Entergy 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

74

federal and state net tax benefit of $97 million that Entergy recorded

in the fourth quarter of 2004. Entergy has established a contingency

provision in its financial statements that management believes will

sufficiently cover the risk associated with this issue.

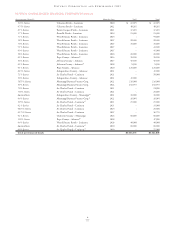

Significant components of net deferred and non-current accrued

tax liabilities as of December 31, 2005 and 2004 are as follows

(in thousands):

2005 2004

Deferred and Non-current

Accrued Tax Liabilities:

Net regulatory liabilities $ (954,742) $ (978,815)

Plant-related basis differences (5,444,178) (4,699,803)

Power purchase agreements (2,422,967) (972,348)

Nuclear decommissioning (390,256) (545,109)

Other (621,179) (346,993)

Total (9,833,322) (7,543,068)

Deferred Tax Assets:

Accumulated deferred investment

tax credit 125,521 133,979

Capital losses 119,003 134,688

Net operating loss carryforwards 2,788,864 1,201,006

Sale and leaseback 238,557 227,155

Unbilled/deferred revenues 25,455 28,741

Pension-related items 231,154 247,662

Reserve for regulatory adjustments 120,792 131,112

Customer deposits 70,222 107,652

Nuclear decommissioning 168,928 158,796

Other 560,980 225,659

Valuation allowance (38,791) (43,864)

Total 4,410,685 2,552,586

Net deferred and non-current

accrued tax liability $(5,422,637) $(4,990,482)

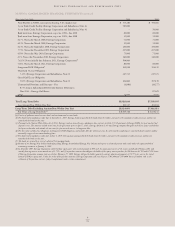

At December 31, 2005, Entergy had $268.4 million in net realized

federal capital loss carryforwards that will expire as follows: $104.9 mil-

lion in 2007, $0.8 million in 2008, and $162.7 million in 2009.

At December 31, 2005, Entergy had federal net operating loss

carryforwards of $6.6 billion primarily resulting from changes in tax

accounting methods relating to (a) the domestic utility companies

calculation of cost of goods sold and (b) Non-Utility Nuclear’s

2005 mark-to-market tax accounting election, and losses due to

Hurricanes Katrina and Rita. Both tax accounting method changes

produce temporary book tax differences, which will reverse in the

future. Approximately $4.0 billion of the net operating loss, attrib-

utable to the two tax accounting method changes, is expected to

reverse within four years. The timing of the reversal depends on

several variables, including the price of power and nuclear plant life

extensions. If the federal net operating loss carryforwards are not

utilized, they will expire in the years 2023 through 2025. Entergy

expects to receive a refund of $242 million from prior tax years

under the special provisions of the Gulf Opportunity Zone Act

of 2005 and the Energy Policy Act of 2005 in the second

quarter of 2006. The expected refund is reflected as a receivable in

the “Prepayments and other” line on the balance sheet as of

December 31, 2005.

At December 31, 2005, Entergy had estimated state net operating

loss carryforwards of $8.4 billion, primarily resulting from Entergy

Louisiana’s mark-to-market tax election, the domestic utility

companies’ change in method of accounting for tax purposes related

to cost of goods sold, and Non-Utility Nuclear’s 2005 mark-to-

market tax accounting election, all discussed above. If the state net

operating loss carryforwards are not utilized, they will expire in the

years 2008 through 2020.

The 2005 and 2004 valuation allowances are provided against

United Kingdom (UK) capital loss and UK net operating loss carry-

forwards, and certain state net operating loss carryforwards. The

UK losses can be utilized against future UK taxable income. For UK

tax purposes, these carryforwards do not expire.

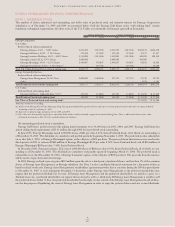

On October 22, 2004, the American Jobs Creation Act of 2004

(the Act) was enacted. The Act promotes domestic production and

investing activities by providing a number of tax incentives including a

temporary incentive to repatriate accumulated foreign earnings,

subject to certain limitations, by providing an 85% dividends

received deduction for certain repatriated earnings and also provid-

ing a tax deduction of up to 9% of qualifying production activities.

In 2004, Entergy repatriated $59.1 million of accumulated foreign

earnings, which resulted in approximately $11.0 million of tax ben-

efit. At December 31, 2005, Entergy had no undistributed earnings

from subsidiary companies outside the United States that are being

considered for repatriation. In accordance with FASB Staff Position

(FSP) 109-1, which was issued by the FASB to address the account-

ing for the impacts of the Act, the allowable production tax credit

will be treated as a special deduction in the period in which it is

deducted rather than treated as a tax rate change during 2004 which

is the period in which the Act was signed into law. The adoption of

FSP 109-1 and FSP 109-2, also issued by the FASB to address the

accounting for the repatriation provisions of the Act, did not have a

material effect on Entergy’s financial statements.

INCOME TAX AUDITS

Entergy is currently under audit by the IRS with respect to tax

returns for tax periods subsequent to 1995 and through 2003, and is

subject to audit by the IRS and other taxing authorities for subse-

quent tax periods. The amount and timing of any tax assessments

resulting from these audits are uncertain, and could have a material

effect on Entergy’s financial position and results of operations.

Entergy believes that the contingency provisions established in its

financial statements will sufficiently cover the liabilities that are rea-

sonably estimable associated with tax matters. Certain material audit

matters as to which management believes there is a reasonable

possibility of a future tax payment are discussed below.

Depreciable Property Lives

In October 2005, Entergy Arkansas, Entergy Louisiana, Entergy

Mississippi, Entergy New Orleans, and System Energy concluded

settlement discussions with IRS Appeals related to the 1996 – 1998

audit cycle. The most significant issue settled involved the changes

in tax depreciation methods with respect to certain types of depre-

ciable property. Entergy Arkansas, Entergy Louisiana, Entergy

Mississippi, and Entergy New Orleans partially conceded deprecia-

tion associated with assets other than street lighting and intend to

pursue the street lighting depreciation in litigation. Entergy Gulf

States was not part of the settlement and did not change its accounting

method for these certain assets until 1999. The total cash concession

related to these deductions for Entergy Arkansas, Entergy

Louisiana, Entergy Mississippi, Entergy New Orleans, and System

Energy is $56 million plus interest of $23 million. The effect of a

similar settlement by Entergy Gulf States would result in a cash tax

exposure of approximately $25 million plus interest of $8 million.

Because this issue relates to the timing of when depreciation expense

is deducted, the conceded amount for Entergy Arkansas, Entergy

Louisiana, Entergy Mississippi, Entergy New Orleans, and System

Energy, or any future conceded amounts by Entergy Gulf States

will be recovered in future periods. Entergy believes that the

contingency provision established in its financial statements

sufficiently covers the risk associated with this item.

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued