Entergy 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

80

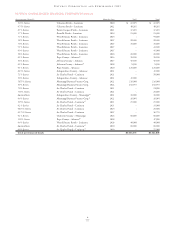

NOTE 6. PREFERRED STOCK

The number of shares authorized and outstanding and dollar value of preferred stock and minority interest for Entergy Corporation

subsidiaries as of December 31, 2005 and 2004 are presented below. Only the Entergy Gulf States series “with sinking fund” contain

mandatory redemption requirements. All other series of the U.S. Utility are redeemable at Entergy’s option ($ in thousands):

Shares Authorized Shares Outstanding

2005 2004 2005 2004 2005 2004

Entergy Corporation

U.S. Utility:

Preferred Stock without sinking fund:

Entergy Arkansas, 4.32% – 7.88% Series 1,613,500 1,613,500 1,613,500 1,613,500 $116,350 $116,350

Entergy Gulf States, 4.20% – 7.56% Series 473,268 473,268 473,268 473,268 47,327 47,327

Entergy Louisiana Holdings, 4.16% – 8.00% Series 2,115,000 2,115,000 2,115,000 2,115,000 100,500 100,500

Entergy Louisiana LLC, 6.95% Series 1,000,000 – 1,000,000 – 100,000 –

Entergy Mississippi, 4.36% – 6.25% Series 1.403,807 503,807 1,403,807 503,807 50,381 50,381

Entergy New Orleans, 4.36% – 5.56% Series(a) – 197,798 – 197,798 – 19,780

Total U.S. Utility Preferred Stock without sinking fund 6,605,575 4,903,373 6,605,575 4,903,373 $414,557 $334,337

Energy Commodity Services:

Preferred Stock without sinking fund:

Entergy Asset Management, 11.50% Rate 1,000,000 1,000,000 297,376 297,376 29,738 29,738

Other – – – – 1,679 1,281

Total Preferred Stock without sinking fund 7,605,575 5,903,373 6,902,951 5,200,749 $445,974 $365,356

U.S. Utility:

Preferred Stock with sinking fund:

Entergy Gulf States, Adjustable Rate 7.0%(b) 139,500 174,000 139,500 174,000 $ 13,950 $ 17,400

Total Preferred Stock with sinking fund 139,500 174,000 139,500 174,000 $ 13,950 $ 17,400

Fair Value of Preferred Stock with sinking fund(c) $ 13,950 $ 15,286

Totals may not foot due to rounding.

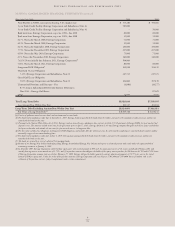

(a) Because of the Entergy New Orleans bankruptcy filing, Entergy deconsolidated Entergy New Orleans and reports its financial position and results under the equity method of

accounting retroactive to January 1, 2005.

(b) Represents weighted-average annualized rate for 2005 and 2004.

(c) Fair values were determined using bid prices reported by dealer markets and by nationally recognized investment banking firms. There is additional disclosure of fair value

of financial instruments in Note 14 to the consolidated financial statements.

All outstanding preferred stock is cumulative.

Entergy Gulf States’ preferred stock with sinking fund retirements were 34,500 shares in 2005, 2004, and 2003. Entergy Gulf States has

annual sinking fund requirements of $3.45 million through 2008 for its preferred stock outstanding.

In June 2005, Entergy Mississippi issued 1,200,000 shares of $25 par value 6.25% Series Preferred Stock, all of which are outstanding as

of December 31, 2005. The dividends are cumulative and payable quarterly beginning November 1, 2005. The preferred stock is redeemable

on or after July 1, 2010, at Entergy Mississippi’s option, at the call price of $25 per share. The proceeds from this issuance were used in the

third quarter of 2005 to redeem all $20 million of Entergy Mississippi’s $100 par value 8.36% Series Preferred Stock and all $10 million of

Entergy Mississippi’s $100 par value 7.44% Series Preferred Stock.

In December 2005, Entergy Louisiana, LLC issued 1,000,000 shares of $100 par value 6.95% Series Preferred Stock, all of which are out-

standing as of December 31, 2005. The dividends are cumulative and payable quarterly beginning March 15, 2006. The preferred stock is

redeemable on or after December 31, 2010, at Entergy Louisiana’s option, at the call price of $100 per share. The proceeds from the issuance

will be used to repay short-term borrowings.

In 2004, Entergy realized a pre-tax gain of $0.9 million upon the sale to a third party of preferred shares, and less than 1% of the common

shares, of Entergy Asset Management, an Entergy subsidiary. See Note 3 to the consolidated financial statements for a discussion of the tax

benefit realized on the sale. Entergy Asset Management’s stockholders’ agreement provides that at any time during the 180-day period prior

to December 31, 2007 or each subsequent December 31 thereafter, either Entergy Asset Management or the preferred shareholders may

request that the preferred dividend rate be reset. If Entergy Asset Management and the preferred shareholders are unable to agree on a

dividend reset rate, a preferred shareholder can request that its shares be sold to a third party. If Entergy Asset Management is unable to sell

the preferred shares within 75 days, the preferred shareholder has the right to take control of the Entergy Asset Management board of direc-

tors for the purpose of liquidating the assets of Entergy Asset Management in order to repay the preferred shares and any accrued dividends.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued