Entergy 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

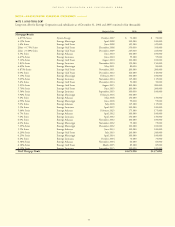

In addition, Waterford 3, Grand Gulf, and the Non-Utility Nuclear

plants are also covered under NEIL’s Accidental Outage Coverage

program. This coverage provides certain fixed indemnities in the event

of an unplanned outage that results from a covered NEIL property

damage loss, subject to a deductible. The following summarizes this

coverage as of December 31, 2006:

Waterford 3

■$2.95 million weekly indemnity

■$413 million maximum indemnity

■Deductible: 26 week waiting period

Grand Gulf

■$100,000 weekly indemnity

■$14 million maximum indemnity

■Deductible: 26 week waiting period

Indian Point 2 and 3

■$4.5 million weekly indemnity

■$490 million maximum indemnity

■Deductible: 12 week waiting period

FitzPatrick and Pilgrim (each plant has an individual policy

with the noted parameters)

■$4.0 million weekly indemnity

■$490 million maximum indemnity

■Deductible: 12 week waiting period

Vermont Yankee

■$4.0 million weekly indemnity

■$435 million maximum indemnity

■Deductible: 12 week waiting period

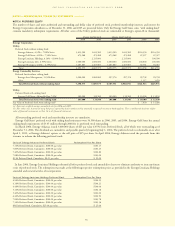

Under the property damage and accidental outage insurance

programs, Entergy nuclear plants could be subject to assessments

should losses exceed the accumulated funds available from NEIL. As

of December 31, 2006, the maximum amounts of such possible

assessments per occurrence were as follows (in millions):

Utility:

Entergy Arkansas $16.6

Entergy Gulf States $13.3

Entergy Louisiana $15.5

Entergy Mississippi $0.10

Entergy New Orleans $0.10

System Energy $11.6

Non-Utility Nuclear $65.6

Entergy maintains property insurance for its nuclear units in excess

of the NRC’s minimum requirement of $1.06 billion per site for

nuclear power plant licensees. NRC regulations provide that the

proceeds of this insurance must be used, first, to render the reactor

safe and stable, and second, to complete decontamination operations.

Only after proceeds are dedicated for such use and regulatory approval

is secured would any remaining proceeds be made available for the

benefit of plant owners or their creditors.

In the event that one or more acts of domestically-sponsored terror-

ism causes property damage under one or more or all nuclear

insurance policies issued by NEIL (including, but not limited to,

those described above) within 12 months from the date the first

property damage occurs, the maximum recovery under all such

nuclear insurance policies shall be an aggregate of $3.24 billion plus

the additional amounts recovered for such losses from reinsurance, indem-

nity, and any other sources applicable to such losses. There is no aggregate

limit involving one or more acts of foreign-sponsored terrorism.

NON-NUCLEAR PROPERTY INSURANCE

Entergy’s non-nuclear property insurance program provides coverage

up to $400 million on an Entergy system-wide basis, subject to a $20

million per occurrence self-insured retention, for all risks coverage for

direct physical loss or damage, including boiler and machinery break-

down. Covered property generally includes power plants, substations,

facilities, inventories, and gas distribution-related properties.

Excluded property generally includes above-ground transmission and

distribution lines, poles, and towers. The primary property program

(excess of the deductible) is placed through Oil Insurance Limited

(OIL) ($250 million layer) with the excess program ($150 million

layer) placed on a quota share basis through underwriters at Lloyds

(50%) and Hartford Steam Boiler Inspection and Insurance

Company (50%). There is an aggregation limit of $500 million for all

parties insured by OIL for any one occurrence. Coverage is in place

for Entergy Corporation, Entergy Arkansas, Entergy Louisiana,

Entergy Mississippi, Entergy Gulf States, and Entergy New Orleans.

Most of Entergy’s non-nuclear excess property insurance coverage

includes a $75 million drop-down feature in the event of an OIL

aggregation loss to which an Entergy loss contributes.

In addition to the OIL program, Entergy has purchased additional cov-

erage for some of its non-regulated, non-generation assets through Zurich

American. This policy serves to buy-down the $20 million deductible and

is placed on a scheduled location basis. The applicable deductibles are

$100,000 or $250,000 as per the schedule provided to underwriters.

There was an aggregation limit of $1 billion for all parties insured by

OIL for any one occurrence at the time of the Hurricane Katrina and

Rita losses, and Entergy has been notified by OIL that it expects claims

for Hurricanes Katrina and Rita to materially exceed this limit. Entergy

is currently evaluating the amount of the covered losses for Entergy and

each of the affected Utility operating companies, working with insurance

adjusters, and preparing proofs of loss for Hurricanes Katrina and Rita.

The Utility operating companies have received $51.5 million through

December 31, 2006 on their insurance claims. Entergy currently esti-

mates that its remaining net insurance recoveries for the losses caused by

the hurricanes, including the effect of the OIL aggregation limit being

exceeded, will be approximately $350 million, including $84 million for

Entergy Gulf States, $30 million for Entergy Louisiana, and $228 mil-

lion for Entergy New Orleans.

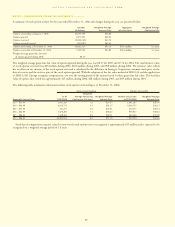

NYPA VALUE SHARING AGREEMENTS

Non-Utility Nuclear’s purchase of the FitzPatrick and Indian Point 3

plants from NYPA included value sharing agreements with NYPA.

Under the value sharing agreements, to the extent that the average

annual price of the energy sales from each of the two plants exceeds

specified strike prices, the Non-Utility Nuclear business will pay 50%

of the amount exceeding the strike prices to NYPA. These payments,

if required, will be recorded as adjustments to the purchase price of

the plants. The annual energy sales subject to the value sharing agree-

ments are limited to the lesser of actual generation or generation

assuming an 85% capacity factor based on the plants’ capacities at the

time of the purchase. The value sharing agreements are effective

through 2014. The strike prices for FitzPatrick range from

$37.51/MWh in 2005 increasing by approximately 3.5% each year to

$51.30/MWh in 2014, and the strike prices for Indian Point 3 range

from $42.26/MWh in 2005 increasing by approximately 3.5% each

year to $57.77/MWh in 2014.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

79