Entergy 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

LONG-TERM INCENTIVE AWARDS

Entergy grants long-term incentive awards earned under its stock ben-

efit plans in the form of performance units, which are equal to the

cash value of shares of Entergy Corporation common stock at the end

of the performance period, which is the last trading day of the year.

Performance units will pay out to the extent that the performance

conditions are satisfied. In addition to the potential for equivalent

share appreciation or depreciation, performance units will earn the

cash equivalent of the dividends paid during the three-year perform-

ance period applicable to each plan. The costs of incentive awards are

charged to income over the three-year period.

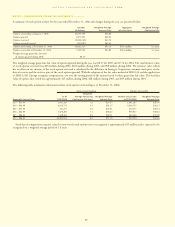

The following table includes financial information for the long-

term incentive awards for each of the years presented (in millions):

2006 2005 2004

Fair value of long-term incentive

awards at December 31, $37 $34 $49

Compensation expense included in

Entergy’s Net Income for the year $22 $16 $31

Tax benefit recognized in

Entergy’s Net Income for the year $ 8 $ 6 $12

Compensation cost capitalized as part

of fixed assets and inventory as of

December 31, $ 3 $ 2 $ 6

Entergy paid $17.1 million in 2006 for awards earned under the

Long-Term Incentive Plan. The distribution is applicable to the

2003 - 2005 performance period.

RESTRICTED AWARDS

Entergy grants restricted awards earned under its stock benefit plans

in the form of stock units that are subject to time-based restrictions.

The restricted units are equal to the cash value of shares of Entergy

Corporation common stock at the time of vesting. The costs of

restricted awards are charged to income over the restricted period,

which varies from grant to grant. The average vesting period for

restricted awards granted is 54 months. As of December 31, 2006,

there were 163,912 unvested restricted units that are expected to vest

over an average period of 33 months.

The following table includes financial information for restricted

awards for each of the years presented (in millions):

2006 2005 2004

Fair value of restricted awards at December 31, $3.6 $ – $ –

Compensation expense included in

Entergy’s Net Income for the year $3.1 $3.5 $5.3

Tax benefit recognized in

Entergy’s Net Income for the year $1.2 $1.4 $2.1

Compensation cost capitalized as

part of fixed assets and inventory as of

December 31, $0.5 $ – $ –

Entergy paid $0.2 million in 2006 for awards earned under the

Restricted Awards Plan.

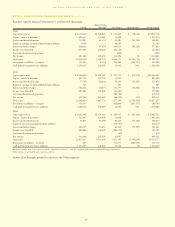

NOTE 13. BUSINESS SEGMENT INFORMATION

Entergy’s reportable segments as of December 31, 2006 are Utility

and Non-Utility Nuclear. Utility generates, transmits, distributes, and

sells electric power in portions of Arkansas, Louisiana, Mississippi,

and Texas, and provides natural gas utility service in portions of

Louisiana. Non-Utility Nuclear owns and operates five nuclear power

plants and is primarily focused on selling electric power produced by

those plants to wholesale customers. "All Other" includes the parent

company, Entergy Corporation, and other business activity, including

the Energy Commodity Services segment, the Competitive Retail

Services business, and earnings on the proceeds of sales of previously-

owned businesses. The Energy Commodity Services segment was

presented as a reportable segment prior to 2005, but it did not meet

the quantitative thresholds for a reportable segment in 2005 and

2004, and with the sale of Entergy-Koch’s businesses in 2004, man-

agement does not expect the Energy Commodity Services segment to

meet the quantitative thresholds in the foreseeable future. The 2004

information in the tables below has been restated to include the

Energy Commodity Services segment in the All Other column. As a

result of the Entergy New Orleans bankruptcy filing, Entergy has dis-

continued the consolidation of Entergy New Orleans retroactive to

January 1, 2005, and is reporting Entergy New Orleans results under

the equity method of accounting in the Utility segment.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

89