Entergy 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

36

Other income decreased from $134 million in 2004 to

$111.2 million in 2005 primarily due to:

■a revision in 2004 to the estimated decommissioning cost liability

for River Bend in accordance with a new decommissioning

cost study that reflected a life extension for the plant. For the

portion of River Bend not subject to cost-based ratemaking, the

revised estimate resulted in the elimination of the asset retire-

ment cost that had been recorded at the time of adoption of

SFAS 143 with the remainder recorded as miscellaneous income

of $27.7 million;

■a decrease of $26.3 million in Entergy New Orleans earnings,

which is now reported as an unconsolidated equity affiliate for

2005 in the “Equity in earnings (loss) of unconsolidated equity

affiliates” line on the Income Statement. The decrease in Entergy

New Orleans earnings is primarily a result of lower net revenue

and higher depreciation and amortization expenses, partially offset

by lower other operation and maintenance expenses and lower

interest charges; and

■a decrease of $10.1 million at Entergy Gulf States due to a

reduction in 2004 in the loss provision for an environmental

clean-up site.

The decrease was partially offset by an increase of $35.3 million

in interest and dividend income due to both the proceeds from

the radwaste settlement, which is discussed further in “Significant

Factors and Known Trends – Central States Compact Claim,” and

increased interest on temporary cash investments.

2004 Compared to 2003

Other operation and maintenance expenses decreased from $1.613 billion

in 2003 to $1.569 billion in 2004 primarily due to voluntary severance

program accruals of $99.8 million in 2003, partially offset by an

increase of $30.5 million as a result of higher customer service support

costs in 2004 and an increase of approximately $33 million as a result

of higher benefits costs in 2004. See “Critical Accounting Estimates –

Pension and Other Retirement Benefits” and Note 10 to the consoli-

dated financial statements for further discussion of benefit costs.

Depreciation and amortization expenses increased from $797.6

million in 2003 to $823.7 million in 2004 primarily due to higher

depreciation of Grand Gulf due to a higher scheduled sale-leaseback

principal payment in addition to an increase in plant in service.

Other income (deductions) changed from ($36.0 million) in 2003

to $108.9 million in 2004 primarily due to the following:

■the $107.7 million accrual in the second quarter of 2003 for

the loss that would be associated with a final, non-appealable

decision disallowing abeyed River Bend plant costs. See Note 2

to the consolidated financial statements for more details

regarding the River Bend abeyed plant costs;

■a reduction in the decommissioning liability for River Bend

in 2004, as discussed in Note 8 to the consolidated financial

statements; and

■a $10 million reduction in the loss provision for an Entergy

Gulf States environmental clean-up site.

Interest on long-term debt decreased from $433.5 million in 2003

to $390.7 million in 2004 primarily due to the net retirement and

refinancing of long-term debt in 2003 and the first six months of

2004. See Note 5 to the consolidated financial statements for details

on long-term debt.

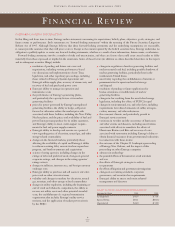

NON-UTILITY NUCLEAR

Following are key performance measures for Non-Utility Nuclear:

2005 2004 2003

Net MW in operation at December 31 4,105 4,058 4,001

Average realized price per MWh $42.39 $41.26 $39.38

Generation in GWh for the year 33,539 32,524 32,379

Capacity factor for the year 93% 92% 92%

Results of Operations

2005 Compared to 2004

The increase in earnings for Non-Utility Nuclear from $245 million

in 2004 to $282.6 million in 2005 was primarily due to the following:

■higher revenues, which increased from $1.342 billion in 2004 to

$1.422 billion in 2005, primarily resulting from higher pricing

in its contracts to sell power. Also contributing to the increase in

revenues was increased generation in 2005 due to power uprates

at several plants completed in 2004 and 2005 and fewer planned

and unplanned outages in 2005; and

■miscellaneous income of $15.8 million net-of-tax resulting from

a reduction in the decommissioning liability for a plant in 2005,

as discussed in Note 8 to the consolidated financial statements.

The increase in earnings was partially offset by the following:

■higher fuel and purchased power expenses, which increased

from $125.7 million in 2004 to $147.9 million in 2005; and

■miscellaneous income of $11.9 million net-of-tax resulting from

a reduction in the decommissioning liability for a plant in 2004,

as discussed in Note 8 to the consolidated financial statements.

2004 Compared to 2003

The decrease in earnings for Non-Utility Nuclear from $300.8 million

in 2003 to $245 million in 2004 was primarily due to the $154.5 mil-

lion net-of-tax cumulative effect of a change in accounting principle

that increased earnings in the first quarter of 2003 upon implementa-

tion of SFAS 143. See “Critical Accounting Estimates – Nuclear

Decommissioning Costs” below for discussion of the implementation

of SFAS 143. Earnings before the cumulative effect of accounting

change increased by $98.7 million primarily due to the following:

■lower operation and maintenance expenses, which decreased

from $681.8 million in 2003 to $595.7 million in 2004, primarily

resulting from charges recorded in 2003 in connection with the

voluntary severance program;

■higher revenues, which increased from $1.275 billion in 2003 to

$1.342 billion in 2004, primarily resulting from higher contract

pricing. The addition of a support services contract for the Cooper

Nuclear Station and increased generation in 2004 due to power

uprates completed in 2003 and fewer planned and unplanned out-

ages in 2004 also contributed to the higher revenues; and

■miscellaneous income of $11.9 million net-of-tax resulting from

a reduction in the decommissioning liability for a plant, as

discussed in Note 8 to the consolidated financial statements.

Partially offsetting this increase were the following:

■higher income taxes, which increased from $88.6 million in

2003 to $142.6 million in 2004; and

■higher depreciation expense, which increased from $34.3 million in

2003 to $48.9 million in 2004, due to additions to plant in service.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

The increase in earnings for Non-Utility Nuclear

to $282.6 million in 2005 was due primarily

to higher revenues resulting from

higher contract pricing and increased generation.

<

>