Entergy 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

Capital Funds Agreement

Pursuant to an agreement with certain creditors, Entergy Corporation

has agreed to supply System Energy with sufficient capital to:

■maintain System Energy’s equity capital at a minimum of 35% of

its total capitalization (excluding short-term debt);

■permit the continued commercial operation of Grand Gulf;

■pay in full all System Energy indebtedness for borrowed money

when due; and

■enable System Energy to make payments on specific System

Energy debt, under supplements to the agreement assigning

System Energy’s rights in the agreement as security for the

specific debt.

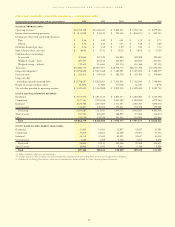

CAPITAL EXPENDITURE PLANS AND OTHER USES OF CAPITAL

Following are the amounts of Entergy’s planned construction and

other capital investments by operating segment for 2007 through

2009, excluding Entergy New Orleans (in millions):

2007 2008 2009

Maintenance Capital:

Utility $ 776 $ 763 $ 762

Non-Utility Nuclear 97 78 82

Parent and Other 12 3 1

885 844 845

Capital Commitments:

Utility 406 985 482

Non-Utility Nuclear 447 172 219

853 1,157 701

Total $1,738 $2,001 $1,546

Entergy New Orleans’ planned capital expenditures for the years

2007-2009 total $110 million, and in addition Entergy New Orleans

expects for the years 2007-2009 to pay $109 million for capital

investments related to Hurricane Katrina restoration and its gas

rebuild project, of which $55 million is expected to be spent in 2007.

Maintenance Capital refers to amounts Entergy plans to spend on

routine capital projects that are necessary to support reliability of its

service, equipment, or systems and to support normal customer growth.

Capital Commitments refers to non-routine capital investments for

which Entergy is either contractually obligated, has Board approval,

or otherwise expects to make to satisfy regulatory or legal require-

ments. Amounts reflected in this category include the following:

■The potential construction or purchase of additional generation

supply sources within the Utility’s service territory through

Entergy’s supply plan initiative.

■The pending Palisades acquisition, which is discussed below.

■The pending $66 million Entergy Gulf States purchase of and

investment in the Calcasieu plant, a 322 MW simple-cycle

gas-fired power plant.

■Transmission improvements and upgrades designed to provide

improved transmission flexibility in the Entergy System.

■Nuclear dry cask spent fuel storage and license renewal projects at

certain nuclear sites.

■Environmental compliance spending.

■NYPA value sharing costs.

The planned construction and capital investment amounts given

above include minimal amounts for initial development costs for

potential new nuclear development at the Grand Gulf and River Bend

sites in the Utility, including licensing and design activities. This proj-

ect is in the early stages, and several issues remain to be addressed over

time before significant capital would be committed to this project.

From time to time, Entergy considers other capital investments as

potentially being necessary or desirable in the future. Because no con-

tractual obligation, commitment, or Board approval exists to pursue

these investments, they are not included in Entergy’s planned con-

struction and capital investments. These potential investments are

also subject to evaluation and approval in accordance with Entergy’s

policies before amounts may be spent.

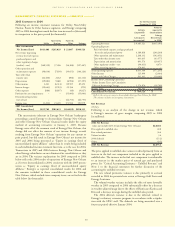

In July 2006, Entergy’s Non-Utility Nuclear business reached an

agreement to purchase Consumers Energy Company’s 798 MW

Palisades nuclear energy plant located near South Haven, Michigan

for $380 million. The NRC recently renewed until 2031 the

Palisades’ operating license. Entergy’s Non-Utility Nuclear business

will acquire the plant, nuclear fuel, and other assets. In the near-term,

Entergy intends to finance the acquisition through borrowings under

Entergy Corporation’s revolving credit facilities. As part of the pur-

chase, Entergy’s Non-Utility Nuclear business also executed a 15-year

purchased power agreement with Consumers Energy for 100% of the

plant’s output, excluding any future uprates. Entergy’s Non-Utility

Nuclear business will assume responsibility for eventual decommis-

sioning of the plant. Consumers Energy will retain $200 million of

the projected $566 million Palisades decommissioning trust fund bal-

ance, and Entergy may return approximately $100 million more of

the trust fund to Consumers Energy depending upon a pending tax

ruling. Also as part of the transaction, Consumers Energy will pay

Entergy’s Non-Utility Nuclear business $30 million to accept respon-

sibility for spent fuel at the decommissioned Big Rock nuclear plant,

which is located near Charlevoix, Michigan. Management expects to

close the transaction in the second quarter 2007, pending the

approvals of the NRC, the FERC, the Michigan Public Service

Commission, and other regulatory agencies.

Estimated capital expenditures are subject to periodic review and

modification and may vary based on the ongoing effects of business

restructuring, regulatory constraints, environmental regulations, busi-

ness opportunities, market volatility, economic trends, and the ability

to access capital.

The planned construction and capital investments given above do not

include the costs associated with the potential interconnection between

Entergy Gulf States and ERCOT that is discussed in Note 2 to the

financial statements. These potential costs are currently estimated to be

approximately $1 billion. The planned construction and capital

investments given above also do not include the potential replacement of

the Waterford 3 steam generators, which could be scheduled as early as

2011. Routine inspections of the Waterford 3 steam generators during

the fall 2006 refueling outage identified degradation of certain tube

spacer supports in the steam generators that required repair beyond that

anticipated prior to the refueling outage inspections. Corrective

measures were successfully implemented to permit continued operation

of the steam generators. Future inspections of the steam generators will

be scheduled to address this degradation mechanism and could result in

additional planned outages, pending discussions with the NRC

regarding this issue. Entergy will continue to manage steam generator

component life in accordance with industry standard practices.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

33