Entergy 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

26

Entergy operates primarily through two business segments: Utility

and Non-Utility Nuclear.

■UTILITY generates, transmits, distributes, and sells electric power in

a four-state service territory that includes portions of Arkansas,

Mississippi, Texas, and Louisiana, including the City of New

Orleans; and operates a small natural gas distribution business.

■NON-UTILITY NUCLEAR owns and operates five nuclear power plants

located in the northeastern United States and sells the electric

power produced by those plants primarily to wholesale customers.

This business also provides services to other nuclear power

plant owners.

In addition to its two primary, reportable, operating segments,

Entergy also operates the non-nuclear wholesale assets business. The

non-nuclear wholesale assets business sells to wholesale customers the

electric power produced by power plants that it owns while it focuses

on improving performance and exploring sales or restructuring

opportunities for its power plants. Such opportunities are evaluated

consistent with Entergy’s market-based point-of-view.

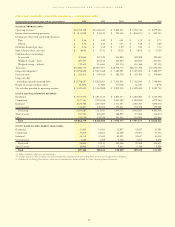

Following are the percentages of Entergy’s consolidated revenues

and net income generated by its operating segments and the percent-

age of total assets held by them:

% of Revenue

Segment 2006 2005 2004

Utility 84 84 84

Non-Utility Nuclear 14 14 14

Parent Company &

Other Business Segments 2 2 2

% of Net Income

Segment 2006 2005 2004

Utility 61 73 71

Non-Utility Nuclear 27 31 27

Parent Company &

Other Business Segments 12 (4) 2

% of Total Assets

Segment 2006 2005 2004

Utility 81 82 81

Non-Utility Nuclear 17 16 16

Parent Company &

Other Business Segments 2 2 3

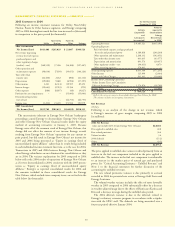

HURRICANE KATRINA AND HURRICANE RITA

In August and September 2005, Hurricanes Katrina and Rita caused

catastrophic damage to large portions of the Utility’s service territory

in Louisiana, Mississippi, and Texas, including the effect of extensive

flooding that resulted from levee breaks in and around the greater

New Orleans area. The storms and flooding resulted in widespread

power outages, significant damage to electric distribution, transmis-

sion, and generation and gas infrastructure, and the loss of sales and

customers due to mandatory evacuations and the destruction of

homes and businesses. Total restoration costs through December 31,

2006 for the repair or replacement of the Utility’s electric and gas

facilities damaged by Hurricanes Katrina and Rita and for business

continuity are $1.48 billion (including $38 million of AFUDC). The

costs include $828 million in construction expenditures and $654

million recorded originally as regulatory assets. Entergy recorded reg-

ulatory assets in accordance with its accounting policies because

management believes that recovery of these prudently incurred costs

through some form of regulatory mechanism is probable, based on

historic treatment of such costs in the Utility’s service territories and

communications with local regulators. These costs do not include

other potential incremental losses, such as the inability to recover

fixed costs scheduled for recovery through base rates, which base rate

revenue was not received due to a loss of anticipated sales. For

instance, at Entergy New Orleans, the Utility operating company that

continues to experience a reduction in the level of cost recovery due

to lost customers caused by Hurricane Katrina, Entergy estimates that

lost net revenue due to Hurricane Katrina will total approximately

$194 million through 2007. In addition, Entergy estimates that the

hurricanes caused $38 million of uncollectible Utility customer

receivables. Entergy estimates that its additional storm restoration

spending, excluding Entergy New Orleans, will be approximately

$60 million.

Entergy New Orleans has spent approximately $188 million on

storm restoration through December 31, 2006, and estimates that it

will ultimately spend approximately $275 million. Entergy New

Orleans also incurred $22 million of uncollectible accounts receivable

because of Hurricane Katrina. The storm restoration cost estimate

includes approximately $80 million in spending for accelerated rebuild-

ing of the gas system in New Orleans that Entergy New Orleans expects

will be necessary due to massive salt water intrusion into the system

caused by the flooding in New Orleans. The salt water intrusion is

expected to shorten the life of the gas system, making it necessary to

rebuild that system over time, earlier than otherwise would be expect-

ed. The storm restoration cost estimate given above does not include the

longer-term spending expected for the gas rebuild project. Entergy New

Orleans currently estimates the additional longer-term costs to rebuild

the gas system to be $385 million, with the project extending for many

years into the future.

Entergy is pursuing a broad range of initiatives to recover storm

restoration and business continuity costs. Initiatives include obtaining

reimbursement of certain costs covered by insurance, obtaining assis-

tance through federal legislation for damage caused by Hurricanes

Katrina and Rita, and, as noted above, pursuing recovery through

existing or new rate mechanisms regulated by the FERC and local reg-

ulatory bodies, in combination with securitization. Entergy Gulf

States, Entergy Louisiana, Entergy Mississippi, and Entergy New

Orleans have filed with their respective retail regulators for recovery of

storm restoration costs. The proceedings are discussed in Note 2 to

the financial statements.

See Note 8 to the financial statements for a discussion of Entergy’s

non-nuclear property insurance program. Entergy is currently evalu-

ating the amount of the covered losses for each of the affected Utility

operating companies, working with insurance adjusters, and prepar-

ing proofs of loss for both Hurricanes Katrina and Rita. There is an

aggregation limit of $1 billion for all parties insured by OIL, Entergy’s

primary insurer, for any one occurrence, and Entergy has been noti-

fied by OIL that it expects claims for Hurricanes Katrina and Rita to

materially exceed this limit. The Utility operating companies have

received $51.5 million through December 31, 2006 on their insur-

ance claims. Entergy currently estimates that its remaining net

insurance recoveries for the losses caused by the hurricanes, including

the effect of the OIL aggregation limit being exceeded, will be approx-

imately $350 million. Entergy currently expects to receive payment

for the majority of its estimated insurance recoveries related to

Hurricanes Katrina and Rita through 2009.

COMMUNITY DEVELOPMENT BLOCK GRANTS (CDBG)

In December 2005, the U.S. Congress passed the Katrina Relief Bill,

a hurricane aid package that includes $11.5 billion in Community

Development Block Grants (for the states affected by Hurricanes

Katrina, Rita, and Wilma) that allows state and local leaders to fund

individual recovery priorities. The bill includes language that permits

funding to be provided for infrastructure restoration.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS