Entergy 2006 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2

2000066

88

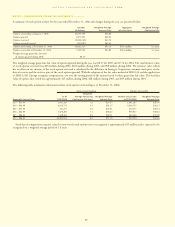

A summary of stock option activity for the year ended December 31, 2006 and changes during the year are presented below:

Number Weighted-Average Aggregate Weighted-Average

of Options Exercise Price Intrinsic Value Contractual Life

Options outstanding at January 1, 2006 10,855,459 $46.80

Options granted 1,875,293 $69.01

Options exercised (1,804,742) $42.54

Options forfeited/expired (123,087) $65.05

Options outstanding at December 31, 2006 10,802,923 $51.16 $445 million 6.2 years

Options exercisable at December 31, 2006 7,452,550 $43.83 $361 million 5.2 years

Weighted-average grant-date fair value

of options granted during 2006 $9.21

The weighted-average grant-date fair value of options granted during the year was $8.17 for 2005 and $7.76 for 2004. The total intrinsic value

of stock options exercised was $65 million during 2006, $100 million during 2005, and $98 million during 2004. The intrinsic value, which

has no effect on net income, of the stock options exercised is calculated by the difference in Entergy’s Corporation common stock price on the

date of exercise and the exercise price of the stock options granted. With the adoption of the fair value method of SFAS 123 and the application

of SFAS 123R, Entergy recognizes compensation cost over the vesting period of the options based on their grant-date fair value. The total fair

value of options that vested was approximately $15 million during 2006, $28 million during 2005, and $49 million during 2004.

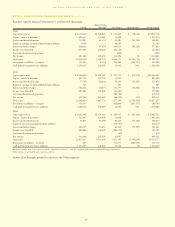

The following table summarizes information about stock options outstanding as of December 31, 2006:

Options Outstanding Options Exercisable

Weighted-

As of Average Remaining Weighted-Average Number Exercisable Weighted-Average

Range of Exercise Prices 12/31/2006 Contractual Life-Years Exercise Price at 12/31/2006 Exercise Price

$23 – $33.99 1,041,285 3.2 $25.55 1,041,285 $25.55

$34 – $44.99 4,634,715 5.1 $41.15 4,634,715 $41.15

$45 – $55.99 210,277 3.6 $49.41 210,277 $49.41

$56 – $66.99 1,478,283 7.1 $58.62 939,927 $58.63

$67 – $86.20 3,438,363 8.5 $69.31 626,346 $70.00

$23 – $86.20 10,802,923 6.2 $51.16 7,452,550 $43.83

Stock-based compensation expense related to non-vested stock options not yet recognized is approximately $13 million and is expected to be

recognized on a weighted-average period of 1.8 years.

NOTESto CONSOLIDATED FINANCIAL STATEMENTS continued