Entergy 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

47

of securities of an electric public utility company or its holding

company in excess of $10 million or the merger of electric

public utility holding company systems. PUHCA 2005 and the

related FERC rule-making also provide a savings provision

which permits continued reliance on certain PUHCA 1935 rules

and orders after the repeal of PUHCA 1935.

■Codifies the concept of participant funding, a form of cost

allocation for transmission interconnections and upgrades, and

allows the FERC to apply participant funding in all regions of

the country. Participant funding helps ensure that a utility’s

native load customers only bear the costs that are necessary to

provide reliable transmission service to them and not bear

costs required by generators who seek to deliver power to

other regions.

■Provides financing benefits, including loan guarantees and

production tax credits, for new nuclear plant construction,

and reauthorizes the Price-Anderson Act, the law that provides

an umbrella of insurance protection for the payment of

public liability claims in the event of a major nuclear power

plant incident.

■Revises current tax law treatment of nuclear decommissioning

trust funds by allowing regulated and non-regulated taxpayers to

make deductible contributions to fund the entire amount of

estimated future decommissioning costs.

■Provides a more rapid tax depreciation schedule for transmission

assets to encourage investment.

■Creates mandatory electricity reliability guidelines with

enforceable penalties to help ensure that the nation’s power

transmission grid is kept in good repair and that disruptions in

the electricity system are minimized. Entergy already voluntarily

complies with National Electricity Reliability Council standards,

which are similar to the guidelines mandated by the Energy

Policy Act of 2005.

■Establishes conditions for the elimination of the Public Utility

Regulatory Policy Act’s (PURPA) mandatory purchase obliga-

tion from qualifying facilities.

■Significantly increased the FERC’s authorization to impose

criminal and civil penalties for violations of the provisions of the

Federal Power Act.

The Energy Policy Act requires several rulemakings by the FERC

and other government agencies in order to implement its provisions

and the FERC in its rulemakings has indicated it plans, by

February 8, 2007, for further review of, and possible changes to, its

implementation of PUHCA 2005 and the repeal of PUHCA 1935.

Therefore, it will be a period of time before a full assessment of its

effects on Entergy and the energy industry can be completed.

MARKET AND CREDIT RISKS

Market risk is the risk of changes in the value of commodity and

financial instruments, or in future operating results or cash flows, in

response to changing market conditions. Entergy is exposed to the

following significant market risks:

■The commodity price risk associated with Entergy’s Non-Utility

Nuclear and Energy Commodity Services segments.

■The foreign currency exchange rate risk associated with certain

of Entergy’s contractual obligations.

■The interest rate and equity price risk associated with Entergy’s

investments in decommissioning trust funds, particularly in the

Non-Utility Nuclear business.

■The interest rate risk associated with changes in interest rates

as a result of Entergy’s issuances of debt. Entergy manages its

interest rate exposure by monitoring current interest rates

and its debt outstanding in relation to total capitalization.

See Notes 4 and 5 to the consolidated financial statements for

the details of Entergy’s debt outstanding.

Entergy is also exposed to credit risk. Credit risk is the risk of loss

from nonperformance by suppliers, customers, or financial counter-

parties to a contract or agreement. Credit risk also includes potential

demand on liquidity due to collateral requirements within supply or

sales agreements. Where it is a significant consideration, counter-

party credit risk is addressed in the discussions that follow.

Commodity Price Risk

Power Generation

The sale of electricity from the power generation plants owned by

Entergy’s Non-Utility Nuclear business and Energy Commodity

Services, unless otherwise contracted, is subject to the fluctuation of

market power prices. Entergy’s Non-Utility Nuclear business has

entered into purchased power agreements (PPAs) and other contracts

to sell the power produced by its power plants at prices established in

the PPAs. Entergy continues to pursue opportunities to extend the

existing PPAs and to enter into new PPAs with other

parties. Following is a summary of the amount of the Non-Utility

Nuclear business’ output that is currently sold forward under

physical or financial contracts:

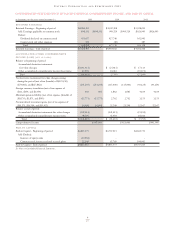

2006 2007 2008 2009 2010

Percent of planned generation

sold forward:

Unit-contingent 34% 32% 25% 19% 12%

Unit-contingent with

availability guarantees 53% 47% 32% 13% 5%

Firm liquidated damages 4% 2% 0% 0% 0%

Total 91% 81% 57% 32% 17%

Planned generation (TWh) 35 34 34 35 34

Average contracted price per MWh $41 $45 $49 $54 $45

The Vermont Yankee acquisition included a 10-year PPA under

which the former owners will buy the power produced by the plant,

which is through the expiration in 2012 of the current operating

license for the plant. The PPA includes an adjustment clause under

which the prices specified in the PPA will be adjusted downward

monthly, beginning in November 2005, if power market prices drop

below PPA prices.

A sale of power on a unit contingent basis coupled with an

availability guarantee provides for the payment to the power

purchaser of contract damages, if incurred, in the event the seller fails

to deliver power as a result of the failure of the specified generation

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

The Energy Policy Act of 2005 became law in

August 2005 and, among other things, provides

financing benefits, including loan guarantees and

production tax credits for new nuclear construction.

<

>