Entergy 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

84

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continuedNOTES to CONSOLIDATED FINANCIAL STATEMENTS continued

These liabilities are recorded at their fair values (which are the

present values of the estimated future cash outflows) in the period in

which they are incurred, with an accompanying addition to the

recorded cost of the long-lived asset. The asset retirement obliga-

tion is accreted each year through a charge to expense, to reflect the

time value of money for this present value obligation. The amounts

added to the carrying amounts of the long-lived assets will be depre-

ciated over the useful lives of the assets.

In accordance with ratemaking treatment and as required by

SFAS 71, the depreciation provisions for the domestic utility com-

panies and System Energy include a component for removal costs

that are not asset retirement obligations under SFAS 143. In accor-

dance with regulatory accounting principles, Entergy has recorded

a regulatory asset for certain of its domestic utility companies and

System Energy of $162.9 million as of December 31, 2005 and

$86.9 million as of December 31, 2004 to reflect an estimate of

incurred but uncollected removal costs previously recorded as a

component of accumulated depreciation. The decommissioning and

retirement cost liability for certain of the domestic utility companies

and System Energy includes a regulatory liability of $22.8 million as of

December 31, 2005 and $34.6 million as of December 31, 2004 repre-

senting an estimate of collected but not yet incurred removal costs.

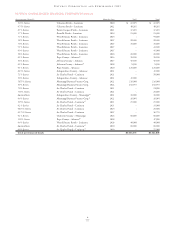

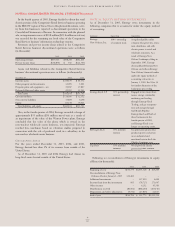

The cumulative decommissioning and retirement cost liabilities

and expenses recorded in 2005 by Entergy were as follows (in millions):

Liabilities Change in Liabilities

as of Implementation Cash Flow as of

Dec. 31, 2004 Accretion of FIN 47 Estimate Spending Dec. 31, 2005

U. S.

Utility $1,328.0 $88.2 $27.8 $(282.2) – $1,161.8

Non-Utility

Nuclear $ 738.3 $59.2 $ 0.9 $ (26.0) $(10.3) $ 762.1

In addition, an insignificant amount of removal costs associated with

non-nuclear power plants are also included in the decommissioning

line item on the balance sheet. Entergy periodically reviews and

updates estimated decommissioning costs. The actual decommis-

sioning costs may vary from the estimates because of regulatory

requirements, changes in technology, and increased costs of labor,

materials, and equipment. During 2004 and 2005, Entergy updated

decommissioning cost studies for ANO 1 and 2, River Bend, Grand

Gulf, Waterford, and a non-utility plant.

In the first quarter of 2004, Entergy Arkansas recorded a revision

to its estimated decommissioning cost liability in accordance with a

new decommissioning cost study for ANO 1 and 2 as a result of

revised decommissioning costs and changes in assumptions regard-

ing the timing of when the decommissioning of the plants will

begin. The revised estimate resulted in a $107.7 million reduction in

its decommissioning liability, along with a $19.5 million reduction

in utility plant and an $88.2 million reduction in the related regula-

tory asset.

In the third quarter of 2004, Entergy Gulf States recorded a revi-

sion to its estimated decommissioning cost liability in accordance

with a new decommissioning cost study for River Bend that reflect-

ed an expected life extension for the plant. The revised estimate

resulted in a $166.4 million reduction in decommissioning liability,

along with a $31.3 million reduction in utility plant, a $49.6 million

reduction in non-utility property, a $40.1 million reduction in the

related regulatory asset, and a regulatory liability of $17.7 million.

For the portion of River Bend not subject to cost-based ratemaking,

the revised estimate resulted in the elimination of the asset retire-

ment cost that had been recorded at the time of adoption of

SFAS 143 with the remainder recorded as miscellaneous income

of $27.7 million ($17 million net-of-tax).

In the third quarter of 2004, Entergy’s Non-Utility Nuclear

business recorded a reduction of $20.3 million in decommissioning

liability to reflect changes in assumptions regarding the timing of

when decommissioning of a plant will begin. Entergy considered the

assumptions as part of recent studies evaluating the economic effect

of the plant in its region. The revised estimate resulted in miscella-

neous income of $20.3 million ($11.9 million net-of-tax), reflecting

the excess of the reduction in the liability over the amount of unde-

preciated asset retirement cost recorded at the time of adoption of

SFAS 143.

In the first quarter of 2005, Entergy’s Non-Utility Nuclear busi-

ness recorded a reduction of $26.0 million in its decommissioning

cost liability in conjunction with a new decommissioning cost study

as a result of revised decommissioning costs and changes in assump-

tions regarding the timing of the decommissioning of a plant. The

revised estimate resulted in miscellaneous income of $26.0 million

($15.8 million net-of-tax), reflecting the excess of the reduction in

the liability over the amount of undepreciated assets.

In the second quarter of 2005, Entergy Louisiana recorded a revi-

sion to its estimated decommissioning cost liability in accordance

with a new decommissioning cost study for Waterford 3 that reflect-

ed an expected life extension for the plant. The revised estimate

resulted in a $153.6 million reduction in its decommissioning

liability, along with a $49.2 million reduction in utility plant and a

$104.4 million reduction in the related regulatory asset.

In the third quarter of 2005, Entergy Arkansas recorded a revision

to its estimated decommissioning cost liability for ANO 2 in accor-

dance with the receipt of approval by the NRC of Entergy Arkansas’

application for a life extension for the unit. The revised estimate

resulted in an $87.2 million reduction in its decommissioning

liability, along with a corresponding reduction in the related

regulatory asset.

In the third quarter of 2005, System Energy recorded a revision to

its estimated decommissioning cost liability in accordance with a new

decommissioning cost study for Grand Gulf. The revised estimate

resulted in a $41.4 million reduction in the decommissioning cost lia-

bility for Grand Gulf, along with a $39.7 million reduction in utility

plant and a $1.7 million reduction in the related regulatory asset.

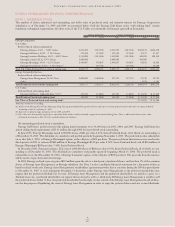

In December 2005, Entergy implemented FASB Interpretation

47, “Accounting for Conditional Asset Retirement Obligations – an

interpretation of FASB Statement No. 143”, (FIN 47), effective as

of that date, which required the recognition of additional asset

retirement obligations other than nuclear decommissioning which

are conditional in nature. The obligations recognized upon imple-

mentation primarily represent Entergy’s obligation to remove and

dispose of asbestos at many of its non-nuclear generating units if and

when those units are retired from commercial service and disman-

tled. For the U.S. Utility business, the implementation of FIN 47

for the rate-regulated business of the domestic utility companies was

recorded in regulatory assets, with no resulting effect on Entergy’s

net income. Entergy recorded these regulatory assets because exist-

ing rate mechanisms in each jurisdiction allow the recovery in rates

of the ultimate costs of asbestos removal, either through cost of

service or in rate base, from current and future customers. As a

result of this treatment, FIN 47 was earnings neutral to the rate-

regulated business of the domestic utility companies. Upon imple-

mentation of FIN 47 in December 2005, assets increased by $28.8

million and liabilities increased by $30.3 million for the U.S. Utility

segment as a result of recording the asset retirement obligations at

their fair values of $30.3 million as determined under FIN 47,