Entergy 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

86

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continuedNOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

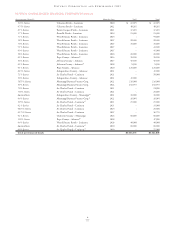

NOTE 9. LEASES

GENERAL

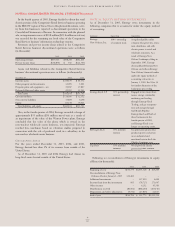

As of December 31, 2005, Entergy had capital leases and non-can-

celable operating leases for equipment, buildings, vehicles, and fuel

storage facilities (excluding nuclear fuel leases and the Grand Gulf

and Waterford 3 sale and leaseback transactions) with minimum

lease payments as follows (in thousands):

Operating Capital

Year Leases Leases

2006 $ 94,533 $ 5,747

2007 77,026 3,495

2008 63,081 1,307

2009 51,692 237

2010 36,695 237

Years thereafter 196,312 2,331

Minimum lease payments 519,339 13,354

Less: Amount representing interest – 3,403

Present value of net

minimum lease payments $519,339 $ 9,951

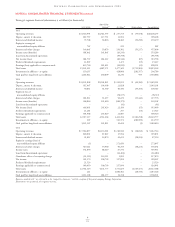

Total rental expenses for all leases (excluding nuclear fuel leases

and the Grand Gulf and Waterford 3 sale and leaseback transac-

tions) amounted to $71.2 million in 2005, $81.3 million in 2004, and

$84.3 million in 2003.

NUCLEAR FUEL LEASES

As of December 31, 2005, arrangements to lease nuclear fuel existed

in an aggregate amount up to $150 million for Entergy Arkansas,

$105 million for Entergy Gulf States, $80 million for Entergy

Louisiana, and $110 million for System Energy. As of December 31,

2005, the unrecovered cost base of nuclear fuel leases amounted to

approximately $92.2 million for Entergy Arkansas, $55.2 million for

Entergy Gulf States, $58.5 million for Entergy Louisiana, and $87.5

million for System Energy. The lessors finance the acquisition and

ownership of nuclear fuel through loans made under revolving cred-

it agreements, the issuance of commercial paper, and the issuance of

intermediate-term notes. The credit agreements for Entergy

Arkansas, Entergy Gulf States, Entergy Louisiana, and System

Energy each have a termination date of October 30, 2006. The ter-

mination dates may be extended from time to time with the consent

of the lenders. The intermediate-term notes issued pursuant to

these fuel lease arrangements have varying maturities through

February 15, 2009. It is expected that additional financing under the

leases will be arranged as needed to acquire additional fuel, to pay

interest, and to pay maturing debt. However, if such additional

financing cannot be arranged, the lessee in each case must repurchase

sufficient nuclear fuel to allow the lessor to meet its obligations in

accordance with the fuel lease.

Lease payments are based on nuclear fuel use. The total nuclear fuel

lease payments (principal and interest) as well as the separate interest

component charged to operations by the domestic utility companies and

System Energy were $135.8 million (including interest of $12.9 million)

in 2005, $146.6 million (including interest of $12.8 million) in 2004, and

$142.0 million (including interest of $11.8 million) in 2003.

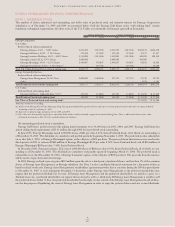

SALE AND LEASEBACK TRANSACTIONS

In 1988 and 1989, System Entergy and Entergy Louisiana, respec-

tively, sold and leased back portions of their ownership interests

in Grand Gulf and Waterford 3 for 26 1/2-year and 28-year lease

terms, respectively. Both companies have options to terminate the

leases, to repurchase the sold interests, or to renew the leases at

the end of their terms.

Under System Energy’s sale and leaseback arrangements, letters of

credit are required to be maintained to secure certain amounts payable

for the benefit of the equity investors by System Energy under the

leases. The current letters of credit are effective until May 2009.

Entergy Louisiana did not exercise its option to repurchase the

undivided interests in Waterford 3 in 1994. As a result, Entergy

Louisiana was required to provide collateral for the equity portion

of certain amounts payable by Entergy Louisiana under the leases.

Such collateral was in the form of a new series of non-interest bear-

ing first mortgage bonds in the aggregate principal amount of

$208.2 million issued by Entergy Louisiana in September 1994.

In July 1997, Entergy Louisiana caused the Waterford 3 lessors to

issue $307.6 million aggregate principle amount of Waterford 3

Secured Lease Obligation Bonds, 8.09% Series due 2017, to refinance

the outstanding bonds originally issued to finance the purchase of

the undivided interests by the lessors. In May 2004, System Energy

caused the Grand Gulf lessors to refinance the outstanding bonds

that they had issued to finance the purchase of their undivided

interest in Grand Gulf. Both refinancings are at lower interest rates,

and Entergy Louisiana’s and System Energy’s lease payments have

been reduced to reflect the lower interest costs.

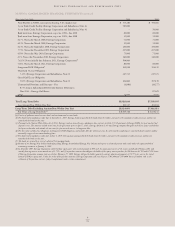

As of December 31, 2005, Entergy Louisiana and System Energy

had future minimum lease payments, recorded as long-term debt

(reflecting an implicit rate of 7.45% and 5.02%, respectively) as follows

(in thousands):

Entergy System

Year Louisiana Energy

2006 $ 18,261 $ 46,019

2007 18,754 46,552

2008 22,606 47,128

2009 32,452 47,760

2010 35,138 48,569

Years thereafter 298,924 253,833

Minimum lease payments 426,135 489,861

Less: Amount representing interest 178,410 125,055

Present value of net

minimum lease payments $ 247,725 $364,806