Entergy 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

FERC Short-Term Order authorized the Registrant Subsidiaries

(except Entergy New Orleans which is authorized by an SEC

PUHCA 1935 order) to continue as participants in the Entergy

System money pool. The money pool is an intercompany borrowing

arrangement designed to reduce Entergy’s subsidiaries’ dependence on

external short-term borrowings. Borrowings from the money pool

and external short-term borrowings combined may not exceed

authorized limits. As of December 31, 2006, Entergy’s subsidiaries’

aggregate money pool and external short-term borrowings authorized

limit was $2.0 billion, the aggregate outstanding borrowing from the

money pool was $251.6 million, and Entergy’s subsidiaries had no

outstanding short-term borrowing from external sources. To the

extent that the Registrant Subsidiaries wish to rely on SEC financing

orders under PUHCA 1935, there are capitalization and investment

grade ratings conditions that must be satisfied in connection with

security issuances, other than money pool borrowings. See Note 4 to

the financial statements for further discussion of Entergy’s short-term

borrowing limits.

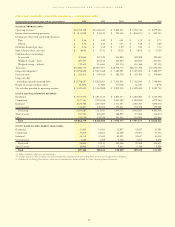

CASH FLOW ACTIVITY

As shown in Entergy’s Statements of Cash Flows, cash flows for

the years ended December 31, 2006, 2005, and 2004 were as follows

(in millions):

2006 2005 2004

Cash and cash equivalents

at beginning of period $ 583 $ 620 $ 507

Effect of deconsolidating

Entergy New Orleans in 2005 – (8) –

Cash flow provided by (used in):

Operating activities 3,419 1,468 2,929

Investing activities (1,899) (1,992) (1,143)

Financing activities (1,084) 496 (1,672)

Effect of exchange rates on

cash and cash equivalents (3) (1) (1)

Net increase (decrease) in

cash and cash equivalents 433 (29) 113

Cash and cash equivalents

at end of period $ 1,016 $ 583 $ 620

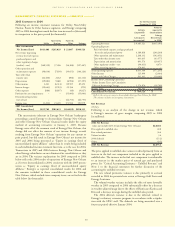

Operating Cash Flow Activity

2006 Compared to 2005

Entergy’s cash flow provided by operating activities increased

by $1,952 million in 2006 compared to 2005 primarily due to the

following activity:

■Utility provided $2,564 million in cash from operating activities

in 2006 compared to providing $964 million in 2005 primarily

due to increased recovery of fuel costs, the receipt of an income

tax refund (discussed below), a decrease in storm restoration

spending, and the effect in 2005 of a $90 million refund paid

to customers in Louisiana, partially offset by an increase of

$136 million in pension funding payments.

■Non-Utility Nuclear provided $833 million in cash from

operating activities in 2006 compared to providing $551 million

in 2005 primarily due to an increase in net revenue and the

receipt of an income tax refund (discussed below).

Entergy Corporation received a $344 million income tax refund

(including $71 million attributable to Entergy New Orleans) as a

result of net operating loss carryback provisions contained in the Gulf

Opportunity Zone Act of 2005. The Gulf Opportunity Zone Act was

enacted in December 2005. The Act contains provisions that allow a

public utility incurring a net operating loss as a result of Hurricane

Katrina to carry back the casualty loss portion of the net operating loss

ten years to offset previously taxed income. The Act also allows a five-

year carry back of the portion of the net operating loss attributable to

Hurricane Katrina repairs expense and first year depreciation deduc-

tions, including 50% bonus depreciation, on Hurricane Katrina

capital expenditures. In accordance with Entergy’s intercompany tax

allocation agreement, $273 million of the refund was distributed to

the Utility (including Entergy New Orleans) in April 2006, with the

remainder distributed primarily to Non-Utility Nuclear.

2005 Compared to 2004

Entergy’s cash flow provided by operating activities decreased

by $1,461 million in 2005 compared to 2004 primarily due to the

following activity:

■The Utility provided $964 million in cash from operating

activities compared to providing $2,208 million in 2004. The

decrease resulted primarily from restoration spending and lost net

revenue caused by Hurricanes Katrina and Rita. Changes in the

timing of fuel cost recovery compared to the prior period due to

higher natural gas prices, which caused an increase in deferred

fuel cost balances, also contributed to the decrease in cash from

operating activities. Also contributing to the decrease in the

Utility segment were increases in income tax payments and in

pension plan contributions, and a $90 million refund to

customers in the Louisiana jurisdiction made as a result of an

LPSC-approved settlement.

■Entergy received dividends from Entergy-Koch of $529 million in

2004 and did not receive any dividends from Entergy-Koch

in 2005.

■Offsetting the decreases in those two businesses, the Non-Utility

Nuclear business provided $551 million in cash from operating

activities compared to providing $415 million in 2004. The

increase resulted primarily from lower intercompany income tax

payments and increases in generation and contract pricing that

led to an increase in revenues.

Investing Activities

2006 Compared to 2005

Net cash used in investing activities decreased slightly in 2006

compared to 2005 and was affected by the following activity:

■The proceeds from the sale of the retail electric portion of the

Competitive Retail Services business operating in the ERCOT

region of Texas and the sale of the non-nuclear wholesale asset

business’ remaining interest in a power development project.

■Entergy Mississippi purchased the 480 MW Attala power plant in

January 2006 for $88 million and Entergy Louisiana purchased the

718 MW Perryville power plant in June 2005 for $162 million.

■Liquidation of other temporary investments net of purchases

provided $188 million in 2005. Entergy had no activity in other

temporary investments in 2006.

■The Utility used $390 million in 2005 for other regulatory

investments as a result of fuel cost under-recovery. See Note 1 to

the financial statements for discussion of the accounting

treatment of these fuel cost under-recoveries.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

35