Entergy 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

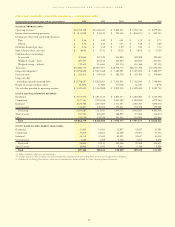

2005 COMPARED TO 2004

Following are income statement variances for Utility, Non-Utility

Nuclear, Parent & Other business segments, and Entergy comparing

2005 to 2004 showing how much the line item increased or (decreased)

in comparison to the prior period (in thousands):

Non-Utility Parent &

Utility Nuclear Other Entergy

2004 Consolidated

Net Income (Loss) $643,408 $245,029 $ 21,087 $909,524

Net revenue (operating

revenue less fuel expense,

purchased power, and

other regulatory charges

(credits) – net) (168,559) 57,496 (16,384) (127,447)

Other operation and

maintenance expenses (98,636) (7,839) (39,651) (146,126)

Taxes other than

income taxes (22,400) 2,182 (896) (21,114)

Depreciation (39,883) 9,680 (6,994) (37,197)

Other income 2,261 (6,314) 89,505 85,452

Interest charges (19,643) (2,783) 22,156 (270)

Other expenses (886) (8,897) (44) (9,827)

Provision for asset impairments – – (55,000) (55,000)

Discontinued operations

(net-of-tax) – – (44,753) (44,753)

Income taxes (1,202) 21,245 173,936 193,979

2005 Consolidated

Net Income (Loss) $659,760 $282,623 $(44,052) $898,331

The uncertainties inherent in Entergy New Orleans’ bankruptcy

proceedings caused Entergy to deconsolidate Entergy New Orleans

and reflect Entergy New Orleans’ financial results under the equity

method of accounting retroactive to January 1, 2005. Because

Entergy owns all of the common stock of Entergy New Orleans, this

change did not affect the amount of net income Entergy records

resulting from Entergy New Orleans’ operations for any current or

prior period, but did result in Entergy New Orleans’ net income for

2005 and 2006 being presented as “Equity in earnings (loss) of

unconsolidated equity affiliates” rather than its results being included

in each individual income statement line item, as is the case for 2004.

Transactions in 2005 and 2006 between Entergy New Orleans and

other Entergy subsidiaries are not eliminated in consolidation as they

are in 2004. The variance explanations for 2005 compared to 2004

below reflect the 2004 results of operations of Entergy New Orleans

as if it were deconsolidated in 2004, consistent with the 2005 presen-

tation as “Equity in earnings (loss) of unconsolidated equity

affiliates.” Entergy’s as reported consolidated results for 2004 and

the amounts included in those consolidated results for Entergy

New Orleans, which exclude inter-company items, are set forth in the

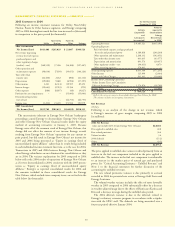

table below (in thousands):

For the Year Ended

December 31, 2004

Amounts

Entergy required to

Corporation deconsolidate

and Entergy

Subsidiaries New Orleans

(as-reported) in 2004*

Operating Revenues $ 9,685,521 $(435,194)

Operating Expenses:

Fuel, fuel-related expenses, and gas purchased

for resale and purchased power 4,189,818 (206,240)

Other operation and maintenance 2,268,332 (102,451)

Taxes other than income taxes 403,635 (43,577)

Depreciation and amortization 893,574 (29,657)

Other regulatory credits – net (90,611) 4,670

Other operating expenses 370,601 –

Total operating expenses 8,035,349 (377,255)

Other Income 125,999 (2,044)

Interest and Other Charges 501,301 (16,008)

Income from Continuing Operations

Before Income Taxes and Cumulative

Effect of Accounting Changes 1,274,870 (18,798)

Income Taxes 365,305 (16,868)

Consolidated Net Income $ 909,524 $ –

* Reflects the entry necessary to deconsolidate Entergy New Orleans for 2004.

The column includes intercompany eliminations.

Net Revenue

Utility

Following is an analysis of the change in net revenue, which

is Entergy’s measure of gross margin, comparing 2005 to 2004

(in millions):

2004 Net Revenue

(does not include $233.6 from Entergy New Orleans) $4,010.3

Price applied to unbilled sales 40.8

Rate refund provisions 36.4

Volume/weather 3.6

2004 deferrals (15.2)

Other (0.5)

2005 Net Revenue $4,075.4

The price applied to unbilled sales variance resulted primarily from an

increase in the fuel cost component included in the price applied to

unbilled sales. The increase in the fuel cost component is attributable

to an increase in the market prices of natural gas and purchased

power. See “Critical Accounting Estimates - Unbilled Revenue” and

Note 1 to the financial statements for further discussion of the

accounting for unbilled revenues.

The rate refund provisions variance is due primarily to accruals

recorded in 2004 for potential rate action at Entergy Gulf States and

Entergy Louisiana.

The volume/weather variance includes the effect of more favorable

weather in 2005 compared to 2004 substantially offset by a decrease

in weather-adjusted usage due to the effects of Hurricanes Katrina and

Rita and a decrease in usage during the unbilled sales period.

The 2004 deferrals variance is due to the deferrals related to

Entergy’s voluntary severance program, in accordance with a stipula-

tion with the LPSC staff. The deferrals are being amortized over a

four-year period effective January 2004.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

30