Entergy 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

32

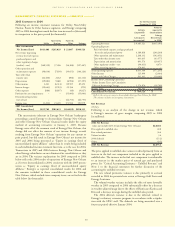

facility, additional debt issuances, including Entergy Corporation’s

equity units issuance, along with a decrease in shareholders’ equity,

primarily due to repurchases of common stock.

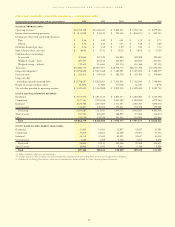

2006 2005 2004

Net debt to net capital at the end of the year 49.4% 51.5% 45.3%

Effect of subtracting cash from debt 2.9% 1.6% 2.1%

Debt to capital at the end of the year 52.3% 53.1% 47.4%

Net debt consists of debt less cash and cash equivalents. Debt consists

of notes payable, capital lease obligations, preferred stock with sink-

ing fund, and long-term debt, including the currently maturing

portion. Capital consists of debt, shareholders’ equity, and preferred

stock without sinking fund. Net capital consists of capital less cash

and cash equivalents. Entergy uses the net debt to net capital ratio

in analyzing its financial condition and believes it provides useful

information to its investors and creditors in evaluating Entergy’s

financial condition.

Long-term debt, including the currently maturing portion, makes

up substantially all of Entergy’s total debt outstanding. Following are

Entergy’s long-term debt principal maturities and estimated interest

payments as of December 31, 2006. To estimate future interest pay-

ments for variable rate debt, Entergy used the rate as of December 31,

2006. The figures below include payments on the Entergy Louisiana

and System Energy sale-leaseback transactions, which are included in

long-term debt on the balance sheet (in millions):

Long-term Debt Maturities 2010- After

and Estimated Interest Payments 2007 2008 2009 2011 2011

Utility $453 $ 1,154 $ 582 $ 1,389 $ 7,219

Non-Utility Nuclear 100 36 36 71 192

Parent Company & Other

Business Segments 144 410 396 1,765 –

Total $697 $1,600 $1,014 $3,225 $7,411

Note 5 to the financial statements provides more detail concerning

long-term debt.

In May 2005, Entergy Corporation entered into a $2 billion five-

year revolving credit facility, which expires in May 2010. In

December 2005, Entergy Corporation entered into a $1.5 billion

three-year revolving credit facility, which expires in December 2008.

Entergy Corporation also has the ability to issue letters of credit

against the total borrowing capacity of both the three-year and the

five-year credit facilities.

Following is a summary of the borrowings outstanding and capac-

ity available under these facilities as of December 31, 2006

(in millions):

Facility Capacity Borrowings Letters of Credit Capacity Available

5-Year Facility $2,000 $820 $94 $1,086

3-Year Facility $1,500 $ – $ – $1,500

Entergy Corporation’s credit facilities require it to maintain a consol-

idated debt ratio of 65% or less of its total capitalization. If Entergy

fails to meet this debt ratio, or if Entergy or one of the Utility operat-

ing companies (other than Entergy New Orleans) default on other

indebtedness or are in bankruptcy or insolvency proceedings, an

acceleration of the credit facilities’ maturity dates may occur.

Capital lease obligations, including nuclear fuel leases, are a mini-

mal part of Entergy’s overall capital structure, and are discussed

further in Note 10 to the financial statements. Following are Entergy’s

payment obligations under those leases (in millions):

2010- After

2007 2008 2009 2011 2011

Capital lease payments,

including nuclear fuel leases $153 $186 $– $– $2

Notes payable includes borrowings outstanding on credit facilities

with original maturities of less than one year. Entergy Arkansas,

Entergy Gulf States, and Entergy Mississippi each have 364-day

credit facilities available as follows (in millions):

Expiration Amount of Amount Drawn as

Company Date Facility of Dec. 31, 2006

Entergy Arkansas April 2007 $85 –

Entergy Gulf States February 2011 $50(a) –

Entergy Mississippi May 2007 $30(b) –

Entergy Mississippi May 2007 $20(b) –

(a) The credit facility allows Entergy Gulf States to issue letters of credit against

the borrowing capacity of the facility. As of December 31, 2006, $1.4 million

in letters of credit had been issued.

(b) Borrowings under the Entergy Mississippi facilities may be secured by a security

interest in its accounts receivable.

Operating Lease Obligations and Guarantees of

Unconsolidated Obligations

Entergy has a minimal amount of operating lease obligations and

guarantees in support of unconsolidated obligations. Entergy’s guar-

antees in support of unconsolidated obligations are not likely to have

a material effect on Entergy’s financial condition or results of opera-

tions. Following are Entergy’s payment obligations as of December

31, 2006 on non-cancelable operating leases with a term over one year

(in millions):

2010- After

2007 2008 2009 2011 2011

Operating lease payments $97 $80 $78 $123 $144

The operating leases are discussed more thoroughly in Note 10 to the

financial statements.

Summary of Contractual Obligations of Consolidated Entities

(in millions)

2008- 2010- After

Contractual Obligations 2007 2009 2011 2011 Total

Long-term debt(1) $ 697 $2,614 $3,225 $7,411 $13,947

Capital lease payments(2) $ 153 $ 186 $ – $ 2 $ 341

Operating leases(2) $ 97 $ 158 $ 123 $ 144 $ 522

Purchase obligations(3) $1,414 $2,127 $1,754 $3,690 $ 8,985

(1) Includes estimated interest payments. To estimate future interest payments for

variable rate debt, Entergy used the rate as of December 31, 2006. Long-term

debt is discussed in Note 5 to the financial statements.

(2) Capital lease payments include nuclear fuel leases. Lease obligations are

discussed in Note 10 to the financial statements.

(3) Purchase obligations represent the minimum purchase obligation or

cancellation charge for contractual obligations to purchase goods or services.

Almost all of the total are fuel and purchased power obligations.

In addition to these contractual obligations, in 2007, Entergy expects

to contribute $176 million to its pension plans, including Entergy

New Orleans’ contribution of $44 million, and $66 million to other

postretirement plans, including Entergy New Orleans’ contribution

of $5 million.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued