Entergy 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Entergy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ENTERGY CORPORATION AND SUBSIDIARIES 2005

*

73

■Entergy Gulf States may not file a general base rate case in

Texas before June 30, 2007, with rates effective no earlier than

June 30, 2008, but may seek before then the recovery of certain

incremental purchased power capacity costs, adjusted for load

growth, not in excess of five percent of its annual base rate

revenues (as discussed above in “Deferred Fuel Costs,” in July

2005, Entergy Gulf States filed a request for implementation of

an incremental purchased capacity recovery rider); and

■Entergy Gulf States may recover over a period not to exceed

15 years reasonable and necessary transition to competition

costs incurred before the effective date of the legislation and

not previously recovered, with appropriate carrying charges

(as discussed above in “Filings with the PUCT and Texas Cities,”

in August 2005, Entergy Gulf States filed with the PUCT an

application for recovery of its transition to competition costs).

Entergy Gulf States made the January 2006 filing regarding the

identification of power region(s) required by the 2005 legislation,

and based on the statutory requirements for the certification of a

qualified power region (QPR), previous PUCT rulings, and

Entergy Gulf States’ geographical location, Entergy Gulf States

identified three potential power regions:

1. Electric Reliability Council of Texas (ERCOT) as the power

region and Independent Organization (IO);

2. Southwest Power Pool (SPP) as the power region and IO; and

3. the Entergy market as the power region and the Independent

Coordinator of Transmission (ICT) as the IO.

Based on previous rulings of the PUCT, and absent reconsidera-

tion of those rulings, Entergy Gulf States believes that the third

alternative – an ICT operating in Entergy’s market area – is not likely

to be a viable QPR alternative at this time. Accordingly, while

noting this alternative, Entergy Gulf States’ filing focuses on the

first two alternatives, which are expected to meet the statutory

requirements for certification so long as certain key implementation

issues can be resolved. Entergy Gulf States’ filing enumerated

and discussed the corresponding steps and a high-level schedule

associated with certifying either of these two power regions.

Entergy Gulf States’ filing does not make a recommendation

between ERCOT and the SPP as a power region. Rather, the filing

discusses the major issues that must be resolved for either of those

alternatives to be implemented. In the case of ERCOT, the major

issue is the cost and time related to the construction of facilities to

interconnect Entergy Gulf States’ Texas operations with ERCOT,

while addressing the interest of Entergy Gulf States’ retail

customers and certain wholesale customers in access to generation

outside of Texas. With respect to the SPP, the major issue is the

development of protocols that would ultimately be necessary to

implement retail open access.

Entergy Gulf States recommended that the PUCT open a project

for the purpose of involving stakeholders in the selection of the

single power region that Entergy Gulf States should request for

certification. Entergy Gulf States notes that House Bill 1567 also

directs Entergy Gulf States to file a transition to competition filing

no later than January 1, 2007. The contents of the January 1, 2007

filing will be affected by the power region selected. Accordingly,

Entergy Gulf States recommended that the goal of the project

should be to reach consensus on a power region in a timely manner

to inform Entergy Gulf States’ January 1, 2007 filing.

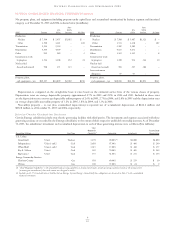

NOTE 3. INCOME TAXES

Income tax expenses from continuing operations for 2005, 2004, and

2003 consist of the following (in thousands):

2005 2004 2003

Current:

Federal(a) (b) $ (306,524) $ 67,924 $ (725,319)

Foreign 13,290 (2,231) 8,284

State(a) (b) (27,212) 38,324 23,316

Total(a) (b) (320,446) 104,017 (693,719)

Deferred – net 898,384 282,275 1,218,796

Investment tax credit

adjustments – net (18,654) (20,987) (27,644)

Income tax expense from

continuing operations $559,284 $365,305 $ 497,433

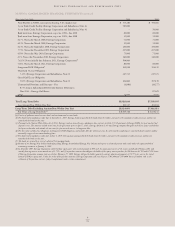

(a) The actual cash taxes paid were $98,072 in 2005, $28,241 in 2004, and $188,709

in 2003. Entergy Louisiana’s mark-to-market tax accounting election significantly

reduced taxes paid in 2002. In 2001, Entergy Louisiana changed its method of

accounting for tax purposes related to its wholesale electric power contracts. The most

significant of these is the contract to purchase power from the Vidalia project

(the contract is discussed in Note 8 to the consolidated financial statements). The new

tax accounting method has provided a cumulative cash flow benefit of approximately

$664 million through 2005, which is expected to reverse in the years 2006 through

2031 depending on several variables, including the price of power. The election did not

reduce book income tax expense.

(b) In 2003, the domestic utility companies and System Energy filed, with the Internal

Revenue Service (IRS), a change in tax accounting method notification for their

respective calculations of cost of goods sold. The adjustment implemented a simplified

method of allocation of overhead to the production of electricity, which is provided under

the IRS capitalization regulations. The cumulative adjustment placing these companies

on the new methodology resulted in a $2.8 billion deduction on Entergy’s 2003 income

tax return. There was no cash benefit from the method change in 2003. In addition, on

a consolidated basis, there was no cash benefit from this method change in 2004 or 2005.

The IRS has issued new proposed regulations effective in 2005 that may preclude a

significant portion of the benefit of this tax accounting method change. In 2005, the

domestic utility companies and System Energy filed a notice with the IRS of a new

tax accounting method for their respective calculations of cost of goods sold. This new

method is also subject to IRS scrutiny.

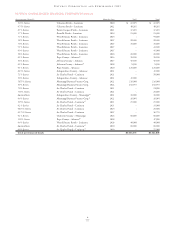

Total income taxes from continuing operations differ from the

amounts computed by applying the statutory income tax rate to

income before taxes. The reasons for the differences for the years

2005, 2004, and 2003 are (in thousands):

2005 2004 2003

Computed at statutory rate (35%) $534,743 $454,438 $463,831

Increases (reductions) in tax

resulting from:

State income taxes net of

federal income tax effect 44,282 36,149 43,210

Regulatory differences-

utility plant items 28,983 41,240 52,446

Amortization of investment

tax credits (18,691) (20,596) (24,364)

EAM Capital Loss (792) (86,426) –

Flow-through/permanent

differences (32,518) (43,037) (29,722)

U.S. tax on foreign income 2,798 2,014 7,888

Other – net 479 (18,477) (15,856)

Total income taxes

from continuing operations $559,284 $365,305 $497,433

Effective income tax rate 36.6% 28.1% 37.5%

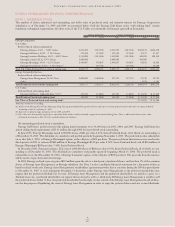

The EAM capital loss is a tax benefit resulting from the sale of preferred

stock and less than 1% of the common stock of Entergy Asset

Management, an Entergy subsidiary. In December 2004, an Entergy

subsidiary sold the stock to a third party for $29.75 million. The sale

resulted in a capital loss for tax purposes of $370 million, producing a

NOTES to CONSOLIDATED FINANCIAL STATEMENTS continued