Entergy 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

69

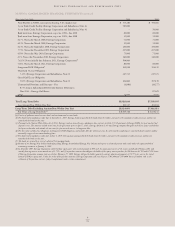

States filed motions for rehearing on these issues which were denied

by the PUCT. Entergy Gulf States and certain Cities filed appeals

to the Travis County District Court. The appeals are pending.

Any disallowance will be netted against Entergy Gulf States’

under-recovered costs and will be included in its deferred fuel

costs balance.

In January 2001, Entergy Gulf States filed with the PUCT a fuel

reconciliation case covering the period from March 1999 through

August 2000. Entergy Gulf States was reconciling approximately

$583 million of fuel and purchased power costs. As part of this

filing, Entergy Gulf States requested authority to collect $28 million,

plus interest, of under-recovered fuel and purchased power costs. In

August 2002, the PUCT reduced Entergy Gulf States’ request to

approximately $6.3 million, including interest through July 31,

2002. Approximately $4.7 million of the total reduction to the

requested surcharge relates to nuclear fuel costs that the PUCT

deferred ruling on at that time. In October 2002, Entergy Gulf

States appealed the PUCT’s final order in Texas District Court.

In its appeal, Entergy Gulf States is challenging the PUCT’s disal-

lowance of approximately $4.2 million related to imputed capacity

costs and its disallowance related to costs for energy delivered from

the 30% non-regulated share of River Bend. The case was argued

before the Travis County District Court in August 2003 and the

Travis County District Court judge affirmed the PUCT’s order. In

October 2003, Entergy Gulf States appealed this decision to the

Court of Appeals. Oral argument before the appellate court

occurred in September 2004, and the Court denied Entergy Gulf

States’ appeal. In October 2005, Entergy Gulf States filed a petition

for review by the Texas Supreme Court, and in December 2005, the

Texas Supreme Court requested that responses be filed to Entergy

Gulf States’ petition as part of its ongoing consideration of whether

to exercise its discretion to grant review of this matter. Those

responses and Entergy Gulf States’ reply to those responses were

filed in January 2006.

Entergy Gulf States (Louisiana) and Entergy Louisiana

In Louisiana, Entergy Gulf States and Entergy Louisiana recover

electric fuel and purchased power costs for the upcoming month

based upon the level of such costs from the prior month. In

Louisiana, Entergy Gulf States’ purchased gas adjustments include

estimates for the billing month adjusted by a surcharge or credit for

deferred fuel expense arising from monthly reconciliations of actual

fuel costs incurred with fuel cost revenues billed to customers.

In August 2000, the LPSC authorized its staff to initiate a pro-

ceeding to audit the fuel adjustment clause filings of Entergy

Louisiana pursuant to a November 1997 LPSC general order. The

time period that is the subject of the audit is January 1, 2000

through December 31, 2001. In September 2003, the LPSC staff

issued its audit report and recommended a disallowance with regard

to one item. The issue relates to the alleged failure to uprate

Waterford 3 in a timely manner, a claim that also has been raised in

the summer 2001, 2002, and 2003 purchased power proceedings.

The global settlement approved by the LPSC in March 2005, dis-

cussed below in “Retail Rate Proceedings,” resolves the uprate

imprudence disallowance and is no longer at issue in this proceed-

ing. Subsequent to the issuance of the audit report, the scope of this

docket was expanded to include a review of annual reports on fuel

and purchased power transactions with affiliates and a prudence

review of transmission planning issues. Also, in July 2005, the

LPSC expanded the audit to include the years 2002 through 2004.

A procedural schedule has been established and LPSC staff and

intervenor testimony is due in April 2006.

In January 2003, the LPSC authorized its staff to initiate a

proceeding to audit the fuel adjustment clause filings of Entergy

Gulf States and its affiliates pursuant to a November 1997 LPSC gen-

eral order. The audit will include a review of the reasonableness of

charges flowed by Entergy Gulf States through its fuel adjustment

clause in Louisiana for the period January 1, 1995 through

December 31, 2002. Discovery is underway, but a detailed proce-

dural schedule extending beyond the discovery stage has not yet

been established, and the LPSC staff has not yet issued its audit

report. In June 2005, the LPSC expanded the audit to include the

years through 2004.

In November 2005, the LPSC authorized its staff to initiate an

expedited proceeding to audit the fuel and power procurement

activities of Entergy Louisiana and Entergy Gulf States for the period

January 1, 2005 through October 31, 2005.

Entergy Mississippi

Entergy Mississippi’s rate schedules include an energy cost recovery

rider which is adjusted quarterly to reflect accumulated over- or

under-recoveries from the second prior quarter. In January 2005,

the MPSC approved a change in Entergy Mississippi’s energy cost

recovery rider. Entergy Mississippi’s fuel over-recoveries for the

third quarter of 2004 of $21.3 million were deferred from the first

quarter 2005 energy cost recovery rider adjustment calculation. The

deferred amount of $21.3 million plus carrying charges was refund-

ed through the energy cost recovery rider in the second and third

quarters of 2005.

In May 2003, Entergy Mississippi filed and the MPSC approved

a change in Entergy Mississippi’s energy cost recovery rider. Under

the MPSC’s order, Entergy Mississippi deferred until 2004 the

collection of fuel under-recoveries for the first and second quarters of

2003 that would have been collected in the third and fourth quarters

of 2003, respectively. The deferred amount of $77.6 million plus

carrying charges was collected through the energy cost recovery

rider over a twelve-month period that began in January 2004.

RETAIL RATE PROCEEDINGS

Filings with the APSC

Retail Rates

No significant retail rate proceedings are pending in Arkansas at

this time.

Filings with the PUCT and Texas Cities

Retail Rates

Entergy Gulf States is operating in Texas under a base rate freeze

that has remained in effect during the delay in the implementation

of retail open access in Entergy Gulf States’ Texas service territory.

As discussed in “Electric Industry Restructuring and the Continued

Application of SFAS 71” below, a Texas law was enacted in June

2005 which includes provisions in the Texas legislation regarding

Entergy Gulf States’ ability to file a general rate case and to file for

recovery of transition to competition costs. As authorized by the

legislation, in August 2005, Entergy Gulf States filed with the

PUCT an application for recovery of its transition to competition

costs. Entergy Gulf States requested recovery of $189 million in

transition to competition costs through implementation of a 15-year

rider to be effective no later than March 1, 2006. The $189 million

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued