Entergy 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

Entergy New Orleans’ plan of reorganization proposes to pay inter-

est from September 23, 2005 on the third-party and affiliate accounts

payable at the Louisiana judicial rate of interest in 2005 (6%) and

2006 (8%), and at the Louisiana judicial rate of interest plus 1%

thereafter. The Louisiana judicial rate of interest is 9.5% for 2007.

Pursuant to an agreement with the first mortgage bondholders,

Entergy New Orleans’ plan of reorganization also proposes to pay the

first mortgage bondholders an amount equal to the one year of inter-

est from the bankruptcy petition date that the bondholders had

waived previously in the bankruptcy proceeding. As approved by the

bankruptcy court, Entergy New Orleans has begun paying interest

accruing after September 23, 2006 on its first mortgage bonds. In the

fourth quarter 2006, Entergy New Orleans accrued for the interest

from September 23, 2005 through December 2006 and for the pro-

posed payment to the bondholders in the amount of the one year of

waived interest.

Municipalization is one potential outcome of Entergy New

Orleans’ recovery effort that may be pursued by a stakeholder or

stakeholders, even after Entergy New Orleans exits from bankruptcy.

In June 2006, the Louisiana Legislature passed a law that establishes a

governance structure for a public power authority, if municipalization

of Entergy New Orleans’ utility business is pursued. Entergy New

Orleans’ October 2006 settlement approved by the City Council

allowing phased-in rate increases through 2008, discussed in Note 2

to the financial statements, provides that Entergy New Orleans will

work with the City Council to seek an exception to the Stafford Act

that will afford Stafford Act protections to Entergy New Orleans if

another catastrophic event affects Entergy New Orleans. The Stafford

Act provides for restoration funding from the federal government for

municipal utilities, but does not allow such funding for investor-

owned utilities like Entergy New Orleans.

Entergy owns 100 percent of the common stock of Entergy New

Orleans, has continued to supply general and administrative services,

and has provided debtor-in-possession financing to Entergy New

Orleans. Uncertainties surrounding the nature, timing, and specifics

of the bankruptcy proceedings, however, have caused Entergy to

deconsolidate Entergy New Orleans and reflect Entergy New Orleans’

financial results under the equity method of accounting retroactive to

January 1, 2005. Because Entergy owns all of the common stock of

Entergy New Orleans, this change does not affect the amount of net

income Entergy records resulting from Entergy New Orleans’ opera-

tions for any current or prior period, but results in Entergy New

Orleans’ net income for 2005 and 2006 being presented as “Equity in

earnings (loss) of unconsolidated equity affiliates” rather than its

results being included in each individual income statement line item,

as is the case for periods prior to 2005. Entergy has reviewed the car-

rying value of its equity investment in Entergy New Orleans to

determine if an impairment has occurred as a result of the storm, the

flood, the power outages, restoration costs, and changes in customer

load. Entergy determined that no impairment has occurred because

management believes that cost recovery is probable. Entergy will con-

tinue to assess the carrying value of its investment in Entergy

New Orleans as developments occur in Entergy New Orleans’

recovery efforts.

Entergy’s income statement for 2006 and 2005 includes $220 mil-

lion and $207 million, respectively, in operating revenues and $46

million and $117 million, respectively, in purchased power expenses

from transactions between Entergy New Orleans and Entergy’s sub-

sidiaries. Entergy’s balance sheet as of December 31, 2006 and 2005

includes $95 million and $103 million, respectively, of accounts

receivable that are payable to Entergy or its subsidiaries by Entergy

New Orleans, including $69.5 million of prepetition accounts. As

stated above, however, because Entergy owns all of the common stock

of Entergy New Orleans, the deconsolidation of Entergy New Orleans

does not affect the amount of net income Entergy records resulting

from Entergy New Orleans’ operations.

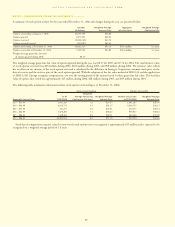

NOTE 19. QUARTERLY FINANCIAL DATA (UNAUDITED)

Operating results for the four quarters of 2006 and 2005 for Entergy

Corporation and subsidiaries were (in thousands):

Operating Operating Net

Revenues Income Income

2006

First Quarter $2,568,031 $394,763 $193,628

Second Quarter $2,628,502 $487,573 $281,802

Third Quarter $3,254,719 $644,408 $388,883

Fourth Quarter $2,480,906 $278,898 $268,289

2005

First Quarter $2,110,182 $311,008 $171,996

Second Quarter $2,445,391 $515,574 $286,150

Third Quarter $2,898,258 $654,340 $349,952

Fourth Quarter $2,652,416 $311,067 $ 90,233

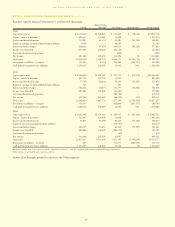

EARNINGS PER AVERAGE COMMON SHARE

2006 2005

Basic Diluted Basic Diluted

First Quarter $0.93 $0.92 $0.80 $0.79

Second Quarter $1.35 $1.33 $1.36 $1.33

Third Quarter $1.87 $1.83 $1.68 $1.65

Fourth Quarter $1.31 $1.28 $0.43 $0.42

NOTESto CONSOLIDATED FINANCIAL STATEMENTS concluded

95