Entergy 2006 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2006 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EENNTTEERRGGYY CCOORRPPOORRAATTIIOONN aanndd SSUUBBSSIIDDIIAARRIIEESS 22000066

Entergy Corporation is an integrated energy company engaged primarily in electric

power production and retail distribution operations. Entergy owns and operates power

plants with approximately 30,000 megawatts of electric generating capacity and it is

the second-largest nuclear generator in the United States. Entergy delivers electricity to

2.6 million utility customers in Arkansas, Louisiana, Mississippi and Texas. Entergy has

annual revenues of more than $10 billion and approximately 14,000 employees.

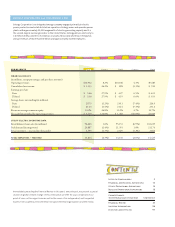

HIGHLIGHTS 2006 CHANGE 2005 CHANGE 2004

FINANCIAL RESULTS

(in millions, except percentages and per share amounts)

Operating revenues $10,932 8.2% $10,106 4.3% $9,685

Consolidated net income $ 1,133 26.2% $ 898 (1.3%) $ 910

Earnings per share

Basic $ 5.46 27.9% $ 4.27 6.5% $ 4.01

Diluted $ 5.36 27.9% $ 4.19 6.6% $ 3.93

Average shares outstanding (in millions)

Basic 207.5 (1.2%) 210.1 (7.4%) 226.9

Diluted 211.5 (1.4%) 214.4 (7.3%) 231.2

Return on average common equity 14.2% 26.8% 11.2% 4.7% 10.7%

Net cash flow provided by operating activities $ 3,419 132.9% $ 1,468 (49.9%) $2,929

UTILITY ELECTRIC OPERATING DATA

Retail kilowatt-hour sales (in millions) 96,663 1.6% 95,153 (6.9%) 102,225

Peak demand (in megawatts) 20,887 (2.4%) 21,391 1.0% 21,174

Retail customers – year end (in thousands) 2,595 (1.3%) 2,629 (1.2%) 2,662

TOTAL EMPLOYEES – YEAR END 13,814 (2.3%) 14,136 (2.0%) 14,425

Immediately preceding the Financial Review in this year’s annual report, we present a special

section on global climate change. In this centerpiece, we offer for your consideration our

point of view on this urgent issue as well as the views of six independent, well-respected

experts from academia, environmental non-governmental organizations and the media.

Letter to Stakeholders 2

Financial and Societal Aspirations 10

Utility Operational Aspirations 14

Nuclear Operational Aspirations 18

Climate Change:

The Defining Issue of Our Time Centerpiece

Financial Review 23

Investor Information 96

Directors and Officers 97