Entergy 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

33

MANAGEMENT’S FINANCIAL DISCUSSION and ANALYSIS continued

plants, substations, facilities, inventories, and gas distribution-related

properties. Excluded property generally includes above-ground

transmission and distribution lines, poles, and towers. The primary

property program (excess of the deductible) is placed through Oil

Insurance Limited ($250 million layer) with the excess program

($150 million layer) placed on a quota share basis through

Underwriters at Lloyds (50%) and Hartford Steam Boiler

Inspection and Insurance Company (50%). Coverage is in place for

Entergy Corporation, Entergy Arkansas, Entergy Gulf States,

Entergy Louisiana, Entergy Mississippi, and Entergy New Orleans.

There is an aggregation limit of $1 billion for all parties insured by

OIL for any one occurrence, and Entergy has been notified by OIL

that it expects claims for Hurricane Katrina to materially exceed this

limit. Entergy is currently evaluating the amount of the covered

losses for each of the affected domestic utility companies, working

with insurance adjusters, and preparing proofs of loss for Hurricanes

Katrina and Rita. Entergy currently estimates that its net insurance

recoveries for the losses caused by the hurricanes, including the

effect of the OIL aggregation limit being exceeded, will be approx-

imately $382 million.

In December 2005, the U.S. Congress passed and the President

signed the Katrina Relief Bill, a hurricane aid package that includes

$11.5 billion in Community Development Block Grants (for the

states affected by Hurricanes Katrina, Rita, and Wilma) that allows

state and local leaders to fund individual recovery priorities. The bill

includes language that permits funding for infrastructure restora-

tion. It is uncertain how much funding, if any, will be designated for

utility reconstruction and the timing of such decisions is also uncer-

tain. Entergy is currently preparing applications to seek Community

Development Block Grant funding.

ENTERGY NEW ORLEANS BANKRUPTCY

Because of the effects of Hurricane Katrina, on September 23, 2005,

Entergy New Orleans filed a voluntary petition in the United States

Bankruptcy Court for the Eastern District of Louisiana seeking

reorganization relief under the provisions of Chapter 11 of the

United States Bankruptcy Code (Case No. 05-17697). Entergy

Corporation owns 100 percent of the common stock of Entergy

New Orleans, has continued to supply general and administrative

services, and has provided debtor-in-possession financing to

Entergy New Orleans. Uncertainties surrounding the nature, tim-

ing, and specifics of the bankruptcy proceedings, however, have

caused Entergy to deconsolidate Entergy New Orleans and reflect

Entergy New Orleans’ financial results under the equity method of

accounting retroactive to January 1, 2005. Because Entergy owns all

of the common stock of Entergy New Orleans, this change did not

affect the amount of net income Entergy records resulting from

Entergy New Orleans’ operations for any current or prior period,

but did result in Entergy New Orleans’ net income for 2005 being

presented as “Equity in earnings (loss) of unconsolidated equity

affiliates” rather than its results being included in each individual

income statement line item, as is the case for periods prior to 2005.

Entergy reviewed the carrying value of its equity investment in

Entergy New Orleans ($149.9 million as of December 31, 2005) to

determine if an impairment had occurred as a result of the storm,

the flood, the power outages, restoration costs, and changes in cus-

tomer load. Entergy determined that as of December 31, 2005, no

impairment had occurred because, as discussed above, management

believes that recovery is probable. In addition to Entergy’s equity

investment in Entergy New Orleans, as of December 31, 2005,

Entergy New Orleans owed Entergy and its subsidiaries a total of

approximately $47 million in prepetition accounts payable. Entergy

will continue to assess the carrying value of its investment in

Entergy New Orleans as developments occur in Entergy New

Orleans’ recovery efforts.

Entergy continues to work with the federal, state, and local

authorities to resolve the bankruptcy in a manner that allows

Entergy New Orleans’ customers to be served by a financially viable

entity as required by law. Key factors that will influence the timing

and outcome of the Entergy New Orleans bankruptcy include:

■The amount of insurance recovery, if any, and the timing of

receipt of proceeds;

■The amount of assistance funding, if any, from the federal and

state government, and the timing of that funding, including

Entergy’s intended application for Community Development

Block Grant funding;

■The level of economic recovery of New Orleans;

■The number of customers that return to New Orleans, and the

timing of their return; and

■The amount and timing of any regulatory recovery approved by

the Council of the City of New Orleans (Council or City Council).

The exclusivity period for filing a final plan of reorganization by

Entergy New Orleans is currently scheduled to end on April 21,

2006, with solicitation of acceptances of the plan scheduled to be

complete by June 20, 2006. If a party to the bankruptcy proceeding,

including Entergy New Orleans, requests it, the bankruptcy court

has the authority to extend these deadlines. In addition, the bank-

ruptcy judge has set a date of April 19, 2006 by which creditors with

prepetition claims against Entergy New Orleans must, with certain

exceptions, file their proofs of claim in the bankruptcy case.

The deconsolidation of Entergy New Orleans is retroactive to

January 1, 2005, and its 2005 results of operations are presented as a

component of “Equity in earnings (loss) of unconsolidated equity affil-

iates.” Transactions in 2005 between Entergy New Orleans and other

Entergy subsidiaries are not eliminated in consolidation as they were in

periods prior to 2005. The variance explanations for 2005 compared to

2004 in “Results of Operations” below reflect the 2004 results of oper-

ations of Entergy New Orleans as if it were deconsolidated in 2004,

consistent with the 2005 presentation as “Equity in earnings (loss) of

unconsolidated equity affiliates.” The variance explanations for 2004

compared to 2003 are based on as-reported amounts. Entergy’s

as-reported consolidated results for 2004 and the amounts included in

those consolidated results for Entergy New Orleans, which exclude

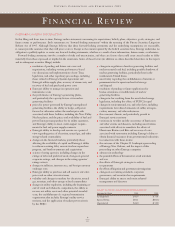

inter-company items, are set forth in the table below (in thousands):

For the Year Ended

December 31, 2004

Amounts

Entergy required to

Corporation deconsolidate

and Entergy

Subsidiaries New Orleans

(as-reported) in 2004*

Operating Revenues $9,685,521 $(435,194)

Operating Expenses:

Fuel, fuel-related expenses, and gas purchased

for resale and purchased power 4,189,818 (206,240)

Other operation and maintenance 2,268,332 (102,451)

Taxes other than income taxes 403,635 (43,577)

Depreciation and amortization 893,574 (29,657)

Other regulatory credits – net (90,611) 4,670

Other operating expenses 370,601 –

Total operating expenses 8,035,349 (377,255)

Other Income 125,999 (2,044)

Interest and Other Charges 477,776 (15,043)

Income from Continuing Operations

Before Income Taxes and Cumulative

Effect of Accounting Changes 1,298,395 (17,833)

Income Taxes 365,305 (16,868)

Consolidated Net Income $ 933,049 $ (965)

Preferred Dividend Requirements

and Other $ 23,525 $ (965)

* Reflects the entry necessary to deconsolidate Entergy New Orleans for 2004.

The column includes intercompany eliminations.