Entergy 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

91

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continuedNOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

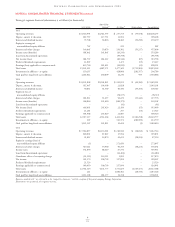

Non-Utility

U.S. Utility Nuclear*All Other*Eliminations Consolidated

2005

Operating revenues $ 8,526,943 $1,421,547 $ 237,735 $ (79,978) $10,106,247

Deprec., amort. & decomm. 867,755 117,752 13,991 – 999,498

Interest and dividend income 75,748 66,836 78,185 (70,290) 150,479

Equity in earnings of

unconsolidated equity affiliates 765 – 220 – 985

Interest and other charges 364,665 50,874 130,302 (70,237) 475,604

Income taxes (benefits) 405,662 163,865 (10,243) – 559,284

Loss from discontinued operations – – (44,794) – (44,794)

Net income (loss) 681,767 282,622 (40,544) (87) 923,758

Preferred dividend requirements 22,007 – 3,475 (55) 25,427

Earnings (loss) applicable to common stock 659,760 282,622 (44,019) (32) 898,331

Total assets 25,242,432 4,887,572 3,477,169 (2,755,904) 30,851,269

Investments in affiliates – at equity 150,135 – 428,006 (281,357) 296,784

Cash paid for long-lived asset additions 1,285,012 160,899 11,230 945 1,458,086

2004

Operating revenues $ 8,142,808 $1,341,852 $ 265,051 $ (64,190) $ 9,685,521

Deprec., amort. & decomm. 915,667 106,408 21,028 – 1,043,103

Interest and dividend income 40,831 63,569 60,430 (55,195) 109,635

Equity in loss of

unconsolidated equity affiliates – – (78,727) – (78,727)

Interest and other charges 383,032 53,657 96,229 (55,142) 477,776

Income taxes (benefits) 406,864 142,620 (184,179) – 365,305

Loss from discontinued operations – – (41) – (41)

Net income (loss) 666,691 245,029 21,384 (55) 933,049

Preferred dividend requirements 23,283 – 297 (55) 23,525

Earnings applicable to common stock 643,408 245,029 21,087 – 909,524

Total assets 22,937,237 4,531,604 2,423,194 (1,581,258) 28,310,777

Investments in affiliates – at equity 207 – 512,571 (280,999) 231,779

Cash paid for long-lived asset additions 1,152,167 242,822 15,626 (5) 1,410,610

2003

Operating revenues $ 7,584,857 $1,274,983 $ 210,910 $ (38,036) $ 9,032,714

Deprec., amort. & decomm. 890,092 87,825 17,954 – 995,871

Interest and dividend income 43,035 36,874 45,651 (38,226) 87,334

Equity in earnings (loss) of

unconsolidated equity affiliates (3) – 271,650 – 271,647

Interest and other charges 419,111 34,460 90,295 (38,225) 505,641

Income taxes 341,044 88,619 67,770 – 497,433

Loss from discontinued operations – – (14,404) – (14,404)

Cumulative effect of accounting change (21,333) 154,512 3,895 – 137,074

Net income 492,574 300,799 157,094 – 950,467

Preferred dividend requirements 23,524 – – – 23,524

Earnings applicable to common stock 469,050 300,799 157,094 – 926,943

Total assets 22,402,314 4,171,777 3,572,824 (1,619,527) 28,527,388

Investments in affiliates – at equity 211 – 1,081,462 (28,345) 1,053,328

Cash paid for long-lived asset additions 1,233,208 281,377 54,358 – 1,568,943

Businesses marked with * are referred to as the “competitive businesses,” with the exception of the parent company, Entergy Corporation.

Eliminations are primarily intersegment activity.

Entergy’s segment financial information is as follows (in thousands):