Entergy 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

78

NOTE 8. COMMITMENTS AND CONTINGENCIES

Entergy and the Registrant Subsidiaries are involved in a number of

legal, tax, and regulatory proceedings before various courts, regulatory

commissions, and governmental agencies in the ordinary course of

business. While management is unable to predict the outcome of such

proceedings, management does not believe that the ultimate resolu-

tion of these matters will have a material adverse effect on Entergy’s

results of operations, cash flows, or financial condition.

ENTERGY NEW ORLEANS BANKRUPTCY

See Note 18 to the financial statements for information on the

Entergy New Orleans bankruptcy proceeding.

VIDALIA PURCHASED POWER AGREEMENT

Entergy Louisiana has an agreement extending through the year 2031

to purchase energy generated by a hydroelectric facility known as the

Vidalia project. Entergy Louisiana made payments under the contract

of approximately $107.1 million in 2006, $115.1 million in 2005,

and $147.7 million in 2004. If the maximum percentage (94%) of the

energy is made available to Entergy Louisiana, current production

projections would require estimated payments of approximately

$138.9 million in 2007, and a total of $3.2 billion for the years 2008

through 2031. Entergy Louisiana currently recovers the costs of the

purchased energy through its fuel adjustment clause. In an LPSC-

approved settlement related to tax benefits from the tax treatment of

the Vidalia contract, Entergy Louisiana agreed to credit rates by $11

million each year for up to ten years, beginning in October 2002. The

provisions of the settlement also provide that the LPSC shall not rec-

ognize or use Entergy Louisiana’s use of the cash benefits from the tax

treatment in setting any of Entergy Louisiana’s rates. Therefore, to the

extent Entergy Louisiana’s use of the proceeds would ordinarily have

reduced its rate base, no change in rate base shall be reflected for

ratemaking purposes.

NUCLEAR INSURANCE

Third Party Liability Insurance

The Price-Anderson Act provides insurance for the public in the event of

a nuclear power plant accident. The costs of this insurance are borne by

the nuclear power industry. Originally passed by Congress in 1957 and

most recently amended in 2005, the Price-Anderson Act requires nuclear

power plants to show evidence of financial protection in the event of a

nuclear accident. This protection must consist of two levels:

1. The primary level is private insurance underwritten by American

Nuclear Insurers and provides liability insurance coverage of $300

million. If this amount is not sufficient to cover claims arising from

the accident, the second level, Secondary Financial Protection,

applies. An industry-wide aggregate limitation of $300 million

exists for domestically-sponsored terrorist acts. There is no aggre-

gate limitation for foreign-sponsored terrorist acts.

2. Within the Secondary Financial Protection level, each nuclear plant

must pay a retrospective premium, equal to its proportionate share

of the loss in excess of the primary level, up to a maximum of

$100.6 million per reactor per incident. This consists of a $95.8

million maximum retrospective premium plus a five percent sur-

charge that may be applied, if needed, at a rate that is presently set

at $15 million per year per nuclear power reactor. There are no

domestically- or foreign-sponsored terrorism limitations.

Currently, 104 nuclear reactors are participating in the Secondary

Financial Protection program - 103 operating reactors and one under

construction. The product of the maximum retrospective premium

assessment to the nuclear power industry and the number of nuclear

power reactors provides over $10 billion in insurance coverage to com-

pensate the public in the event of a nuclear power reactor accident.

Entergy Arkansas has two licensed reactors and Entergy Gulf States,

Entergy Louisiana, and System Energy each have one licensed reactor

(10% of Grand Gulf is owned by a non-affiliated company (SMEPA),

which would share on a pro-rata basis in any retrospective premium

assessment under the Price-Anderson Act). Entergy’s Non-Utility

Nuclear business owns and operates five nuclear power reactors and

owns the shutdown Indian Point 1 reactor.

An additional but temporary contingent liability exists for all

nuclear power reactor owners because of a previous Nuclear Worker

Tort (long-term bodily injury caused by exposure to nuclear radiation

while employed at a nuclear power plant) insurance program that was

in place from 1988 to 1998. The maximum premium assessment

exposure to each reactor is $3 million and will only be applied if such

claims exceed the program’s accumulated reserve funds. This contin-

gent premium assessment feature will expire with the Nuclear Worker

Tort program’s expiration, scheduled for 2008.

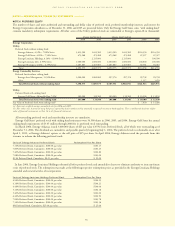

Property Insurance

Entergy’s nuclear owner/licensee subsidiaries are members of certain

mutual insurance companies that provide property damage coverage,

including decontamination and premature decommissioning expense,

to the members’ nuclear generating plants. These programs are under-

written by Nuclear Electric Insurance Limited (NEIL). As of

December 31, 2006, Entergy was insured against such losses per the

following structures:

Utility Plants (ANO 1 and 2, Grand Gulf, River Bend, and

Waterford 3)

■Primary Layer (per plant) – $500 million per occurrence

■Excess Layer (per plant) – $100 million per occurrence

■Blanket Layer (shared among the Utility plants) –

$1.0 billion per occurrence

■Total limit – $1.6 billion per occurrence

■Deductibles:

■$5.0 million per occurrence – Turbine/generator damage

■$5.0 million per occurrence – Other than turbine/

generator damage

Note: ANO 1 and 2 share in the Primary Layer with one policy in

common.

Non-Utility Nuclear Plants (Indian Point 2 and 3, FitzPatrick,

Pilgrim, and Vermont Yankee)

■Primary Layer (per plant) – $500 million per occurrence

■Blanket Layer (shared among all plants) – $615 million

per occurrence

■Total limit – $1.115 billion per occurrence

Deductibles:

■$2.5 million per occurrence – Turbine/generator damage

■$2.5 million per occurrence – Other than turbine/

generator damage

Note: Indian Point 2 and 3 share in the Primary Layer with one policy

in common.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued