Entergy 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

95

NOTES to CONSOLIDATED FINANCIAL STATEMENTS concluded

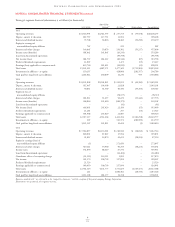

The fair value of debt securities, summarized by contractual

maturities, at December 31, 2005 and 2004 are as follows (in millions):

2005 2004

Less than 1 year $ 80 $ 134

1 year – 5 years 357 592

5 years – 10 years 382 425

10 years – 15 years 116 158

15 years – 20 years 73 60

20 years + 97 88

Total $1,105 $1,457

During the year ended December 31, 2005, the proceeds from

the dispositions of securities amounted to $50 million with gross

gains of $0.7 million and gross losses of $2.3 million, which were

reclassified out of other comprehensive income into earnings during

the period. During the year ended December 31, 2004, the proceeds

from the dispositions of securities amounted to $37 million with

gross gains of $0.7 million and gross losses of $0.7 million, which

were reclassified out of other comprehensive income into earnings

during the period.

NOTE 16. ENTERGY NEW ORLEANS

BANKRUPTCY PROCEEDING

Because of the effects of Hurricane Katrina, on September 23, 2005,

Entergy New Orleans filed a voluntary petition in the United States

Bankruptcy Court for the Eastern District of Louisiana seeking reorgan-

ization relief under the provisions of Chapter 11 of the United States

Bankruptcy Code (Case No. 05-17697). Entergy New Orleans contin-

ues to operate its business as a debtor-in-possession under the jurisdiction

of the bankruptcy court and in accordance with the applicable provisions

of the Bankruptcy Code and the orders of the bankruptcy court.

In September 2005, Entergy New Orleans, as borrower, and

Entergy Corporation, as lender, entered into the Debtor-in-

Possession (DIP) credit agreement, a debtor in possession credit

facility to provide funding to Entergy New Orleans during its busi-

ness restoration efforts. On December 9, 2005, the bankruptcy

court issued its final order approving the DIP credit agreement,

including the priority and lien status of the indebtedness under the

agreement. The credit facility provides for up to $200 million in

loans. The facility enables Entergy New Orleans to request funding

from Entergy Corporation, but the decision to lend money is at the

sole discretion of Entergy Corporation. As of December 31, 2005,

Entergy New Orleans had outstanding borrowings of $90 million

under the DIP credit agreement.

Entergy owns 100 percent of the common stock of Entergy

New Orleans, has continued to supply general and administrative

services, and has provided debtor-in-possession financing to

Entergy New Orleans. Uncertainties surrounding the nature,

timing, and specifics of the bankruptcy proceedings, however, have

caused Entergy to deconsolidate Entergy New Orleans and reflect

Entergy New Orleans’ financial results under the equity method of

accounting retroactive to January 1, 2005. Because Entergy owns all

of the common stock of Entergy New Orleans, this change will not

affect the amount of net income Entergy records resulting from

Entergy New Orleans’ operations for any current or prior period,

but will result in Entergy New Orleans’ net income for 2005 being

presented as “Equity in earnings (loss) of unconsolidated equity

affiliates” rather than its results being included in each individual

income statement line item, as is the case for periods prior to 2005.

Entergy reviewed the carrying value of its investment in Entergy

New Orleans to determine if an impairment had occurred as a result

of the storm, the flood, the power outages, restoration costs and

changes in customer load. Entergy determined that as of December

31, 2005, no impairment had occurred because management

believes that recovery is probable. Entergy will continue to assess

the carrying value of its investment in Entergy New Orleans as

developments occur in Entergy New Orleans’ recovery efforts.

Entergy’s results of operations for 2005 include $207.2 million in

operating revenues, primarily from sales of power by Entergy con-

solidated subsidiaries to Entergy New Orleans, and $117.5 million

in purchased power, primarily from purchases of power by Entergy

consolidated subsidiaries from Entergy New Orleans. As stated

above, however, because Entergy owns all of the common stock of

Entergy New Orleans, the deconsolidation of Entergy New Orleans

does not affect the amount of net income Entergy records resulting

from Entergy New Orleans’ operations.

NOTE 17. QUARTERLY FINANCIAL DATA

(UNAUDITED)

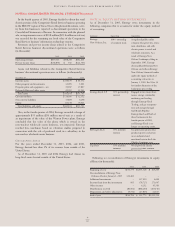

Operating results for the four quarters of 2005 and 2004 were

(in thousands):

Operating Operating Net

Revenues(a) Income(b) Income

2005

First Quarter $2,110,182 $311,008 $178,620

Second Quarter $2,445,389 $515,573 $292,789

Third Quarter $2,898,259 $654,339 $356,388

Fourth Quarter $2,652,417 $311,069 $ 95,961

2004

First Quarter $2,169,983 $379,020 $213,016

Second Quarter $2,379,668 $491,267 $271,011

Third Quarter $2,832,642 $570,316 $288,047

Fourth Quarter $2,303,228 $209,569 $160,975

(a) Operating revenues are lower by $102,461 in the first quarter 2005 and $110,597

in the second quarter 2005 due to the deconsolidation of Entergy New Orleans

retroactive to January 1, 2005. Operating revenues are lower by $110,771 in the

first quarter 2005, $153,533 in the second quarter 2005, $231,472 in the third

quarter 2005, $81,566 in the first quarter 2004, $105,429 in the second quarter

2004, and $130,939 in the third quarter 2004 due to the treatment of a portion of

the Competitive Retail Services business as a discontinued operation.

(b) Operating income is lower by $12,521 in the first quarter 2005 and $17,934 in the

second quarter 2005 due to the deconsolidation of Entergy New Orleans retroactive

to January 1, 2005. Operating income is lower (higher) by $(1,850) in the first

quarter 2005, $(3,897) in the second quarter 2005, $(10,502) in the third quarter

2005, $(186) in the first quarter 2004, $3,045 in the second quarter 2004, and

$1,156 in the third quarter 2004 due to the treatment of a portion of the

Competitive Retail Services business as a discontinued operation.

EARNINGS PER AVERAGE COMMON SHARE

2005 2004

Basic Diluted Basic Diluted

First Quarter $0.80 $0.79 $0.90 $0.88

Second Quarter $1.36 $1.33 $1.16 $1.14

Third Quarter $1.68 $1.65 $1.24 $1.22

Fourth Quarter $0.43 $0.42 $0.71 $0.69