Entergy 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

94

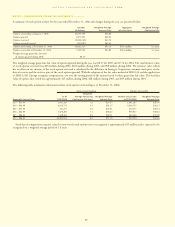

The fair value of debt securities, summarized by contractual

maturities, at December 31, 2006 and 2005 are as follows (in millions):

2006 2005

Less than 1 year $ 82 $ 80

1 year – 5 years 309 357

5 years – 10 years 472 382

10 years – 15 years 106 116

15 years – 20 years 72 73

20 years + 112 97

Total $1,153 $1,105

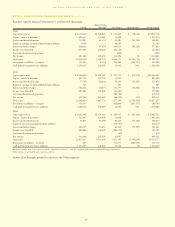

During the years ended December 31, 2006, 2005, and 2004, pro-

ceeds from the dispositions of securities amounted to $778 million,

$944 million, and $679 million, respectively. During the years ended

December 31, 2006, 2005, and 2004, gross gains of $5 million, $5

million, and $4 million, respectively, and gross losses of $10 million,

$8 million, and $3 million, respectively, were reclassified out of other

comprehensive income into earnings.

NOTE 18. ENTERGY NEW ORLEANS BANKRUPTCY PROCEEDING

Because of the effects of Hurricane Katrina, on September 23, 2005,

Entergy New Orleans filed a voluntary petition in the United States

Bankruptcy Court for the Eastern District of Louisiana seeking reor-

ganization relief under the provisions of Chapter 11 of the United

States Bankruptcy Code (Case No. 05-17697). Entergy New Orleans

continues to operate its business as a debtor-in-possession under the

jurisdiction of the bankruptcy court and in accordance with the appli-

cable provisions of the Bankruptcy Code and the orders of the

bankruptcy court.

On September 26, 2005, Entergy New Orleans, as borrower, and

Entergy Corporation, as lender, entered into the Debtor-in-Possession

(DIP) credit agreement, a debtor-in-possession credit facility to

provide funding to Entergy New Orleans during its business restora-

tion efforts. On December 9, 2005, the bankruptcy court issued

its final order approving the DIP Credit Agreement. The credit

facility provides for up to $200 million in loans. The facility enables

Entergy New Orleans to request funding from Entergy Corporation, but

the decision to lend money is at the sole discretion of Entergy

Corporation. As of December 31, 2006, Entergy New Orleans had out-

standing borrowings of $52 million under the DIP credit agreement.

On February 5, 2007, Entergy New Orleans filed an amended plan

of reorganization and a disclosure statement with the bankruptcy

court. The bankruptcy court entered an order on February 13, 2007

that approves the adequacy of Entergy New Orleans’ disclosure state-

ment. The Unsecured Creditors’ Committee also filed a plan of

reorganization on February 5, 2007. The Unsecured Creditors’

Committee’s plan is similar in some respects to Entergy New Orleans’

plan, but contains several differences. The significant differences

are noted below. A hearing regarding confirmation for both plans of

reorganization is scheduled for May 3 and 4, 2007.

Entergy New Orleans’ plan of reorganization reflects its continuing

effort to work with federal, state, and local authorities to resolve the

bankruptcy in a manner that allows Entergy New Orleans’ customers

to be served by a financially viable entity as required by law. The plan

of reorganization provides full compensation to Entergy New Orleans’

creditors whose claims are allowed by the bankruptcy court.

Conditions precedent proposed in Entergy New Orleans’ plan of

reorganization before it can become effective include:

■A final confirmation order from the bankruptcy court approving

the plan of reorganization;

■Receipt by Entergy New Orleans of insurance proceeds of at least

$50 million;

■Receipt by Entergy New Orleans of $200 million in CDBG

funding; and

■No material adverse change shall have occurred from and after the

confirmation date of the plan of reorganization.

In addition, key factors that will continue to influence the timing and

outcome of Entergy New Orleans’ recovery efforts include the level of

economic recovery of New Orleans and the number of customers that

return to New Orleans, including the timing of their return. Entergy

New Orleans currently estimates that approximately 95,000 electric cus-

tomers and 65,000 gas customers have returned and are taking service.

Prior to Hurricane Katrina, Entergy New Orleans had approximately

190,000 electric customers and 144,000 gas customers.

The Unsecured Creditors’ Committee’s plan does not contain the

conditions precedent regarding receipt by Entergy New Orleans of

insurance proceeds and CDBG funds. Instead, the Unsecured

Creditors’ Committee’s plan proposes exit financing of up to $150

million, with a maturity of up to 5 years, and with an estimated inter-

est rate of 10.5%, increasing by 1% per year. Obtaining this exit

financing is a condition precedent to the Unsecured Creditors’

Committee’s plan.

The bankruptcy judge set a date of April 19, 2006 by which credi-

tors with prepetition claims against Entergy New Orleans, with

certain exceptions, had to file their proofs of claim in the bankruptcy

case. Approximately 560 claims, including amending claims, have

been filed thus far in Entergy New Orleans’ bankruptcy proceeding.

Entergy New Orleans is currently analyzing the accuracy and validity

of the claims filed, and is seeking withdrawal or modification of

claims or objecting to claims with which it disagrees. Several of the

filed claims have been withdrawn or disallowed by the bankruptcy

court. Entergy New Orleans currently estimates that the prepetition

claims that will be allowed in the bankruptcy case will approximate

the prepetition liabilities currently recorded by Entergy New Orleans.

Entergy New Orleans’ plan of reorganization proposes to pay the

third-party prepetition accounts payable in full in cash and to issue

three-year notes in satisfaction of the affiliate prepetition accounts

payable, and proposes that its first mortgage bonds will remain out-

standing with their current maturity dates and interest terms. The

plan of reorganization proposes that Entergy New Orleans’ preferred

stock will also remain outstanding on its current dividend terms, with

payment of unpaid preferred dividends in arrears. The Unsecured

Creditors’ Committee’s plan is similar, but would pay the affiliate

prepetition accounts payable in cash.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued