Entergy 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

INCOME TAX LITIGATION

On November 16, 2006, the IRS issued a Notice of Deficiency to

Entergy for the tax years 1997 and 1998. The Notice asserts that

Entergy owes additional tax of $17.3 million for 1997 and $61.7 mil-

lion for 1998. Entergy and the IRS have settled all issues for 1997 and

1998 except for those raised in the Notice which are described as fol-

lows: 1) The IRS believes that U.K. Windfall Tax paid by London

Electricity, a former subsidiary of Entergy, was not an eligible tax

under the foreign tax credit provisions of the Internal Revenue Code.

Entergy believes that it properly claimed a foreign tax credit for the

tax year 1998 attributable to the Windfall Tax paid by London

Electricity. This issue accounts for $59.7 million of the 1998 deficien-

cy and results in interest exposure of $49.1 million. 2) The IRS denied

Entergy’s change in method of accounting for street lighting assets

and the related increase in depreciation deductions for 1997 and

1998. Entergy believes that street lighting assets are a separate line of

business not subject to the same 20-year depreciable life as distribu-

tion assets, but rather are properly classified as having a 7-year

depreciable life. This issue accounts for all of the 1997 deficiency of

$17.3 million and $2 million of the 1998 deficiency and results in

interest exposure of $13.5 million. On December 6, 2006, Entergy

filed a petition in the U.S. Tax Court requesting a redetermination of

these issues and the resulting deficiencies.

FASB INTERPRETATION NO.48

FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (FIN 48) was issued in July 2006 and is effective for Entergy

in the first quarter of 2007. FIN 48 establishes a “more-likely-than-

not” recognition threshold that must be met before a tax benefit can

be recognized in the financial statements. If a tax deduction is taken

on a tax return, but does not meet the more-likely-than-not recogni-

tion threshold, an increase in income tax liability, above what is

payable on the tax return, is required to be recorded. Additional dis-

closure in the footnotes to the financial statements will also be

required for such liabilities. Entergy does not expect that the adoption

of FIN 48 will materially affect its financial position, results of oper-

ations, or cash flows. Entergy expects that the cumulative effect of the

adoption of FIN 48 will result in a reduction to consolidated retained

earnings at January 1, 2007 in the range of $3 million to $5 million.

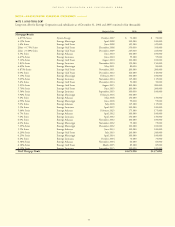

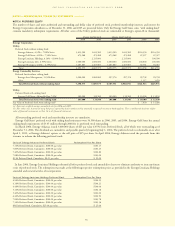

NOTE 4. REVOLVING CREDIT FACILITIES, LINES OF CREDIT AND

SHORT-TERM BORROWINGS

Entergy Corporation has in place two separate revolving credit facili-

ties, a five-year credit facility and a three-year credit facility. The

five-year credit facility, which expires in May 2010, has a borrowing

capacity of $2 billion and the three-year facility, which expires in

December 2008, has a borrowing capacity of $1.5 billion. Entergy

also has the ability to issue letters of credit against the total borrowing

capacity of both credit facilities. The commitment fee for these

facilities is currently 0.13% per annum of the unused amount.

Commitment fees and interest rates on loans under the credit facility

can fluctuate depending on the senior debt ratings of the Utility oper-

ating companies. Following is a summary of the borrowings

outstanding and capacity available under these facilities as of

December 31, 2006 (in millions):

Letters Capacity

Facility Capacity Borrowings of Credit Available

5-Year Facility $2,000 $820 $94 $1,086

3-Year Facility $1,500 $ – $ – $1,500

Entergy Corporation’s facilities require it to maintain a

consolidated debt ratio of 65% or less of its total capitalization. If

Entergy fails to meet this ratio, or if Entergy or the Utility operating

companies (except Entergy New Orleans) and System Energy default

on other indebtedness or are in bankruptcy or insolvency proceedings,

an acceleration of the facilities’ maturity dates may occur.

Entergy Arkansas, Entergy Gulf States, and Entergy Mississippi

each has credit facilities available as of December 31, 2006 as follows

(in millions):

Amount Drawn as

Expiration Date Amount of Facility of Dec. 31, 2006

Entergy Arkansas April 2007 $85 –

Entergy Gulf States February 2011 $50(a) –

Entergy Mississippi May 2007 $30(b) –

Entergy Mississippi May 2007 $20(b) –

(a) The credit facility allows Entergy Gulf States to issue letters of credit against

the borrowing capacity of the facility. As of December 31, 2006, $1.4 million

in letters of credit had been issued.

(b) Borrowings under the Entergy Mississippi facilities may be secured by a security

interest in its accounts receivable.

The credit facilities have variable interest rates and the average

commitment fee is 0.13%. The Entergy Arkansas credit facility

requires that it maintain total shareholders’ equity of at least 25% of

its total assets.

The short-term borrowings of the Registrant Subsidiaries (other

than Entergy New Orleans) and certain other Entergy subsidiaries are

limited to amounts authorized by the FERC. The current FERC-

authorized limits are effective through March 31, 2008. In addition

to borrowings from commercial banks, these companies are author-

ized under a FERC order to borrow from the Entergy System money

pool. The money pool is an inter-company borrowing arrangement

designed to reduce Entergy’s subsidiaries’ dependence on external

short-term borrowings. Borrowings from the money pool and exter-

nal borrowings combined may not exceed the FERC authorized

limits. As of December 31, 2006, Entergy’s subsidiaries’ aggregate

money pool and external short-term borrowings authorized limit was

$2.0 billion, the aggregate outstanding borrowing from the money

pool was $251.6 million, and Entergy’s subsidiaries’ had no outstand-

ing short-term borrowing from external sources.

The following are the FERC-authorized limits for short-term borrow-

ings effective February 8, 2006 and the outstanding short-term

borrowings from the money pool for the Registrant Subsidiaries (other

than Entergy New Orleans) as of December 31, 2006 (in millions):

Authorized Borrowings

Entergy Arkansas $250 –

Entergy Gulf States $350 –

Entergy Louisiana $250 $54.1

Entergy Mississippi $175 –

System Energy $200 –

Under a savings provision in PUHCA 2005, which repealed

PUHCA 1935, Entergy New Orleans may continue to be a partici-

pant in the money pool to the extent authorized by its SEC PUHCA

1935 order. However, Entergy New Orleans has not, and does not

expect to make, any additional money pool borrowings while it is in

bankruptcy proceedings. Entergy New Orleans had $37.2 million

in borrowings outstanding from the money pool as of its bankruptcy

filing date, September 23, 2005.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

71