Entergy 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

70

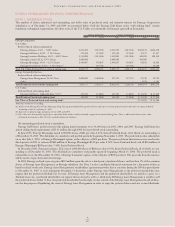

represents transition to competition costs Entergy Gulf States

incurred from June 1, 1999 through June 17, 2005 in preparing for

competition in its service area, including attendant AFUDC, and all

carrying costs projected to be incurred on the transition to compe-

tition costs through February 28, 2006. The $189 million is before

any gross-up for taxes or carrying costs over the 15-year recovery

period. Entergy Gulf States has reached a unanimous settlement

agreement in principle on all issues with the active parties in the

transition to competition cost recovery case. The agreement in prin-

ciple allows Entergy Gulf States to recover $14.5 million per year in

transition to competition costs over a 15-year period. Entergy Gulf

States implemented interim rates based on this revenue level on

March 1, 2006, subject to refund. Entergy Gulf States expects that

the PUCT will consider the formal settlement document, which is

currently being developed, in the second quarter 2006.

The Texas law enacted also allowed Entergy Gulf States to

file with the PUCT for recovery of certain incremental purchased

capacity costs which was implemented effective December 1, 2005.

This proceeding is discussed above under “Deferred Fuel Costs.”

Recovery of River Bend Costs

In March 1998, the PUCT disallowed recovery of $1.4 billion of

company-wide abeyed River Bend plant costs, which have been held

in abeyance since 1988. Entergy Gulf States appealed the PUCT’s

decision on this matter to the Travis County District Court in Texas.

In April 2002, the Travis County District Court issued an order

affirming the PUCT’s order on remand disallowing recovery of the

abeyed plant costs. Entergy Gulf States appealed this ruling to the

Third District Court of Appeals. In July 2003, the Third District

Court of Appeals unanimously affirmed the judgment of the Travis

County District Court. After considering the progress of the proceed-

ing in light of the decision of the Court of Appeals, Entergy Gulf

States accrued for the loss that would be associated with a final, non-

appealable decision disallowing the abeyed plant costs. The net carry-

ing value of the abeyed plant costs was $107.7 million at the time of

the Court of Appeals decision. Accrual of the $107.7 million loss was

recorded in the second quarter of 2003 as miscellaneous other income

(deductions) and reduced net income by $65.6 million after-tax.

In September 2004, the Texas Supreme Court denied Entergy Gulf

States’ petition for review, and Entergy Gulf States filed a motion for

rehearing. In February 2005, the Texas Supreme Court denied the

motion for rehearing, and the proceeding is now final.

Filings with the LPSC

Global Settlement including Entergy Gulf States

and Entergy Louisiana

In March 2005, the LPSC approved a settlement proposal to resolve

various dockets covering a range of issues for Entergy Gulf States

and Entergy Louisiana. The settlement resulted in credits totaling

$76 million for retail electricity customers in Entergy Gulf States’

Louisiana service territory and credits totaling $14 million for retail

electricity customers of Entergy Louisiana. The net income effect of

$48.6 million for Entergy Gulf States and $8.6 million for Entergy

Louisiana was recognized primarily in 2004 when Entergy Gulf

States and Entergy Louisiana recorded provisions for the expected

outcome of the proceeding. The settlement dismissed Entergy Gulf

States’ fourth, fifth, sixth, seventh, and eighth annual earnings

reviews, Entergy Gulf States’ ninth post-merger earnings review

and revenue requirement analysis, the continuation of a fuel review

for Entergy Gulf States, dockets established to consider issues con-

cerning power purchases for Entergy Gulf States and Entergy

Louisiana for the summers of 2001, 2002, 2003, and 2004, all

prudence issues associated with decisions made through May 2005

related to the nuclear plant uprates at issue in these cases, and an

LPSC docket concerning retail issues arising under the System

Agreement. The settlement does not include the System Agreement

case at FERC. In addition, Entergy Gulf States agreed not to seek

recovery from customers of $2 million of excess refund amounts

associated with the fourth through the eighth annual earnings

reviews and Entergy Louisiana agreed to forgo recovery of $3.5 mil-

lion of deferred 2003 capacity costs associated with certain power

purchase agreements. The credits were issued in connection with

April 2005 billings. Entergy Gulf States and Entergy Louisiana

reserved for the approximate refund amounts.

The settlement includes the establishment of a three-year formula

rate plan for Entergy Gulf States that, among other provisions,

establishes an ROE midpoint of 10.65% for the initial three-year

term of the plan and permits Entergy Gulf States to recover incre-

mental capacity costs outside of a traditional base rate proceeding.

Under the formula rate plan, over- and under-earnings outside an

allowed range of 9.9% to 11.4% will be allocated 60% to customers

and 40% to Entergy Gulf States. Entergy Gulf States made its

initial formula rate plan filing in June 2005, as discussed below. In

addition, there is the potential to extend the formula rate plan

beyond the initial three-year effective period by mutual agreement

of the LPSC and Entergy Gulf States.

Retail Rates – Electric (Entergy Louisiana)

Entergy Louisiana made a rate filing with the LPSC requesting a

base rate increase in January 2004. In March 2005, the LPSC staff

and Entergy Louisiana filed a proposed settlement that included an

annual base rate increase of approximately $18.3 million that was

implemented, subject to refund, effective with May 2005 billings. In

May 2005, the LPSC approved a modified settlement which, among

other things, reduces depreciation and decommissioning expense

due to assuming a life extension of Waterford 3 and results in no

change in rates. Subsequently, in June 2005, Entergy Louisiana

made a revised compliance filing with the LPSC supporting a

revised depreciation rate for Waterford 3, which reflects the

removal of interim additions, and a rate increase from the purchase

of the Perryville power plant, which results in a net $0.8 million

annual rate reduction. Entergy Louisiana reduced rates effective

with the first billing cycle in July 2005 and refunded excess revenue

collected during May 2005, including interest, in August 2005.

The May 2005 rate settlement includes the adoption of a three-

year formula rate plan, the terms of which include an ROE midpoint

of 10.25% for the initial three-year term of the plan and permit

Entergy Louisiana to recover incremental capacity costs outside of a

traditional base rate proceeding. Under the formula rate plan, over-

and under-earnings outside an allowed regulatory range of 9.45% to

11.05% will be allocated 60% to customers and 40% to Entergy

Louisiana. The initial formula rate plan filing will be in May 2006

based on a 2005 test year with rates effective September 2006. In

addition, there is the potential to extend the formula rate plan

beyond the initial three-year effective period by mutual agreement

of the LPSC and Entergy Louisiana.

(Entergy Gulf States)

In June 2005, Entergy Gulf States made its formula rate plan filing

with the LPSC for the test year ending December 31, 2004. The fil-

ing shows a net revenue deficiency of $2.58 million indicating that

no refund liability exists. The filing also indicates that a prospective

rate increase of $23.8 million is required in order for Entergy Gulf

States to earn the authorized ROE midpoint of 10.65%. A revision

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued