Entergy 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

41

CASH FLOW ACTIVITY

As shown in Entergy’s Statements of Cash Flows, cash flows for the

years ended December 31, 2005, 2004, and 2003 were as follows

(in millions):

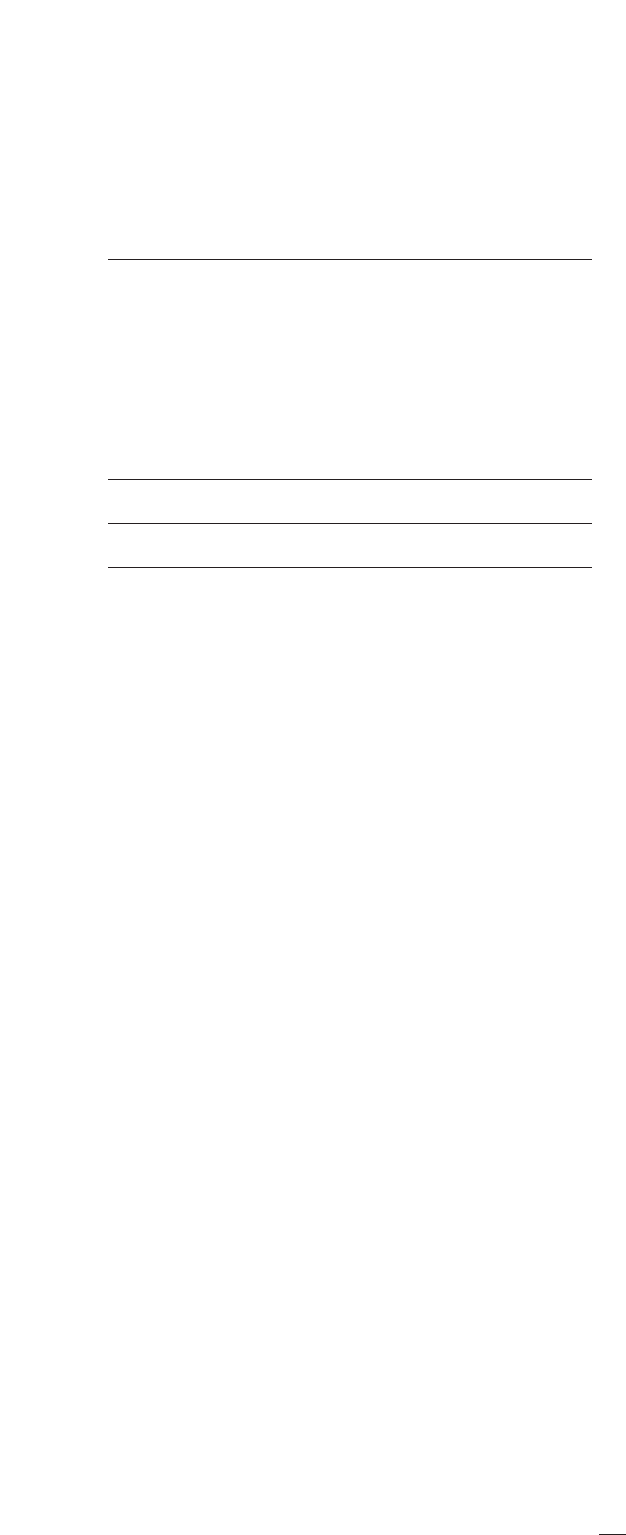

2005 2004 2003

Cash and cash equivalents

at beginning of period $ 620 $ 507 $1,335

Effect of deconsolidating

Entergy New Orleans in 2005 (8) – –

Cash flow provided by (used in):

Operating activities 1,468 2,929 2,006

Investing activities (1,992) (1,143) (1,968)

Financing activities 496 (1,672) (869)

Effect of exchange rates on

cash and cash equivalents (1) (1) 3

Net increase (decrease) in

cash and cash equivalents (29) 113 (828)

Cash and cash equivalents

at end of period $ 583 $ 620 $ 507

Operating Cash Flow Activity

2005 Compared to 2004

Entergy’s cash flow provided by operating activities decreased in

2005 primarily due to the following:

■The U.S. Utility provided $964 million in cash from operating

activities compared to providing $2,208 million in 2004. The

decrease resulted primarily from restoration spending and lost

net revenue caused by Hurricanes Katrina and Rita. Changes in

the timing of fuel cost recovery compared to the prior period

due to higher natural gas prices, which caused an increase in

deferred fuel cost balances, also contributed to the decrease in

cash from operating activities. Also contributing to the decrease

in the U.S. Utility segment were increases in income tax pay-

ments and in pension plan contributions, and a $90 million

refund to customers in the Louisiana jurisdiction made as a

result of an LPSC-approved settlement.

■Entergy received dividends from Entergy-Koch of $529 million in

2004 and did not receive any dividends from Entergy-Koch in 2005.

■Offsetting the decreases in those two businesses, the Non-

Utility Nuclear business provided $551 million in cash from

operating activities compared to providing $415 million in 2004.

The increase resulted primarily from lower intercompany

income tax payments and increases in generation and contract

pricing that led to an increase in revenues.

2004 Compared to 2003

Entergy’s cash flow provided by operating activities increased in

2004 primarily due to the following:

■The U.S. Utility provided $2,208 million in cash from operating

activities compared to providing $1,675 million in 2003. The

increase resulted primarily from the receipt of intercompany

income tax refunds from the parent company, Entergy

Corporation. Income tax refunds/payments contributed approxi-

mately $400 million of the increase in cash from operating

activities in 2004. Improved recovery of fuel costs and a reduc-

tion in interest paid also contributed to the increase in 2004.

■The Non-Utility Nuclear business provided $415 million in

cash from operating activities compared to providing $183 million

in 2003. The increase resulted primarily from lower intercom-

pany income tax payments and increases in generation and

contract pricing that led to an increase in revenues.

■Entergy’s investment in Entergy-Koch, LP provided $526

million in cash from operating activities compared to using

$41 million in 2003. Entergy received dividends from Entergy-

Koch of $529 million in 2004 compared to $100 million in 2003.

In addition, tax payments related to the investment were higher

in 2003 because the investment had higher net income in 2003.

■The non-nuclear wholesale asset business used $46 million in

cash from operating activities compared to using $70 million

in 2003. The decrease in cash used resulted primarily from a

one-time $33 million payment in 2003 related to a generation

contract in the non-nuclear wholesale assets business.

■The parent company, Entergy Corporation, used $146 million

in cash from operating activities in 2004 compared to providing

$209 million in 2003 primarily due to higher intercompany

income tax payments.

In 2003, the domestic utility companies and System Energy filed,

with the Internal Revenue Service (IRS), notification of a change in

tax accounting method for their respective calculations of cost of

goods sold. The adjustment implemented a simplified method of

allocation of overhead to the production of electricity, which is pro-

vided under the IRS capitalization regulations. The cumulative

adjustment placing these companies on the new methodology result-

ed in a $2.8 billion deduction on Entergy’s 2003 income tax return.

There was no tax cash benefit from the method change in 2003.

In addition, on a consolidated basis, no cash tax benefit

was realized in 2004 or 2005. The IRS has issued new proposed

regulations effective in 2005 that may preclude a significant portion of

the benefit of this tax accounting method change. In 2005, the domes-

tic utility companies and System Energy filed a notice with the IRS of

a new tax accounting method for their respective calculations of cost

of goods sold. This new method is also subject to IRS scrutiny.

In 2005, Non-Utility Nuclear changed its method of accounting

for income tax purposes related to its wholesale electric power

contracts. The adjustment placing these companies on the new

mark-to-market methodology is expected to result in a $3.8 billion

deduction on Entergy’s 2005 income tax return. The election did

not reduce book income tax expense. This deduction is expected to

reverse over the next four years. The timing of the reversal of this

deduction depends on several variables, including the price of

power. On a consolidated basis, it is estimated that there was a

$7 million cash tax benefit from the method change in 2005.

In August of 2005, the Energy Policy Act of 2005 was enacted.

This Act contains provisions that enable the full accumulation of

nuclear decommissioning funds on a tax deductible basis, shortens

the depreciation recovery period for certain transmission capital

expenditures, provides a production credit for electricity generated

by new nuclear plants, and expands the net operating loss carryback

period to five years for 2003, 2004, and 2005 losses to the extent of

20% of transmission capital expenditures incurred in 2005, 2006,

and 2007.

In December of 2005, the Gulf Opportunity Zone Act of 2005

was enacted. The Act contains provisions that allow a public utility

incurring a net operating loss as a result of Hurricane Katrina to

carry back the casualty loss portion of the net operating loss ten

years to offset previously taxed income. The Act also allows a five-

year carryback of the portion of the net operating loss attributable

to Hurricane Katrina repairs expense and first year depreciation

deductions, including 50% bonus depreciation, on Hurricane

Katrina capital expenditures.

Entergy expects the above provisions to generate 2006 income

tax refunds of approximately $300 million, including Entergy

New Orleans.

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued