Entergy 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

75

Mark-to-Market of Certain Power Contracts

In 2001, Entergy Louisiana changed its method of accounting for

income tax purposes related to its wholesale electric power con-

tracts. The most significant of these is the contract to purchase

power from the Vidalia hydroelectric project. On audit of Entergy

Louisiana’s 2001 tax return, the IRS made an adjustment reducing

the amount of the deduction associated with this method change.

The adjustment had no material impact on Entergy Louisiana’s

earnings and required no additional cash payment of 2001 income

tax. The Vidalia contract method change has resulted in estimated

cumulative cash flow benefits of approximately $664 million

through December 31, 2005. This benefit could reverse in the years

2006 through 2031 depending on several variables, including the

price of power. The tax accounting election has had no effect on

book income tax expense.

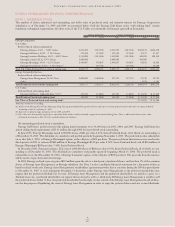

NOTE 4. LINES OF CREDIT AND

SHORT-TERM BORROWINGS

Entergy Corporation has in place two separate revolving credit

facilities, a five-year credit facility and a three-year credit facility.

The five-year credit facility, which expires in May 2010, has

a borrowing capacity of $2 billion, of which $785 million was

outstanding as of December 31, 2005. The three-year facility, which

expires in December 2008, has the borrowing capacity of $1.5 billion,

none of which was outstanding at December 31, 2005. Entergy also

has the ability to issue letters of credit against the total borrowing

capacity of both credit facilities, and letters of credit totaling

$239.5 million had been issued against the five-year facility at

December 31, 2005. The total unused capacity for these facilities

as of December 31, 2005 was approximately $2.2 billion. The

commitment fee for these facilities is currently 0.13% per annum of

the unused amount. Commitment fees and interest rates on loans

under the credit facility can fluctuate depending on the senior debt

ratings of the domestic utility companies.

Entergy Corporation’s facilities require it to maintain a consoli-

dated debt ratio of 65% or less of its total capitalization. If Entergy

fails to meet this ratio, or if Entergy or the domestic utility compa-

nies (except Entergy New Orleans) default on other indebtedness or

are in bankruptcy or insolvency proceedings, an acceleration of the

facilities’ maturity dates may occur.

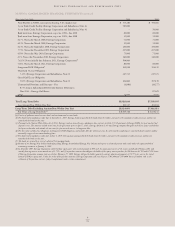

Entergy Arkansas, Entergy Louisiana, and Entergy Mississippi

each have 364-day credit facilities available as follows:

Amount Drawn as

Company Expiration Date Amount of Facility of Dec. 31, 2005

Entergy Arkansas April 2006 $85 million(a) –

Entergy Louisiana April 2006 $85 million(a) $40 million

Entergy Louisiana May 2006 $15 million(b) –

Entergy Mississippi May 2006 $25 million –

(a) The combined amount borrowed by Entergy Arkansas and Entergy Louisiana under

these facilities at any one time cannot exceed $85 million. Entergy Louisiana granted

a security interest in its receivables to secure its $85 million facility.

(b) The combined amount borrowed by Entergy Louisiana under its $15 million facility

and by Entergy New Orleans under a $15 million facility that it has with the same

lender cannot exceed $15 million at any one time. Because Entergy New Orleans’

facility is fully drawn, no capacity is currently available on Entergy Louisiana’s facility.

The 364-day credit facilities have variable interest rates and

the average commitment fee is 0.13%. The $85 million Entergy

Arkansas and Entergy Louisiana credit facilities each require the

respective company to maintain total shareholders’ equity of at least

25% of its total assets.

After the repeal of the Public Utility Holding Company Act of

1935 (PUHCA 1935), effective February 8, 2006, the FERC, under

the Federal Power Act, and not the SEC, has jurisdiction over

authorizing securities issuances by the domestic utility companies

and System Energy (except securities with maturities longer than

one year issued by (a) Entergy Arkansas which are subject to the

jurisdiction of the APSC and (b) Entergy New Orleans which are

currently subject to the jurisdiction of the bankruptcy court). Under

the Public Utility Holding Company Act of 2005 (PUHCA 2005)

and the Federal Power Act, no approvals are necessary for Entergy

Corporation to issue securities. Under a savings provision in

PUHCA 2005, each of the domestic utility companies and System

Energy may rely on the financing authority in its existing PUHCA

1935 Securities and Exchange Commission (SEC) order or orders

through December 31, 2007 or until the SEC authority is superceded

by FERC authorization. The FERC has issued an order (FERC

Short-Term Order) approving the short-term borrowing limits of

the domestic utility companies (except Entergy New Orleans) and

System Energy through March 31, 2008. Entergy New Orleans

may rely on existing SEC PUHCA 1935 orders for its short-term

financing authority, subject to bankruptcy court approval. In addi-

tion to borrowings from commercial banks, the FERC Short-Term

Order authorized the domestic utility companies (except Entergy

New Orleans which is authorized by an SEC PUHCA 1935 order)

and System Energy to continue as participants in the Entergy

System money pool through February 8, 2007. The money pool is

an inter-company borrowing arrangement designed to reduce

Entergy’s subsidiaries’ dependence on external short-term borrowings.

Borrowings from the money pool and external short-term borrowings

combined may not exceed authorized limits. As of December 31,

2005, Entergy’s subsidiaries’ aggregate money pool and external

short-term borrowings authorized limit was $2.0 billion, the

aggregate outstanding borrowing from the money pool was $379.7

million, and Entergy’s subsidiaries’ outstanding short-term borrow-

ing from external sources was $40 million. To the extent that the

domestic utility companies and System Energy wish to rely on SEC

financing orders under PUHCA 1935, there are capitalization and

investment grade ratings conditions that must be satisfied in con-

nection with security issuances, other than money pool borrowings.

There is further discussion of commitments for long-term financing

arrangements in Note 5 to the consolidated financial statements.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued