Entergy 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

with offsetting regulatory assets or liabilities. The notional volumes of

these swaps are based on a portion of projected purchases of gas for

the summer (electric generation) and winter (gas distribution at

Entergy Gulf States and Entergy New Orleans) peak seasons.

Entergy’s exposure to market risk is determined by a number of fac-

tors, including the size, term, composition, and diversification of

positions held, as well as market volatility and liquidity. For instru-

ments such as options, the time period during which the option may

be exercised and the relationship between the current market price of

the underlying instrument and the option’s contractual strike or exer-

cise price also affects the level of market risk. A significant factor

influencing the overall level of market risk to which Entergy is

exposed is its use of hedging techniques to mitigate such risk. Entergy

manages market risk by actively monitoring compliance with stated

risk management policies as well as monitoring the effectiveness of its

hedging policies and strategies. Entergy’s risk management policies limit

the amount of total net exposure and rolling net exposure during the

stated periods. These policies, including related risk limits, are regularly

assessed to ensure their appropriateness given Entergy’s objectives.

Hedging Derivatives

Entergy classifies substantially all of the following types of derivative

instruments held by its consolidated businesses as cash flow hedges:

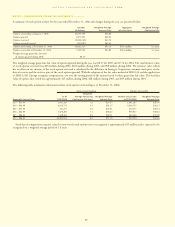

Instrument Business

Natural gas and electricity Non-Utility Nuclear,

futures and forwards Energy Commodity Services,

Non-Nuclear Wholesale Assets

Foreign currency forwards Utility, Non-Utility Nuclear

Cash flow hedges with net unrealized losses of approximately

$99 million (net-of-tax) at December 31, 2006 are scheduled to mature

during 2007. Net losses totaling approximately $79 million were realized

during 2006 on the maturity of cash flow hedges. Unrealized gains or

losses result from hedging power output at the Non-Utility Nuclear

power stations and foreign currency hedges related to Euro-denominated

nuclear fuel acquisitions. The related gains or losses from hedging power

are included in revenues when realized. The realized gains or

losses from foreign currency transactions are included in the cost of cap-

italized fuel. The maximum length of time over which Entergy is

currently hedging the variability in future cash flows for forecasted trans-

actions at December 31, 2006 is approximately five years. The ineffective

portion of the change in the value of Entergy’s cash flow hedges during

2006, 2005, and 2004 was insignificant.

Fair Values

Financial Instruments

The estimated fair value of Entergy’s financial instruments is deter-

mined using bid prices reported by dealer markets and by nationally

recognized investment banking firms. The estimated fair value of

derivative financial instruments is based on market quotes.

Considerable judgment is required in developing some of the esti-

mates of fair value. Therefore, estimates are not necessarily indicative

of the amounts that Entergy could realize in a current market

exchange. In addition, gains or losses realized on financial instruments

held by regulated businesses may be reflected in future rates and

therefore do not necessarily accrue to the benefit or detriment

of stockholders.

Entergy considers the carrying amounts of most of its financial instru-

ments classified as current assets and liabilities to be a reasonable estimate

of their fair value because of the short maturity of these instruments.

Additional information regarding financial instruments and their fair

values is included in Notes 5 and 6 to the financial statements.

NOTE 17. DECOMMISSIONING TRUST FUNDS

Entergy holds debt and equity securities, classified as available-

for-sale, in nuclear decommissioning trust accounts. The NRC requires

Entergy to maintain trusts to fund the costs of decommissioning ANO

1, ANO 2, River Bend, Waterford 3, Grand Gulf, Pilgrim, Indian Point

1 and 2, and Vermont Yankee (NYPA currently retains the decommis-

sioning trusts and liabilities for Indian Point 3 and FitzPatrick). The

funds are invested primarily in equity securities; fixed-rate, fixed-income

securities; and cash and cash equivalents. The majority of the unrealized

gains and losses below relate to Entergy’s Utility operating companies

and System Energy. The securities held at December 31, 2006 and 2005

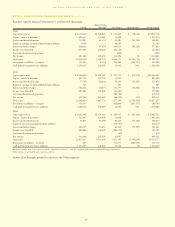

are summarized as follows (in millions):

Total Total

Unrealized Unrealized

2006 Fair Value Gains Losses

Equity $1,706 $418 $ 2

Debt Securities 1,153 17 11

Total $ 2,859 $435 $13

2005

Equity $1,502 $280 $12

Debt Securities 1,105 20 10

Total $ 2,607 $300 $22

The debt securities have an average coupon rate of approximately

5.2%, an average duration of approximately 5.5 years, and an average

maturity of approximately 8.9 years. The equity securities are gener-

ally held in funds that are designed to approximate or somewhat

exceed the return of the Standard & Poor’s 500 Index, and a relatively

small percentage of the securities are held in a fund intended to

replicate the return of the Wilshire 4500 Index.

The fair value and gross unrealized losses of available-for-sale equity

and debt securities, summarized by investment type and length of

time that the securities have been in a continuous loss position, are

as follows at December 31, 2006 (in millions):

Equity Securities Debt Securities

Gross Gross

Unrealized Unrealized

Fair Value Losses Fair Value Losses

Less than 12 months $ 6 $ – $270 $ 2

More than 12 months 33 2 335 9

Total $39 $ 2 $605 $11

Entergy evaluates these unrealized gains and losses at the end of

each period to determine whether an other than temporary impair-

ment has occurred. The assessment of whether an investment has

suffered an other than temporary impairment is based on a number of

factors including, first, whether Entergy has the ability and intent to

hold the investment to recover its value and, then, whether it is

expected that the investment will recover its value within a reasonable

period of time. Entergy's trusts are managed by third parties who have

independent discretion over purchases and sales of securities in the

trusts and, according to interpretations of authoritative literature in

December 2006, Entergy did not satisfy the ability to hold criteria.

Entergy did not record any impairments in 2006 or 2005 on these

assets due to the insignificance of any impairments.

Due to the regulatory treatment of decommissioning collections and

trust fund earnings, Entergy Arkansas, Entergy Gulf States, Entergy

Louisiana, and System Energy record regulatory assets or liabilities for

unrealized gains and losses on trust investments. For the unregulated

portion of River Bend, Entergy Gulf States has recorded an offsetting

amount of unrealized gains or losses in other deferred credits.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued

93