Entergy 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

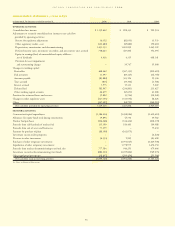

In thousands, as of December 31, 2006 2005

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES:

Currently maturing long-term debt $ 181,576 $ 103,517

Notes payable 25,039 40,041

Accounts payable 1,122,596 1,655,787

Customer deposits 248,031 222,206

Taxes accrued 187,324 188,159

Accumulated deferred income taxes – 143,409

Interest accrued 160,831 154,855

Deferred fuel costs 73,031 –

Obligations under capital leases 153,246 130,882

Pension and other postretirement liabilities 41,912 –

Other 271,544 473,510

Total 2,465,130 3,112,366

NON-CURRENT LIABILITIES:

Accumulated deferred income taxes and taxes accrued 5,820,700 5,282,759

Accumulated deferred investment tax credits 358,550 376,550

Obligations under capital leases 188,033 175,005

Other regulatory liabilities 449,237 408,667

Decommissioning and retirement cost liabilities 2,023,846 1,923,971

Transition to competition 79,098 79,101

Regulatory reserves 219 18,624

Accumulated provisions 88,902 144,880

Pension and other postretirement liabilities 1,410,433 1,118,964

Long-term debt 8,798,087 8,824,493

Preferred stock with sinking fund 10,500 13,950

Other 847,196 1,184,082

Total 20,074,801 19,551,046

Commitments and Contingencies

Preferred stock without sinking fund 344,913 445,974

SHAREHOLDERS’ EQUITY:

Common stock, $.01 par value, authorized 500,000,000

shares; issued 248,174,087 shares in 2006 and in 2005 2,482 2,482

Paid-in capital 4,827,265 4,817,637

Retained earnings 6,113,042 5,433,931

Accumulated other comprehensive loss (100,512) (343,819)

Less – treasury stock, at cost (45,506,311 shares in 2006 and

40,644,602 shares in 2005) 2,644,390 2,161,960

Total 8,197,887 7,748,271

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY $31,082,731 $30,857,657

See Notes to Financial Statements.

CONSOLIDATED BALANCE SHEETS

53