77