Entergy 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

80

Non-Utility Nuclear calculated that nothing was owed to NYPA

under the value sharing agreements for 2005. On November 1, 2006,

NYPA filed a demand for arbitration claiming that $90.5 million was

due to NYPA under these agreements for 2005. Non-Utility Nuclear

has filed a motion in New York State court to determine whether

NYPA’s claim should be decided by a court as opposed to by an arbi-

trator. Regardless of whether a court or an arbitrator decides NYPA’s

claim, Non-Utility Nuclear disagrees with NYPA’s interpretation of

the value sharing agreements, believes it has meritorious defenses to

NYPA’s claims, and intends to litigate those claims vigorously.

CASHPOINT BANKRUPTCY

In 2003, the Utility operating companies entered an agreement with

CashPoint Network Services (CashPoint) under which CashPoint was

to manage a network of payment agents through which Entergy’s util-

ity customers could pay their bills. The payment agent system allows

customers to pay their bills at various commercial or governmental

locations, rather than sending payments by mail. Approximately one-

third of Entergy’s utility customers use payment agents.

On April 19, 2004, CashPoint failed to pay funds due to the Utility

operating companies that had been collected through payment agents.

The Utility operating companies then obtained a temporary restrain-

ing order from the Civil District Court for the Parish of Orleans, State

of Louisiana, enjoining CashPoint from distributing funds belonging

to Entergy, except by paying those funds to Entergy. On April 22,

2004, a petition for involuntary Chapter 7 bankruptcy was filed

against CashPoint by other creditors in the United States Bankruptcy

Court for the Southern District of New York. In response to these

events, the Utility operating companies expanded an existing contract

with another company to manage all of their payment agents. The

Utility operating companies filed proofs of claim in the CashPoint

bankruptcy proceeding in September 2004. Although Entergy cannot

precisely determine at this time the amount that CashPoint owes to

the Utility operating companies that may not be repaid, it has accrued

an estimate of loss based on current information. If no cash is repaid

to the Utility operating companies, an event Entergy does not believe

is likely, the current estimates of maximum exposure to loss are

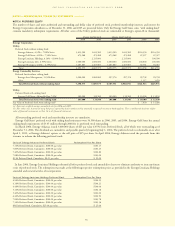

approximately as follows (in millions):

Entergy Arkansas $1.8

Entergy Gulf States $7.7

Entergy Louisiana $8.8

Entergy Mississippi $4.3

Entergy New Orleans $2.4

HARRISON COUNTY PLANT FIRE

On May 13, 2005, an explosion and fire damaged the non-nuclear

wholesale assets business’ Harrison County power plant. A catastroph-

ic failure and subsequent natural gas escape from a nearby 36-inch

interstate pipeline owned and operated by a third party is believed to

have caused the damage. Repairs to the damaged portions of the plant

have been completed and the plant returned to commercial operations

on May 1, 2006. The total cost of clean-up and repairs were approx-

imately $48 million. The plant’s property insurer has acknowledged

coverage, subject to a $200 thousand deductible and has begun pay-

ing on the claim. Entergy owns approximately 61% of this facility.

Entergy does not expect the damage caused to the Harrison County

plant to have a material effect on its financial position or results

of operations.

EMPLOYMENT LITIGATION

Entergy Corporation and the Registrant Subsidiaries are defendants in

numerous lawsuits and other labor-related proceedings filed by for-

mer employees asserting that they were wrongfully terminated and/or

discriminated against on the basis of age, race, sex, and/or other pro-

tected characteristics. Entergy Corporation and these subsidiaries are

vigorously defending these suits and deny any liability to the plain-

tiffs. Nevertheless, no assurance can be given as to the outcome of

these cases.

ASBESTOS AND HAZARDOUS MATERIAL LITIGATION

Numerous lawsuits have been filed in federal and state courts in Texas,

Louisiana, and Mississippi primarily by contractor employees in the

1950-1980 timeframe against Entergy Gulf States, Entergy Louisiana,

and Entergy New Orleans, and Entergy Mississippi as premises own-

ers of power plants, for damages caused by alleged exposure to

asbestos or other hazardous material. Many other defendants are

named in these lawsuits as well. Presently, there are approximately 600

lawsuits involving approximately 10,000 claims. Management

believes that adequate provisions have been established to cover any

exposure. Additionally, negotiations continue with insurers to recover

more reimbursement. Management believes that loss exposure has

been and will continue to be handled successfully so that the ultimate

resolution of these matters will not be material, in the aggregate, to

the financial position or results of operation of these companies.

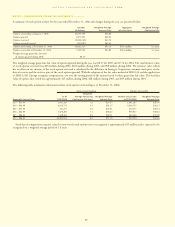

NOTE 9. ASSET RETIREMENT OBLIGATIONS

SFAS 143, “Accounting for Asset Retirement Obligations,” which was

implemented effective January 1, 2003, requires the recording of lia-

bilities for all legal obligations associated with the retirement of

long-lived assets that result from the normal operation of those assets.

For Entergy, substantially all of its asset retirement obligations consist

of its liability for decommissioning its nuclear power plants. In addi-

tion, an insignificant amount of removal costs associated with

non-nuclear power plants is also included in the decommissioning

line item on the balance sheets.

These liabilities are recorded at their fair values (which are the pres-

ent values of the estimated future cash outflows) in the period in

which they are incurred, with an accompanying addition to the

recorded cost of the long-lived asset. The asset retirement obligation

is accreted each year through a charge to expense, to reflect the time

value of money for this present value obligation. The accretion will

continue through the completion of the asset retirement activity. The

amounts added to the carrying amounts of the long-lived assets will

be depreciated over the useful lives of the assets. SFAS 143 is expect-

ed to be earnings neutral to the rate-regulated business of the

Registrant Subsidiaries.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued