Entergy 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

90

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continuedNOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

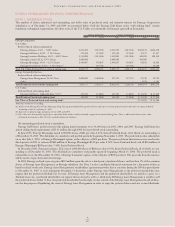

VOLUNTARY SEVERANCE PROGRAM

As part of an initiative to achieve productivity improvements with a

goal of reducing costs, primarily in the Non-Utility Nuclear and

U.S. Utility businesses, in the second half of 2003 Entergy offered a

voluntary severance program to employees in various departments.

Approximately 1,100 employees, including 650 employees in

nuclear operations from the Non-Utility Nuclear and U.S. Utility

businesses, accepted the offers. As a result of this program, in the

fourth quarter 2003 Entergy recorded additional pension and

postretirement costs (including amounts capitalized) of $110.3 mil-

lion for special termination benefits and plan curtailment charges.

These amounts are included in the net pension cost and net postre-

tirement benefit cost for the year ended December 31, 2003.

MEDICARE PRESCRIPTION DRUG, IMPROVEMENT

AND MODERNIZATION ACT OF 2003

In December 2003, the President signed the Medicare Prescription

Drug, Improvement and Modernization Act of 2003 into law. The

Act introduces a prescription drug benefit cost under Medicare

(Part D), starting in 2006, as well as federal subsidy to employers

who provide a retiree prescription drug benefit that is at least actu-

arially equivalent to Medicare Part D.

The actuarially estimated effect of future Medicare subsidies

reduced the December 31, 2005 and 2004 Accumulated

Postretirement Benefit Obligation by $176 million and $161 million,

respectively, and reduced the 2005 and 2004 other postretirement

benefit cost by $24.3 million and $23.3 million, respectively.

NON-QUALIFIED PENSION PLANS

Entergy also sponsors non-qualified, non-contributory defined ben-

efit pension plans that provide benefits to certain executives.

Entergy recognized net periodic pension cost of $16.4 million in

2005, $16.4 million in 2004, and $14.5 million in 2003. The projected

benefit obligation was $142 million and $141 million as of

December 31, 2005 and 2004, respectively. There are $0.4 million

in plan assets for a pre-merger Entergy Gulf States plan. The

accumulated benefit obligation was $133 million and $130 million

as of December 31, 2005 and 2004, respectively. As of December 31,

2005, Entergy’s additional minimum pension liability for the non-

qualified pension plans was $63.1 million. This liability was offset by

a $13.6 million intangible asset, $38.1 million regulatory asset, and

an $11.4 million charge to accumulated other comprehensive

income before taxes.

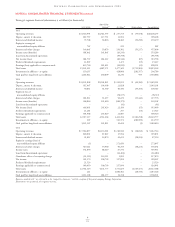

DEFINED CONTRIBUTION PLANS

Entergy sponsors the Savings Plan of Entergy Corporation and

Subsidiaries (System Savings Plan). The System Savings Plan is a

defined contribution plan covering eligible employees of Entergy

and its subsidiaries. The employing Entergy subsidiary makes

matching contributions for all non-bargaining and certain bargaining

employees to the System Savings Plan in an amount equal to 70%

of the participants’ basic contributions, up to 6% of their eligible

earnings per pay period. The 70% match is allocated to investments

as directed by the employee.

Through January 31, 2004, the System Savings Plan provided

that the employing Entergy subsidiary make matching contributions

in the following manner for all non-bargaining and certain bargain-

ing employees. The employing Entergy subsidiary continues to

make matching contributions in the following manner for all other

bargaining employees who don’t receive the 70% matching

contribution discussed above. The System Savings Plan provides that

the employing Entergy subsidiary make matching contributions:

■in an amount equal to 75% of the participants’ basic contribu-

tions, up to 6% of their eligible earnings per pay period, in

shares of Entergy Corporation common stock if the employees

direct their company-matching contribution to the purchase of

Entergy Corporation’s common stock; or

■in an amount equal to 50% of the participants’ basic contribu-

tions, up to 6% of their eligible earnings per pay period, if the

employees direct their company-matching contribution to other

investment funds.

Entergy also sponsors the Savings Plan of Entergy Corporation

and Subsidiaries II (established in 2001), Savings Plan of Entergy

Corporation and Subsidiaries IV (established in 2002), and the

Savings Plan of Entergy Corporation and Subsidiaries V (estab-

lished in 2002) to which matching contributions are also made. The

plans are defined contribution plans that cover eligible employees,

as defined by each plan, of Entergy and its subsidiaries. Effective

December 31, 2005, employees participating in the Savings Plan

of Entergy Corporation and Subsidiaries V (Savings Plan V) were

transferred into the System Savings Plan when Savings Plan V was

merged into the System Savings Plan.

Entergy’s subsidiaries’ contributions to defined contribution

plans collectively were $33.8 million in 2005, $32.9 million in 2004,

and $31.5 million in 2003. The majority of the contributions were

to the System Savings Plan.

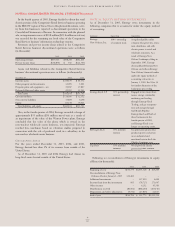

NOTE 11. BUSINESS SEGMENT INFORMATION

Entergy’s reportable segments as of December 31, 2005 are U.S.

Utility and Non-Utility Nuclear. U.S. Utility generates, transmits,

distributes, and sells electric power in portions of Arkansas,

Louisiana, Mississippi, and Texas, and provides natural gas utility

service in portions of Louisiana. Non-Utility Nuclear owns and

operates five nuclear power plants and is primarily focused on sell-

ing electric power produced by those plants to wholesale customers.

“All Other” includes the parent company, Entergy Corporation, and

other business activity, including the Energy Commodity Services

segment, the Competitive Retail Services business, and earnings on

the proceeds of sales of previously-owned businesses. The Energy

Commodity Services segment was presented as a reportable seg-

ment prior to 2005, but it did not meet the quantitative thresholds

for a reportable segment in 2005 and 2004, and with the sale of

Entergy-Koch’s businesses in 2004, management does not expect

the Energy Commodity Services segment to meet the quantitative

thresholds in the foreseeable future. The 2004 and 2003 informa-

tion in the tables below has been restated to include the Energy

Commodity Services segment in the All Other column. As a result

of the Entergy New Orleans bankruptcy filing, Entergy has discon-

tinued the consolidation of Entergy New Orleans retroactive to

January 1, 2005, and is reporting Entergy New Orleans results

under the equity method of accounting in the U.S. Utility segment.