Entergy 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

34

RESULTS OF OPERATIONS

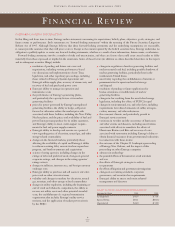

Earnings applicable to common stock for the years ended December

31, 2005, 2004, and 2003 by operating segment are as follows

(in thousands):

Operating Segment 2005 2004 2003

U.S. Utility $659,760 $643,408 $469,050

Non-Utility Nuclear 282,623 245,029 300,799

Parent Company &

Other Business Segments (44,052) 21,087 157,094

Total $898,331 $909,524 $926,943

Following is a discussion of Entergy’s income before taxes accord-

ing to the business segments listed above. Earnings for 2005 were

negatively affected by $44.8 million net-of-tax of discontinued oper-

ations due to the planned sale of the retail electric portion of

Entergy’s Competitive Retail Services business operating in the

ERCOT region of Texas. This amount includes a net charge of

$25.8 million, net-of-tax, related to the impairment reserve for the

remaining net book value of the Competitive Retail Services

business’ information technology systems.

Earnings for 2004 include a $97 million tax benefit that resulted

from the sale of preferred stock and less than 1% of the common

stock in a subsidiary in the non-nuclear wholesale assets business;

and a $36 million net-of-tax impairment charge in the non-nuclear

wholesale assets business, both of which are discussed below.

Earnings for 2003 include the $137.1 million net-of-tax cumula-

tive effect of changes in accounting principle that increased earnings

in the first quarter of 2003, almost entirely resulting from the imple-

mentation of Statement of Financial Accounting Standards (SFAS)

143. Earnings were negatively affected in the fourth quarter of 2003

by voluntary severance program expenses of $122.8 million net-of-

tax. As part of an initiative to achieve productivity improvements

with a goal of reducing costs, primarily in the Non-Utility Nuclear

and U.S. Utility businesses, in the second half of 2003 Entergy

offered a voluntary severance program to employees in various

departments. Approximately 1,100 employees, including 650

employees in nuclear operations from the Non-Utility Nuclear and

U.S. Utility businesses, accepted the offers.

U.S. UTILITY

The increase in earnings for the U.S. Utility from $643 million in

2004 to $660 million in 2005 was primarily due to higher net rev-

enue and lower depreciation and amortization expenses, partially

offset by lower other income, including equity in earnings of uncon-

solidated equity affiliates related to Entergy New Orleans, and higher

taxes other than income taxes.

The increase in earnings for the U.S. Utility from $469 million in

2003 to $643 million in 2004 was primarily due to the following:

■the $107.7 million ($65.6 million net-of-tax) accrual in 2003 of

the loss that would be associated with a final, non-appealable

decision disallowing abeyed River Bend plant costs. Refer to

Note 2 to the consolidated financial statements for more details

regarding the River Bend abeyed plant costs;

■lower other operation and maintenance expenses primarily due

to $99.8 million ($70.1 million net-of-tax) of charges recorded

in 2003 in connection with the voluntary severance program;

■the $21.3 million net-of-tax cumulative effect of a change in

accounting principle that reduced earnings at Entergy Gulf

States in the first quarter of 2003 upon implementation of

SFAS 143. See “Critical Accounting Estimates – Nuclear

Decommissioning Costs” below for discussion of the implemen-

tation of SFAS 143;

■miscellaneous other income of $27.7 million (pre-tax) in 2004

resulting from a revision of the decommissioning liability for

River Bend, as discussed in Note 8 to the consolidated financial

statements;

■higher net revenue; and

■lower interest charges.

Net Revenue

2005 Compared to 2004

Net revenue, which is Entergy’s measure of gross margin, consists of

operating revenues net of: 1) fuel, fuel-related expenses and gas

purchased for resale, 2) purchased power expenses, and 3) other

regulatory credits. Following is an analysis of the change in net

revenue comparing 2005 to 2004 (in millions):

2004 net revenue $4,010.3

Price applied to unbilled sales 40.8

Rate refund provisions 36.4

Volume/weather 3.6

2004 deferrals (15.2)

Other (0.5)

2005 net revenue $4,075.4

The price applied to unbilled sales variance resulted from an

increase in the fuel cost component included in the price applied to

unbilled sales. The increase in the fuel cost component is attributable

to an increase in the market prices of natural gas and purchased

power. See “Critical Accounting Estimates – Unbilled Revenue” and

Note 1 to the consolidated financial statements for further discus-

sion of the accounting for unbilled revenues.

The rate refund provisions variance is due primarily to accruals

recorded in 2004 for potential rate action at Entergy Gulf States and

Entergy Louisiana.

The volume/weather variance includes the effect of more favor-

able weather in 2005 compared to 2004, substantially offset by a

decrease in weather-adjusted usage and a decrease in usage during

the unbilled sales period, both due to the effects of Hurricanes

Katrina and Rita. See “Critical Accounting Estimates – Unbilled

Revenue” and Note 1 to the consolidated financial statements for

further discussion of the accounting for unbilled revenues.

The 2004 deferrals variance is due to the deferrals related to

Entergy’s voluntary severance program, in accordance with a stipu-

lation with the Louisiana Public Service Commission (LPSC) staff.

The deferrals are being amortized over a four-year period effective

January 2004.

Gross operating revenues, fuel and purchased power expenses, and

other regulatory credits – Gross operating revenues include an

increase in fuel cost recovery revenues of $586.3 million resulting

from increases in the market prices of purchased power and natural

gas. As such, this revenue increase is offset by increased fuel and

purchased power expenses. The price applied to unbilled sales

and the rate refund provisions variances, discussed above, and an

increase in gross wholesale revenue also contributed to the increase

in gross operating revenues. Gross wholesale revenues increased

$84.2 million primarily due to an increase in the average price of

energy available for resale.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued