Entergy 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

issue is the cost and time related to the construction of facilities to

interconnect Entergy Gulf States’ Texas operations with ERCOT,

while addressing the interest of Entergy Gulf States’ retail customers

and certain wholesale customers in access to generation outside of

Texas. With respect to the SPP, the major issue is the development of

protocols that would ultimately be necessary to implement retail open

access. Entergy Gulf States recommended that the PUCT open a proj-

ect for the purpose of involving stakeholders in the selection of the

single power region that Entergy Gulf States should request for certi-

fication. In August 2006, the PUCT staff recommended that Entergy

Gulf States be required to provide additional information on both the

ERCOT option and the SPP option. The PUCT accepted the PUCT

staff’s recommendation and stated the need for a “robust record” to

make a decision on the applicable power region.

As required by the June 2005 legislation, Entergy Gulf States filed

its proposed transition to competition plan in December 2006 and

maintained that to achieve full customer choice, Entergy Gulf States

should join ERCOT since it already has all of the prerequisites for

retail choice. The plan contains several conditions, including cost

recovery mechanisms, that must be met before Entergy Gulf States

could proceed with the plan, and identifies several legislative

requirements needed to accomplish the required infrastructure

improvements. Assuming that these conditions can be met, retail

open access could commence in 2013. Entergy Gulf States’

filing includes an estimate that construction costs for facilities to

interconnect Entergy Gulf States’ Texas operations with ERCOT

could be approximately $1 billion. The PUCT has 180 days to accept,

reject, or modify the plan. The Texas Legislature began its session on

January 9, 2007.

In December 2006, the PUCT asked for parties to brief the effects

of the 2005 legislation on the competition dockets of Entergy Gulf

States, most notably, the settlement that the parties entered with

respect to the unbundling of Entergy Gulf States for retail open

access. Finding that the 2005 legislation now provides the mechanism

by which Entergy Gulf States will transition to competition,

the PUCT, on February 1, 2007, dismissed Entergy Gulf States’

unbundled cost of service proceeding.

CO-OWNER-INITIATED PROCEEDING AT THE FERC

In September 2004, East Texas Electric Cooperative (ETEC) filed a

complaint at the FERC against Entergy Arkansas relating to a contract

dispute over the pricing of substitute energy at the co-owned

Independence coal unit. In October 2004, Arkansas Electric

Cooperative (AECC) filed a similar complaint at the FERC against

Entergy Arkansas, addressing the same issue with respect to

Independence and another co-owned coal unit, White Bluff. FERC

consolidated these cases, ordered a hearing in the consolidated pro-

ceeding, and established refund effective dates. The main issue in the

consolidated case relates to the consequences under the governing

contracts when the dispatch of the coal units is constrained due to sys-

tem operating conditions. In August 2005, Entergy Arkansas and

ETEC filed a settlement at the FERC that resolved all issues in dis-

pute between ETEC and Entergy Arkansas. As part of the settlement,

ETEC dismissed its complaint. A hearing was held on the AECC

complaint and an ALJ Initial Decision was issued in January 2006 in

which the ALJ found AECC’s claims to be without merit. On

October 25, 2006, the FERC issued its order in the proceeding. In the

order, the FERC reversed the ALJ’s findings. Specifically, the FERC

found that the governing contracts do not recognize the effects of

dispatch constraints on the co-owned units. The FERC explained that

for over twenty-three years the course of conduct of the parties was

such that AECC received its full entitlement to the two coal units,

regardless of any reduced output caused by system operating

constraints. Based on the order, Entergy Arkansas is required to refund

to AECC all excess amounts billed to AECC as a result of the system

operating constraints. Entergy Arkansas estimates currently that this will

result in a refund to AECC of approximately $26 million, although

Entergy Arkansas is still refining the estimate. In November 2006

Entergy Arkansas filed with the FERC a request for rehearing.

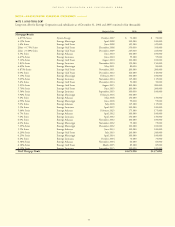

NOTE 3. INCOME TAXES

Income tax expenses from continuing operations for 2006, 2005,

and 2004 for Entergy Corporation and subsidiaries consist of the

following (in thousands):

2006 2005 2004

Current:

Federal $(266,464) $(306,524) $ 67,924

Foreign 64 13,290 (2,231)

State (74,319) (27,212) 38,324

Total (340,719) (320,446) 104,017

Deferred – net 801,745 898,384 282,275

Investment tax credit

adjustments – net (17,982) (18,654) (20,987)

Income tax expense from

continuing operations $ 443,044 $ 559,284 $365,305

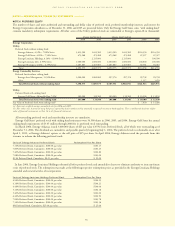

Total income taxes from continuing operations for Entergy

Corporation and subsidiaries differ from the amounts computed

by applying the statutory income tax rate to income before taxes.

The reasons for the differences for the years 2006, 2005, and 2004 are

(in thousands):

2006 2005 2004

Computed at statutory rate (35%) $551,650 $525,843 $446,205

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 44,230 44,282 36,149

Regulatory differences –

utility plant items 50,211 28,983 41,240

Amortization of investment

tax credits (17,460) (18,691) (20,596)

Capital loss (79,427) (792) (86,426)

Flow-through/permanent

differences (52,866) (23,618) (34,804)

Tax reserves (53,610) – (9,600)

Valuation allowance 22,300 – –

Other – net (21,984) 3,277 (6,863)

Total income taxes

from continuing operations $443,044 $559,284 $365,305

Effective income tax rate 28.1% 37.2% 28.7%

The capital loss for 2006 includes a loss for tax purposes recorded

in the fourth quarter 2006 resulting from the liquidation of Entergy

Power International Holdings, Entergy’s holding company for

Entergy-Koch, LP. The $79.4 million tax benefit is net of other capi-

tal gains. The capital loss for 2004 is a tax benefit resulting from the

sale of preferred stock and less than 1% of the common stock of

Entergy Asset Management, an Entergy subsidiary. In December

2004, an Entergy subsidiary sold the stock to a third party for $29.75

million. The sale resulted in a capital loss for tax purposes of $370

million, producing a federal and state net tax benefit of $97 million

that Entergy recorded in the fourth quarter of 2004. Entergy has

established a contingency provision in its financial statements that

management believes will sufficiently cover the risk associated with

these issues.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

69