Entergy 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

52

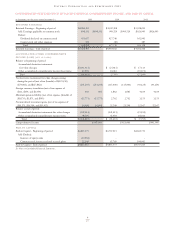

Cost Sensitivity

The following chart reflects the sensitivity of qualified pension cost

to changes in certain actuarial assumptions (dollars in thousands):

Impact on Impact on

Actuarial Change in 2005 Qualified Qualified Projected

Assumption Assumption Pension Cost Benefit Obligation

Increase/(Decrease)

Discount rate (0.25%) $10,564 $105,990

Rate of return

on plan assets (0.25%) $ 4,705 –

Rate of increase

in compensation 0.25% $ 5,510 $ 33,091

The following chart reflects the sensitivity of postretirement

benefit cost to changes in certain actuarial assumptions (dollars

in thousands):

Impact on

Impact on 2005 Accumulated

Actuarial Change in Postretirement Postretirement

Assumption Assumption Benefit Cost Benefit Obligation

Increase/(Decrease)

Health care

cost trend 0.25% $4,511 $24,536

Discount rate (0.25%) $3,082 $29,341

Each fluctuation above assumes that the other components of the

calculation are held constant.

Accounting Mechanisms

In accordance with SFAS No. 87, “Employers’ Accounting for

Pensions,” Entergy utilizes a number of accounting mechanisms

that reduce the volatility of reported pension costs. Differences

between actuarial assumptions and actual plan results are deferred

and are amortized into cost only when the accumulated differences

exceed 10% of the greater of the projected benefit obligation or the

market-related value of plan assets. If necessary, the excess is amor-

tized over the average remaining service period of active employees.

Additionally, Entergy accounts for the effect of asset performance

on pension expense over a twenty-quarter phase-in period through

a “market-related” value of assets calculation. Since the market-

related value of assets recognizes investment gains or losses over a

twenty-quarter period, the future value of assets will be impacted as

previously deferred gains or losses are recognized. As a result, the

losses that the pension plan assets experienced in 2002 may have an

adverse impact on pension cost in future years depending on

whether the actuarial losses at each measurement date exceed the

10% corridor in accordance with SFAS 87.

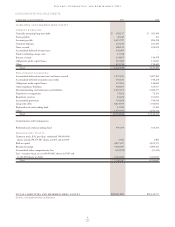

Costs and Funding

In 2005, Entergy’s total qualified pension cost was $118.3 million.

Entergy anticipates 2006 qualified pension cost to increase to

$131.6 million due to a decrease in the discount rate (from 6.00%

to 5.90%), actual return on plan assets less than 8.5%, and a plan

amendment at Non-Utility Nuclear. Pension funding was $131.8

million for 2005, and under current law, is projected to be $349 mil-

lion in 2006. This projection may change pending passage of pen-

sion reform legislation. In January 2006, $109 million was funded.

$107 million of this contribution was originally planned for 2005;

however, it was delayed as a result of the Katrina Emergency Tax

Relief Act. The rise in pension funding requirements is due to

declining interest rates and the phased-in effect of asset underper-

formance from 2000 to 2002, offset by the Pension Funding Equity

Act relief passed in April 2004.

Entergy’s qualified pension accumulated benefit obligation at

December 31, 2005, 2004, and 2003 exceeded plan assets. As a

result, Entergy was required to recognize an additional minimum

pension liability as prescribed by SFAS 87. At December 31, 2005,

Entergy increased its qualified pension plans’ additional minimum

pension liability to $406 million ($382 million net of related pension

assets) from $244 million ($218 million net of related pension assets)

at December 31, 2004. Other comprehensive income increased to

$15 million at December 31, 2005 from $6.6 million at December

31, 2004, after reductions for the unrecognized prior service cost,

amounts recoverable in rates, and taxes. Net income for 2005, 2004,

and 2003 was not affected.

Total postretirement health care and life insurance benefit costs

for Entergy in 2005 were $83.7 million, including $24.3 million in

savings due to the estimated effect of future Medicare Part D subsi-

dies. Entergy expects 2006 postretirement health care and life insur-

ance benefit costs to approximate $94.1 million, including a project-

ed $27.8 million in savings due to the estimated effect of future

Medicare Part D subsidies. The increase in postretirement health

care and life insurance benefit costs is due to the decrease in the dis-

count rate (from 6.00% to 5.90%) and an increase in the health care

cost trend rate used to calculate benefit obligations.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued