Entergy 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

67

NOTE 2. RATE AND REGULATORY MATTERS

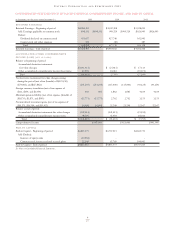

REGULATORY ASSETS

Other Regulatory Assets

The domestic utility companies and System Energy are subject to

the provisions of SFAS 71, “Accounting for the Effects of Certain

Types of Regulation.” Regulatory assets represent probable future

revenues associated with certain costs that are expected to be recov-

ered from customers through the ratemaking process. In addition to

the regulatory assets that are specifically disclosed on the face of the

balance sheets, the table below provides detail of “Other regulatory

assets” that are included on the balance sheets as of December 31,

2005 and 2004 (in millions):

2005 2004

Asset Retirement Obligation –

recovery dependent upon

timing of decommissioning (Note 8) $ 271.7 $ 380.1

Deferred fuel – non-current –

recovered through rate riders when rates

are redetermined periodically (Note 2) 6.1 21.9

Depreciation re-direct –

recovery begins at start of

retail open access (Note 1) 79.1 79.1

U.S. Department of Energy (DOE)

Decommissioning

and Decontamination Fees –

recovered through fuel rates

until December 2006 (Note 8) 17.5 25.3

Low-level radwaste – 19.4

Pension costs (Note 10) 396.1 207.3

Postretirement benefits –

recovered through 2012 (Note 10) 16.8 19.1

Provision for storm damages –

recovered through cost of service(a) 695.8 124.5

Removal costs –

recovered through depreciation rates (Note 8) 140.4 53.2

Deferred capacity – recovery timing

will be determined by the LPSC in the formula

rate plan filings (Note 2) 93.8 25.4

River Bend AFUDC –

recovered through August 2025 (Note 1) 35.6 37.5

Sale-leaseback deferral –

recovered through June 2014 (Note 9) 121.4 127.3

Spindletop gas storage facility -

recovered through December 2032 40.6 42.3

Unamortized loss on reacquired debt –

recovered over term of debt 165.1 169.9

Other – various 53.7 97.0

Total $2,133.7 $1,429.3

(a) As a result of Hurricane Katrina and Hurricane Rita that hit Entergy’s service

territory in August and September 2005, Entergy has recorded accruals for the

estimated storm restoration costs. Entergy recorded some of these costs as regulatory

assets because management believes that recovery of these prudently incurred costs

through some form of regulatory mechanism is probable. Entergy is pursuing a

broad range of initiatives to recover storm restoration costs. Initiatives include

obtaining reimbursement of certain costs covered by insurance, obtaining assistance

through federal legislation for Hurricanes Katrina and Rita, and pursuing recovery

through existing or new rate mechanisms regulated by the FERC and local

regulatory bodies.

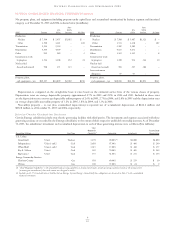

In December 2005, Entergy Mississippi filed with the MPSC a

Notice of Intent to change rates by implementing a Storm Damage

Rider to recover storm damage restoration costs associated with

Hurricanes Katrina and Rita totaling approximately $84 million

as of November 30, 2005. The notice proposes recovery of

approximately $14.7 million, including carrying charges, annually

over a five-year period. A hearing on this matter is expected in April

2006. Entergy Mississippi plans to make a second filing in late

spring of 2006 to recover additional restoration costs associated with

the hurricanes incurred after November 30, 2005 and to reflect

receipt of insurance and federal aid.

In December 2005, Entergy Gulf States filed with the LPSC for

interim recovery of $141 million of storm costs. The filing proposes

implementing an $18.7 million annual interim surcharge, including

carrying charges and subject to refund, effective March 2006 based

on a ten-year recovery period. The filing includes provisions for

updating the surcharge to reflect actual costs incurred as well as the

receipt of insurance or federal aid. Hearings occurred in February

2006. The LPSC ordered that Entergy Gulf States recover

$850,000 per month as interim storm cost recovery. For the period

March 2006 to September 2006, Entergy Gulf States’ interim storm

cost recovery shall be through its fuel adjustment clause, with the

total recovery for that time period capped at $6 million. The mech-

anism for the fuel adjustment clause recovery is a retention by

Entergy Gulf States of 15% of the difference between the February

2006 fuel adjustment clause and the fuel adjustment clause in those

successive months in which the fuel adjustment clause is lower than

it was in the February 2006 fuel adjustment clause, until the $6 mil-

lion cap is reached. Beginning in September 2006, Entergy Gulf

States’ interim storm cost recovery of $850,000 per month shall be

through base rates. In addition, all excess earnings that Entergy Gulf

States may earn under its 2005 formula rate plan, and any ensuing

period in which interim relief is being collected, will be used as an

offset to any prospective storm restoration recovery.

In December 2005, Entergy Louisiana filed with the LPSC for

interim recovery of $355 million of storm costs. The filing proposes

implementing a $41.8 million annual interim surcharge, including

carrying charges and subject to refund, effective March 2006 based

on a ten-year recovery period. The filing includes provisions for

updating the surcharge to reflect actual costs incurred as well as the

receipt of insurance or federal aid. Hearings occurred in February

2006. The LPSC ordered that Entergy Louisiana recover $2 mil-

lion per month as interim storm cost recovery. For the period

March 2006 to September 2006, Entergy Louisiana’s interim storm

cost recovery shall be through its fuel adjustment clause, with the

total recovery for that time period capped at $14 million. The

mechanism for the fuel adjustment clause recovery is a retention by

Entergy Louisiana of 15% of the difference between the February

2006 fuel adjustment clause and the fuel adjustment clause in those

successive months in which the fuel adjustment clause is lower than

it was in the February 2006 fuel adjustment clause, until the $14

million cap is reached. Beginning in September 2006, Entergy

Louisiana’s interim storm cost recovery of $2 million per month

shall be through base rates. In addition, all excess earnings that

Entergy Louisiana may earn under its 2005 formula rate plan, and

any ensuing period in which interim relief is being collected, will be

used as an offset to any prospective storm restoration recovery.

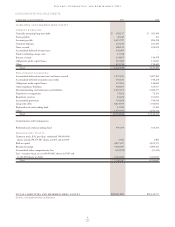

Deferred Fuel Costs

The domestic utility companies are allowed to recover certain fuel

and purchased power costs through fuel mechanisms included in

electric and gas rates that are recorded as fuel cost recovery rev-

enues. The difference between revenues collected and the current

fuel and purchased power costs is recorded as “Deferred fuel costs”

on the domestic utility companies’ financial statements. The table

below shows the amount of deferred fuel costs as of December 31,

2005 and 2004 that Entergy expects to recover or (refund) through

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued