Entergy 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

93

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continuedNOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

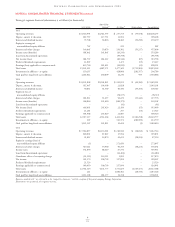

The following is a summary of combined financial information

reported by Entergy’s equity method investees (in thousands):

2005 2004 2003

Income Statement Items

Operating revenues $ 721,410 $ 270,177 $585,404

Operating income $ 9,526 $(111,535) $207,301

Net income $ 1,592 $ 739,858(1) $172,595

Balance Sheet Items

Current assets $ 415,586 $ 540,386

Non-current assets $1,498,465 $ 418,038

Current liabilities $ 544,030 $ 180,009

Non-current liabilities $ 999,346 $ 463,899

(1) Includes gains recorded by Entergy-Koch on the sales of its energy trading and

pipeline businesses.

RELATED-PARTY TRANSACTIONS AND GUARANTEES

See Note 16 to the consolidated financial statements for a discussion

of the Entergy New Orleans bankruptcy proceedings and activity

between Entergy and Entergy New Orleans.

During 2004 and 2003, Entergy procured various services from

Entergy-Koch consisting primarily of pipeline transportation serv-

ices for natural gas and risk management services for electricity and

natural gas. The total cost of such services in 2004 and 2003 was

approximately $9.5 million and $15.9 million, respectively. There

were no related party transactions between Entergy-Koch and

Entergy in 2005. Entergy Louisiana and Entergy New Orleans

entered into purchase power agreements with RS Cogen, and pur-

chased a total of $61.2 million, $43.6 million, and $26.0 million of

capacity and energy from RS Cogen in 2005, 2004, and 2003,

respectively. Entergy’s operating transactions with its other equity

method investees were not material in 2005, 2004, or 2003.

In the purchase agreements for its energy trading and the pipeline

business sales, Entergy-Koch agreed to indemnify the respective

purchasers for certain potential losses relating to any breaches of the

sellers’ representations, warranties, and obligations under each of

the purchase agreements. Entergy Corporation has guaranteed up

to 50% of Entergy-Koch’s indemnification obligations to the

purchasers. Entergy does not expect any material claims under these

indemnification obligations, but to the extent that any are asserted

and paid, the gain that Entergy expects to record in 2006 may

be reduced.

During the fourth quarter of 2004, an Entergy subsidiary pur-

chased from a commercial bank holder $16.3 million of RS Cogen

subordinated indebtedness, due October 2017, bearing interest at

LIBOR plus 4.50%. The debt was purchased at a discount of

approximately $2.4 million that was to be amortized over the

remaining life of the debt. In June 2005, 100% of the $16.0 million

balance of the subordinated indebtedness was sold to a lending insti-

tution for 100.75% of par.

NOTE 13. ACQUISITIONS AND DISPOSITIONS

ASSET ACQUISITIONS

In June 2005, Entergy Louisiana purchased the 718 MW Perryville

power plant located in northeast Louisiana for $162 million from a

subsidiary of Cleco Corporation. Entergy received the plant, mate-

rials and supplies, SO2emission allowances, and related real estate.

The LPSC approved the acquisition and the long-term cost-of-

service purchased power agreement under which Entergy Gulf

States will purchase 75 percent of the plant’s output.

ASSET DISPOSITIONS

Entergy-Koch Businesses

In the fourth quarter of 2004, Entergy-Koch sold its energy trading

and pipeline businesses to third parties. The sales came after a

review of strategic alternatives for enhancing the value of Entergy-

Koch, LP. Entergy received $862 million of cash distributions

in 2004 from Entergy-Koch after the business sales, and Entergy

ultimately expects to receive total net cash distributions exceeding

$1 billion, comprised of the after-tax cash from the distributions of

the sales proceeds and the eventual liquidation of Entergy-Koch.

Entergy currently expects the net cash distributions that it will

receive will exceed its equity investment in Entergy-Koch, and

expects to record a $60 million net-of-tax gain when it receives the

remaining cash distributions, which it expects will occur in 2006.

Other

In January 2004, Entergy sold its 50% interest in the Crete project,

which is a 320MW power plant located in Illinois, and realized an

insignificant gain on the sale.

In the fourth quarter of 2004, Entergy sold undivided interests in

the Warren Power and the Harrison County plants at a price that

approximated book value.

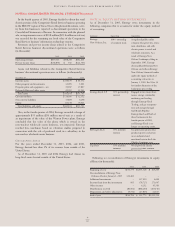

NOTE 14. RISK MANAGEMENT AND FAIR VALUES

MARKET AND COMMODITY RISKS

In the normal course of business, Entergy is exposed to a number of

market and commodity risks. Market risk is the potential loss

that Entergy may incur as a result of changes in the market or fair

value of a particular instrument or commodity. All financial and

commodity-related instruments, including derivatives, are subject to

market risk. Entergy is subject to a number of commodity and

market risks, including:

Type of Risk Primary Affected Segments

Power price risk U.S. Utility, Non-Utility Nuclear

Energy Commodity Services

Fuel price risk U.S. Utility, Non-Utility Nuclear

Energy Commodity Services

Foreign currency exchange rate risk U.S. Utility, Non-Utility Nuclear

Energy Commodity Services

Equity price and interest U.S. Utility, Non-Utility Nuclear

rate risk – investments